United Airlines’ Q2 2025 earnings reflect a confident pivot toward premium growth and operational precision — key signals for global luxury investors tracking travel sector resilience.

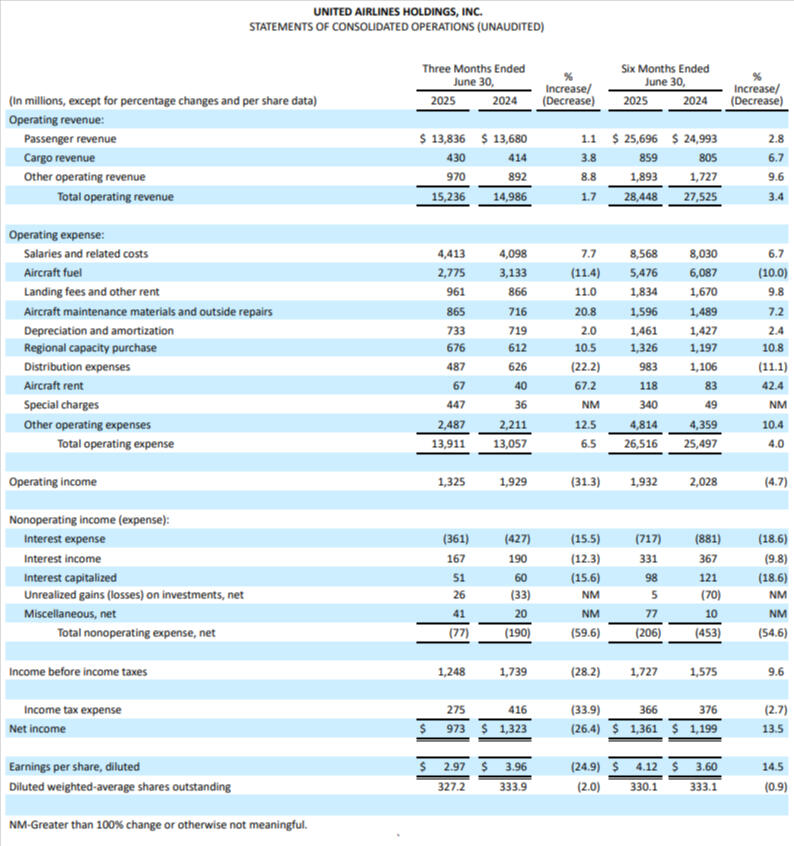

United posted US$15.24 billion in revenue, up 1.7% YoY but slightly below expectations of $15.36 billion. Adjusted EPS was reported at $3.87 versus $3.81 expected, while adjusted pre-tax earnings came in at $1.7 billion.

Premium cabin revenue rose 5.6%, loyalty revenue jumped 8.7%, and the airline achieved its best post-pandemic on-time performance.

"Our second-quarter performance was more proof that the United Next strategy is working. I am extremely proud of the team for executing a strong operation and navigating through a volatile macroeconomic period, while still growing earnings and pre-tax margin for the first half of the year," said United CEO Scott Kirby. "Importantly, United saw a positive shift in demand beginning in early July, and, like 2024, anticipates another inflection in industry supply in mid-August. The world is less uncertain today than it was during the first six months of 2025 and that gives us confidence about a strong finish to the year."

A six-point acceleration in booking demand began in early July, prompting full-year EPS guidance of $9–$11.

United also repaid high-cost debt tied to MileagePlus, leaving one of the world’s most valuable loyalty programs unencumbered.

United Airlines’ Q2 results signal a strategic inflection point for premium travel.

With record-high premium seat offerings and the debut of United Polaris Studio suites, the airline is doubling down on high-margin experiences.

Operational excellence — highlighted by Newark’s top-tier performance and industry-leading seat cancellation rates — supports brand loyalty and pricing power.

MileagePlus-backed debt repayment enhances balance sheet flexibility, while strong free cash flow ($1.1 billion) and liquidity ($18.6 billion) position United to capitalise on reduced macro uncertainty and surging demand.

At the time of writing, United Airlines Holdings Inc (NASDAQ: UAL) share price was US$88.47, up $2.09 (2.42%) at the close. After hours, it was trading at $87.17 (-1.5%). United Airlines' market cap is around $28.89 billion.