CHOICE’s analysis of hospital insurance pricing data showed that health insurers are pushing up the price of premium cover at a much higher rate than advertised.

Every year, the health insurers must seek government approval to increase their premiums on 1 April. However the insurers only need approval to raise premiums for existing policies, not new policies.

CHOICE found that health insurers avoid the premium approval process by closing existing policies and opening a new policy with the same or similar cover, but with a jacked-up price.

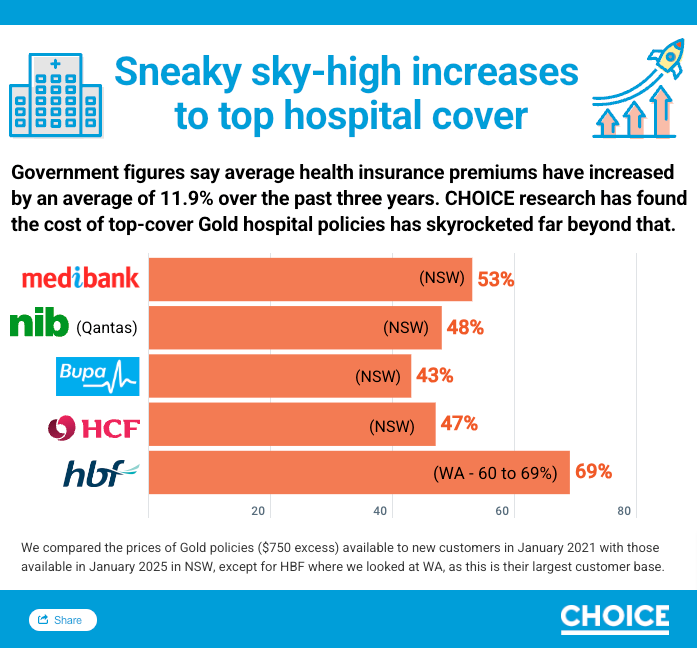

This has caused out-of-control health policy inflation, with Gold hospital coverage in particular rising by around 45% in the past four years. There was also an 11.9% increase across all hospital and extras policies.

This includes the big five health funds, Medibank, Bupa, HCF, HBF and NIB, which have implemented substantial price rises.

In 2021, a NSW family would pay on average A$5380 for a gold hospital policy (with a $750 excess) per year, this has now risen to $7840 per year.

One of the largest increases was in Western Australia, where HBF’s Gold policy is 60-69% more expensive than it was selling four years ago.

According to CHOICE, there are a range of tactics the health insurers implement including replacing cheaper policies with more expensive ones and only showing new customers the expensive policies.