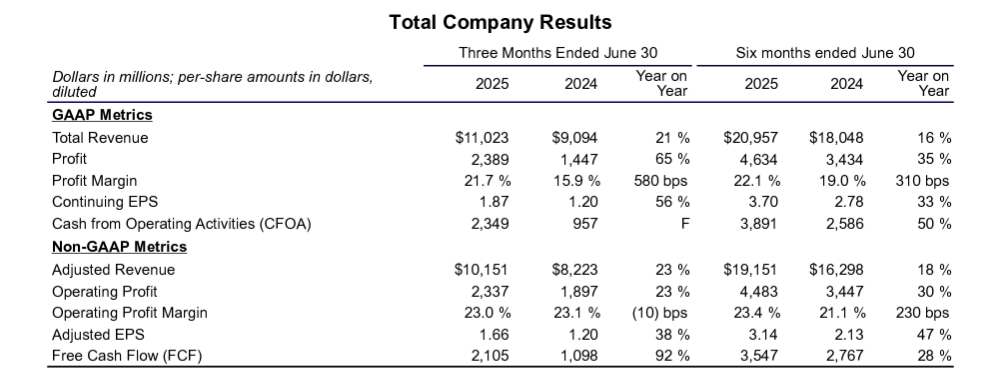

GE Aerospace reported a robust second quarter, with adjusted revenue rising 23% year-over-year to $10.2 billion and adjusted EPS climbing 38% to $1.66 exceeding analysts' estimates of $1.43.

Despite expectations of $9.59 billion, revenue increased by 21% year-over-year to $11.02 billion.

Free cash flow nearly doubled to $2.1 billion, driven by a 30% surge in Commercial Engines & Services (CES) revenue and a 45% increase in engine unit deliveries.

The company credits its proprietary FLIGHT DECK operating model for streamlining supplier performance and boosting output, with over 95% of committed volume delivered and material input improving 10% sequentially.

GE also completed more than 350 tests under its CFM RISE program, advancing next-gen turbine durability and Open Fan blade technology.

Chairman and CEO H. Lawrence Culp, Jr. announced a raised 2025 guidance and 2028 outlook, citing strong operating momentum and a $175 billion backlog.

Culp, Jr., said, “The GE Aerospace team delivered an excellent second quarter with free cash flow nearly doubling and more than 20% growth in orders, revenue, operating profit, and EPS. We are raising our 2025 guidance and 2028 outlook, with our operating performance and robust commercial services outlook underpinning our higher revenue, earnings, and cash growth expectations. Our team is using FLIGHT DECK to improve safety, quality, delivery and cost — always in that order — as we strive to provide unrivaled customer service and deliver on our roughly $175 billion backlog."

GE now expects 2025 adjusted EPS of $5.60–$5.80 and free cash flow of $6.5–$6.9 billion, with 2028 targets of ~$11.5 billion in operating profit and ~$8.5 billion in free cash flow — both up $1.5 billion from prior estimates.

Capital returns to shareholders will increase 20% from 2024 to 2026, totaling ~$24 billion, with a commitment to return at least 70% of free cash flow via dividends and buybacks beyond 2026.

Strategic wins include a historic agreement with Qatar Airways for over 400 GE9X and GEnx engines — the largest widebody engine deal in GE Aerospace history — and a contract with IAG for 32 GEnx-powered Boeing 787s for British Airways.

CES is now forecasting high-teens revenue growth and ~$8.2 billion in operating profit for 2025, with low-double-digit growth expected through 2028.

GE also announced major investments in hypersonics testing infrastructure across its U.S. sites, reinforcing its long-term innovation pipeline.

GE Aerospace’s performance signals durable growth, disciplined capital allocation, and expanded leadership in propulsion technologies.

At the time of writing, the GE Aerospace (NYSE: GE) share price was US$260.70 in after-hours trading, after closing at $260.28. It has a market cap of around $277.56 billion.