Given the Australian share markets' lack of diversification into a myriad of new-age technology-related sectors, there have always been compelling reasons for local investors to have exposure to more dynamic offshore markets.

Last year alone Australians invested an estimated $15 billion into international funds – double that placed in local share funds – and the U.S. market – home to the Magnificent Seven tech giants - was by far the most popular market to trade in.

While U.S. equities and Silicon Valley stocks have always attracted Australian investors, the table stakes for investing in this market have risen again since President Donald Trump took office. Trump has vowed to turbocharge corporate investment in the U.S. and by default the U.S. market – despite already appearing stretched – is expected to continue its upward ascent.

U.S equities outperform

If the recent track-record of the S&P500 - a benchmark for U.S. stocks - is anything to go by U.S. stocks are expected to continue outperforming their Australian counterparts. While 2024 was arguably a good year for the ASX, up 11%, the S&P500 doubled this performance with 22%.

This trend is also continuing into 2025 with the U.S. market adding 4%, twice as much as the ASX within the first few weeks of the new year.

Investing in any market isn’t without its risks and some fear that one of the unintended consequences of Trump’s plans to unleash capital in the private sector could be the resurgence of inflationary pressures – which could negatively impact U.S. equities.

By comparison, Australian shares are not without their risks, including the price they’re trading at. By Morningstar’s reckoning local shares are even more overvalued than their U.S. counterparts.

With the Australian share market getting smaller - and with stellar stocks continuing to be the target of foreign takeovers and then delisted - the argument for tapping into the U.S. upside has never been more compelling.

Tapping US equities direct

With that said, how can local investors gain access to the U.S. market from Australia?

Investing directly in U.S.-based stocks can be as easy as opening an online brokerage account, adding money to your account and buying stocks in your own name.

All four major ASX banks let ASX investors purchase U.S. shares using their brokerage platforms. However, there are cheaper ways to invest in U.S. stocks. For example, Sydney-based start-up Stake offers free brokerage on US shares but charges a foreign exchange fee of 1% on all deposits and withdrawals (and an additional 0.5% for instant deposits).

Other brokerage options available to Australian investors include Charles Schwab, and eToro which allows free brokerage and fractional shares for ASX investors and a 0.5% currency conversion fee.

Then there’s SelfWealth Ltd (ASX: SWF), CMC Markets which allows trading across the US, Canadian, UK, and Japanese stock markets, Saxo Markets offering access to 22,000-plus international shares on 50 exchanges worldwide and IG Share Trading which offers shares in the US, UK, German, and Irish stock markets.

ETF options

However, given that not all investors want to be stock pickers or have foreign currency exposure, many Aussie investors are tapping into U.S. equities via low-cost ETFs and there are a growing plethora to choose from.

According to data from Betashares.net flows of $23.7 billion [into ETFs] for the year to October 31 are above the previous record of $23.2 billion set in 2021. The cohort tapping into ETFs is getting younger.

According to State Street Global Advisors' ETF Impact Report 2024, 65% of surveyed Millennials have ETFs in their portfolio. This is compared to 34% of Gen X and 31% of Baby Boomers.

ETFs provide diversified exposure to a basket of shares rather than having all your exposure to just one stock.

Here’s a sneak peak at five U.S.-focused ETFs you can trade on the ASX.

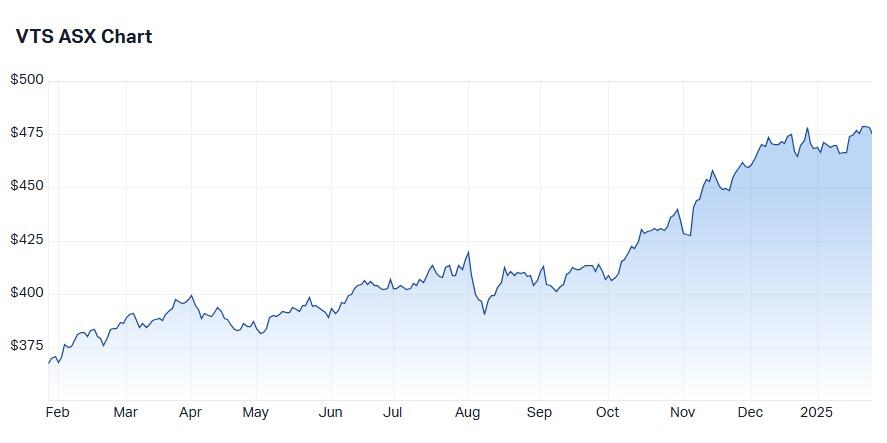

1) Vanguard US Total Market Shares Index ETF (ASX: VTS)

Representing 3,731 American companies, including large-caps, small-caps, and micro-caps, VTS is one of the most popular ETFs on the ASX, with a market cap of $5.6 billion.

It provides low-cost exposure to some of the world's largest companies listed in the U.S. VTS is currently trading at $475.65 and is up 30% over the past year.

The fees (aka MER, the management expense ratio) are 0.03%.

The fund invests in leading US-listed businesses like Apple, NVIDIA, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, Berkshire Hathaway, Broadcom and JPMorgan Chase.

Dividend yield is 1.2%.

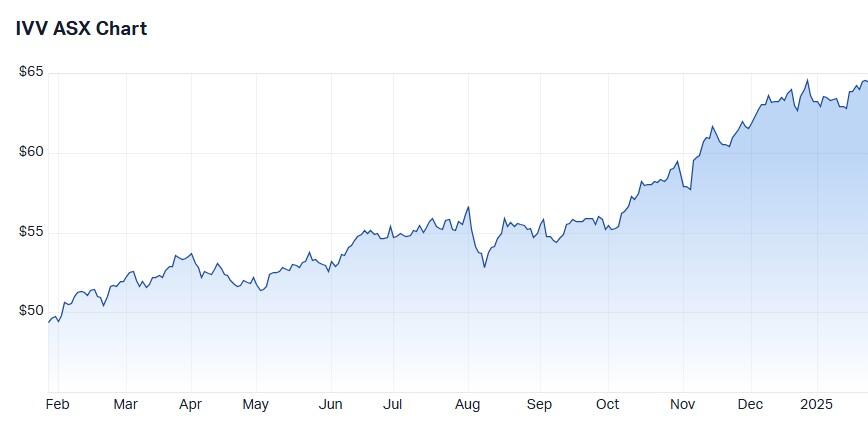

2) iShares S&P 500 ETF (ASX: IVV)

Managed by BlackRock Fund Advisors, IVV tracks the yield and performance of the S&P 500 Index. As such, it contains the largest 500 stocks on the American market.

The ETF exposes Australian investors to quality US stocks like Netflix, PayPal, Mastercard and Berkshire Hathaway; its biggest position is Microsoft Corp, with a 7.17% weighting.

IVV shares are currently trading at $64.04, up 30% in one year. MER is 0.04%.

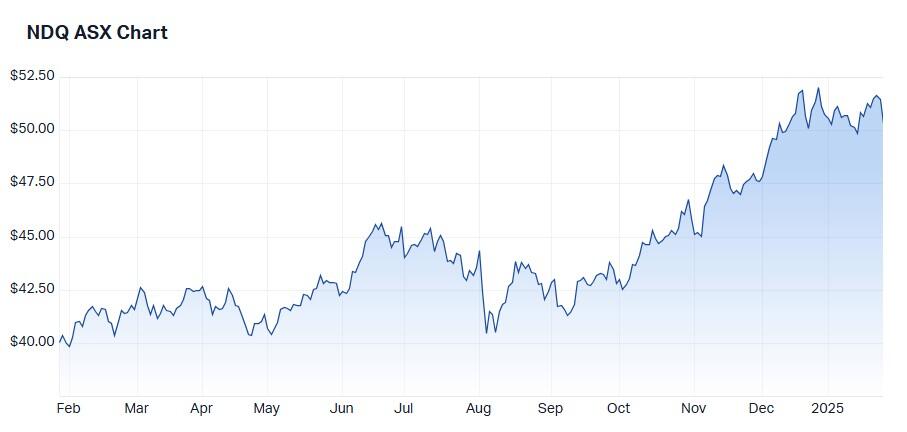

3) BetaShares NASDAQ 100 ETF (ASX: NDQ)

NDQ tracks the NASDAQ-100 Index and provides investors with exposure to the performance of the 100 largest non-financial securities listed on the NASDAQ stock market, by market cap.

Around 41.4% of its overall weighting is invested in six tech giants, Microsoft, Alphabet, Amazon, Apple, NVIDIA, and Meta Platforms.

NDQ shares are currently trading at $50.33 and are up 25% in one year.

MER: 0.48%.

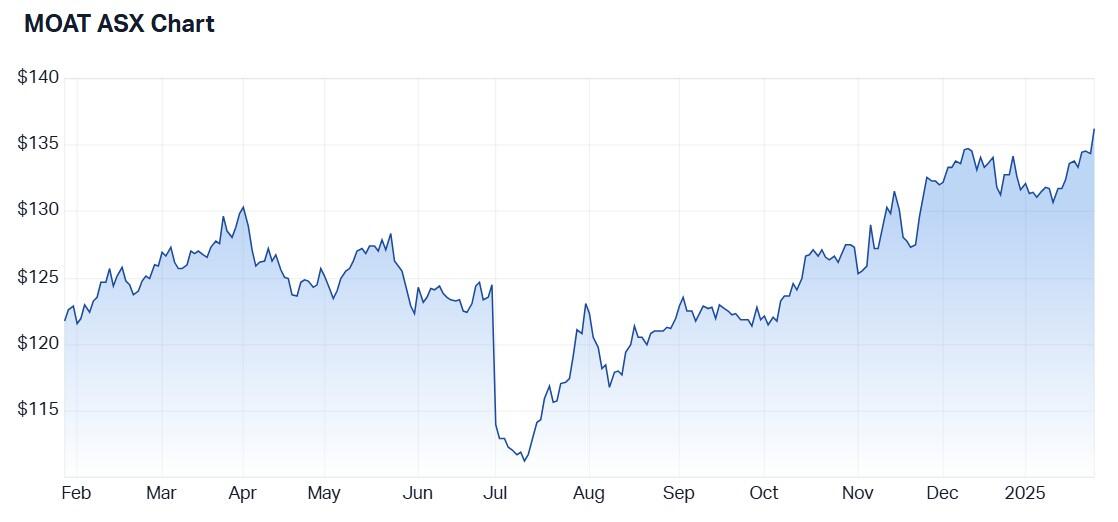

4) VanEck Morningstar Wide Moat ETF (ASX: MOAT)

MOAT seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar Wide Moat Focus Index (MWMFTR).

The ETF holds a small basket of 54 US stocks with moats or sustainable competitive advantages. Its biggest positions are Alphabet Inc and Veeva Systems, each with a 2.73% weighting.

MOAT shares are currently trading at $136.20 and are up around 12% in one year.

MER: 0.49%.

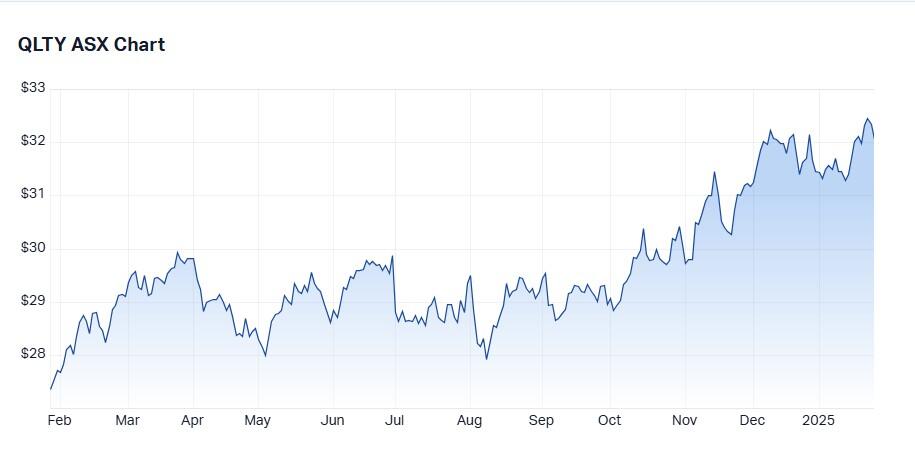

5) Betashares Global Quality Leaders ETF (ASX: QLTY)

QLTY is currently trading at $32.06 and is up around 18% over the past year.

This ETF invests in 150 companies that meet certain criteria based on metrics such as strong return on equity (ROE), debt to capital, cash flow generation, and earnings stability.

Around 67.6% of holdings are US shares and the ETF’s biggest position is Alphabet, with a 2.2% weighting.

MER: 0.35%.

Australian stocks to benefit from the strong US economy

If you'd rather get exposure to the U.S. economy via ASX-stocks you’ve got plenty of options to choose from.

Macquarie’s Research recently noted stocks – with over 50% exposure to US revenue streams - that could benefit from Trump's growth initiatives.

These include Pro Medicus (ASX: PME), Polynovo (ASX: PNV), Reliance Worldwide Corporate (ASX: RWC), Orora (ASX: ORA) and Computershare (ASX: CPU).

Other ASX stocks with significant U.S. earnings include:

James Hardie (ASX: JHX)

Light & Wonder (ASX: LNW)

ResMed (ASX: RMD)

Megaport (ASX: MP1)

CSL (ASX: CSL)

Amcor (ASX: AMC)

Aristocrat (ASX: ALL)

WiseTech (ASX: WTC)

Bluescope Steel (ASX: BLS)

Cochlear (ASX: COH)

Incitec Pivot (ASX: IPL)

Brambles (ASX: BXB)

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.