Here's a number that'll make your head spin: US$390 billion. That's what the 'Magnificent 7' are hurling at AI infrastructure this year. That's more than South Africa's entire GDP, and the spending spree is pumping half a percentage point into United States economic growth.

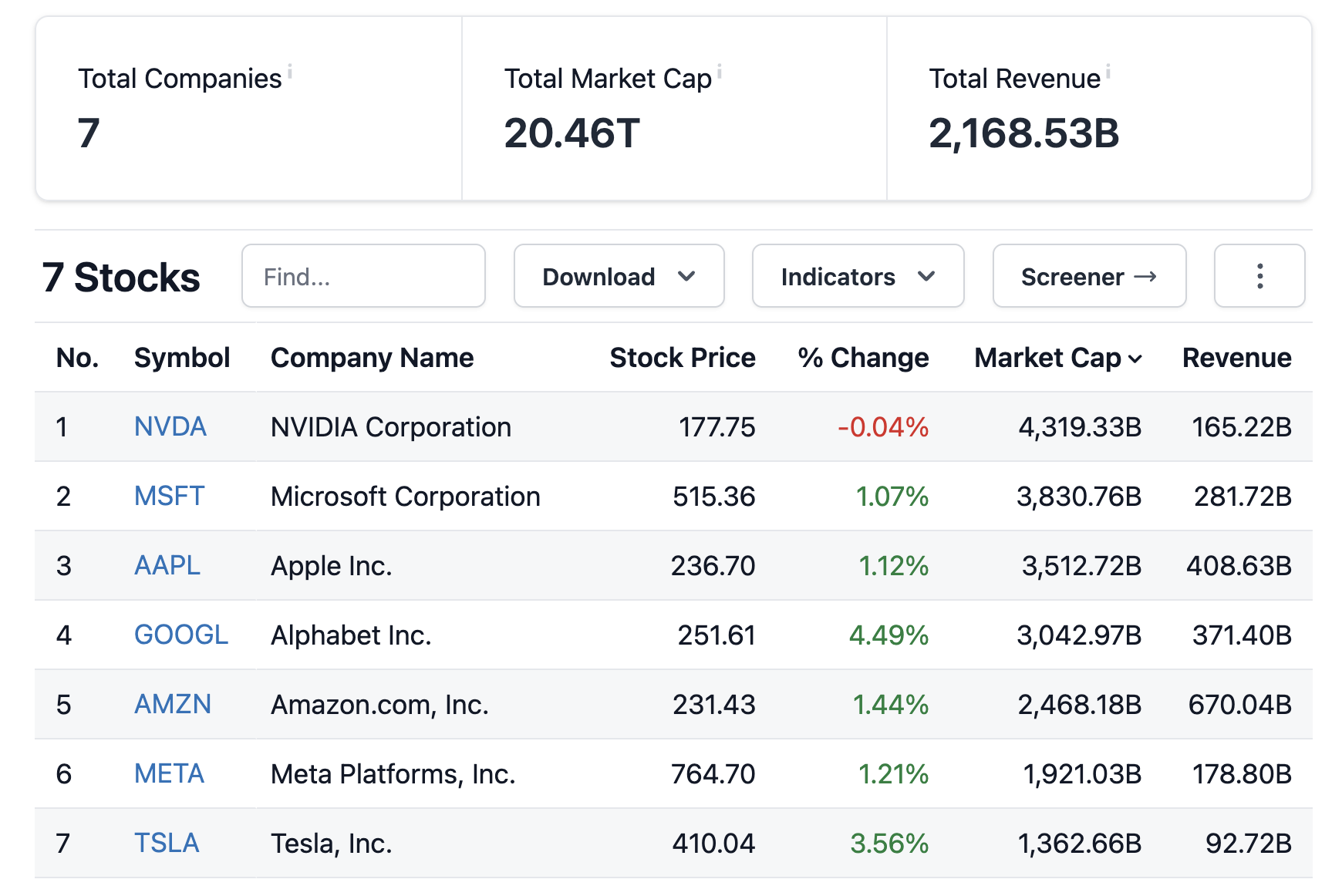

The companies building today's AI backbone will likely control tomorrow's economy, and the Mag 7 tech stocks of Microsoft, Amazon, Google, Meta, Nvidia, Tesla and Apple aren't just buying servers anymore - they're building the digital backbone of whatever comes next.

Amazon's going full throttle

$100 billion has been committed this year to Amazon's AWS cloud infrastructure. Another $4 billion went to doubling down on Anthropic, bringing its Claude AI stake to $8 billion.

CEO Andy Jassy reckons GPU shortages will ease in the second half. "I predict those constraints really start to relax," he told analysts. Translation? All that capex is about to become revenue.

Here's where it gets interesting though: Amazon's playing a different game than Microsoft. Where Redmond's tied itself to OpenAI like a ball and chain, Amazon stays neutral.

With multiple AI providers, one massive cloud platform, AWS, was able to generate two-thirds of operating profit last year on just 16% of revenue.

Think of Amazon as the toll booth operator. Every AI workload needs compute power, and AWS controls the biggest pipeline in the business.

Microsoft doubling down on enterprise dominance

The stalwart tech business is throwing $80 billion at the wall to see what sticks. Half's staying in America, with most of it chasing OpenAI's coattails.

It seems the strategy's working. Azure AI usage doubled in six months, and GE Aerospace rolled out Microsoft AI assistants to 52,000 workers.

The OpenAI partnership keeps delivering, with Azure AI adding 16 percentage points to Azure's 35% growth rate. Microsoft 365 Copilot penetration could hit 31% of endpoints over the next 12 months, up from 17% last quarter.

Its major issue is that data centre lease cancellations surfaced recently, though Microsoft is sticking to its original $80bn commitment. Management is diplomatically calling it "strategically pacing infrastructure in some areas".

That's a roundabout way of saying it's run into bottlenecks. Power grids and property developments don't move at software speeds, and that's becoming a genuine problem.

Google's panic spending

Alphabet bumped capex guidance from $75 billion to $85 billion mid-year.

Google's cloud division hit 18% operating margins in Q1, and its custom TPU chips cost less than Nvidia's.

Problem is, enterprise adoption is lagging. IT departments trust Microsoft's sales machine more than Google's engineering brilliance.

The $10bn revision tells you everything. CEO Sundar Pichai knows infrastructure still trumps algorithms when CIOs are making purchase decisions.

Meta's struck advertising gold

Meta's playing a different game entirely. $60-72 billion of investment, but it's already paying dividends.

Ad pricing jumped 14% in Q1 after falling throughout 2023. AI targeting works because engagement rises and conversion rates improve. That translates directly into Meta's bottom line.

Zuckerberg is also building a 1.3mn GPU cluster by year-end - more computing power than most governments control.

Unlike AWS or Azure, every processing cycle counts toward the advertising engine that generates 97% of revenue. It's a focused bet, not a scattergun approach.

Meta's the only Mag 7 company showing clear AI returns. Ad algorithms get smarter → advertisers pay more → shareholders collect the difference.

Nvidia's printing money

Jensen Huang's sitting pretty with a $60 billion R&D budget because everyone else's capex flows straight to Nvidia's margins in terms of AI processing chips.

The numbers are bonkers: 90% market share in AI chips, 43% of global server spending, gross margins above 70%. It's basically a licence to print money.

Saudi Arabia is buying 18,000 chips for Humain. UAE gets 500,000 annually. Every hyperscaler needs what Nvidia makes.

However, efficiency might trump raw power. DeepSeek's Chinese model runs on older, cheaper hardware with competitive performance metrics. If that trend continues, Nvidia's moat shrinks fast.

The question isn't demand - it's whether custom chips from Google and Amazon eventually break the stranglehold.

Apple's… waiting?

Apple's spending is just $10-11 billion, the smallest among the seven… and it could be the smartest strategy of the lot.

Why build data centres when Google Cloud, AWS and Azure compete for your business? Competition drives prices down and service levels up.

Apple Intelligence runs on external infrastructure, and its iPhone 16 sales benefit without massive capex. Services revenue grows at 45% margins while everyone else burns cash on GPUs.

Tim Cook's betting AI gets commoditised and feels device integration and user experience will matter more than owning servers.

If he's right, Apple wins without the spending hangover that'll hit everyone else when reality bites.

Tesla's doing the robot

Tesla is focusing $11 billion purely on autonomous driving and robotics. $20-30,000 robots by 2027, with full self-driving eventually.

Musk's betting AI moves atoms, not just bits. A fundamentally different approach to the cloud-focused competition.

It's a big gamble. If robotics takes another decade, Tesla's AI spending becomes a stranded cost.

But success means owning the physical AI market as others fight over cloud computing. This could be the bigger prize long-term.

Winning variables

Three trends matter for positioning:

- Scale wins the infrastructure game. Amazon and Microsoft benefit regardless of which AI applications succeed. Cloud usage grows, margins expand, and competition gets priced out.

- Technical moats matter more than ever. Nvidia's chip dominance and Meta's advertising AI show how proprietary technology translates to pricing power. Google's custom chips and Apple's device integration represent alternative approaches.

- Capital efficiency separates winners from pretenders. Meta's demonstrating revenue acceleration from AI investment. Others mostly show expense acceleration. Companies proving returns will command premium valuations.

And you can't ignore the concentration risk either. The Mag 7 dragged the rest of the S&P 500 down 4.27% in Q1.

When seven companies control over $20 TRILLION of value, their AI bets become everyone's problem.