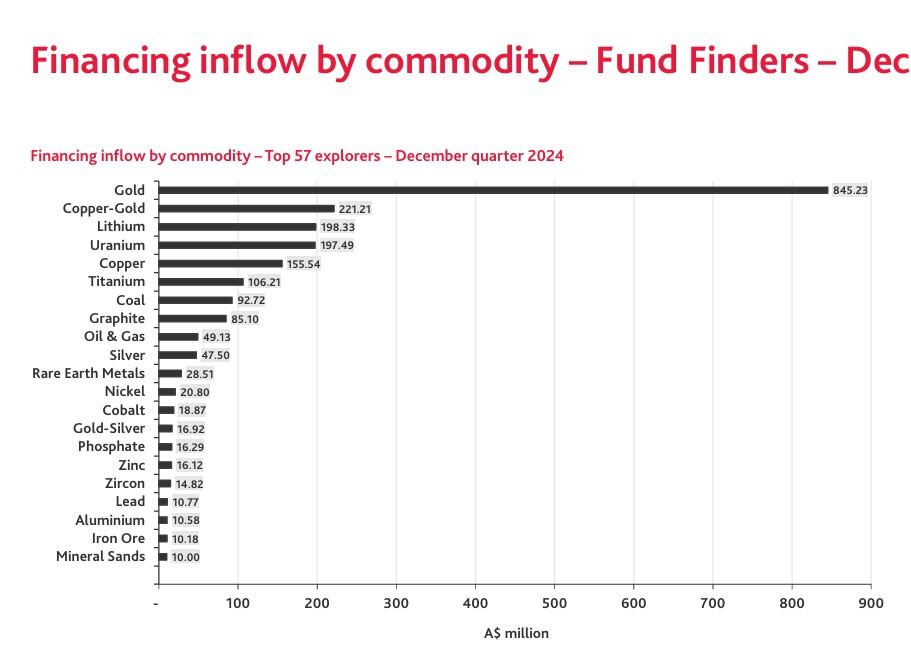

Gold explorers again eclipsed all other commodities in fundraising stakes in the December 2024 quarter - securing a staggering $845 million, according to BDO’s latest report. BDO’s global head of natural resources Sherif Andrawes notes the bulk of the funds raised will be dedicated to resurrecting mothballed projects.

"Considering the momentous rise in [gold] prices over the year, it’s unsurprising that investors' funds were focused on near-term producers,” said Andrawes.

Assuming gold maintains its perch as the go-to safe haven asset class, BDO’s December fundraising figures look primed to soar.

The current gold price, sitting above $US3,000 an ounce, is expected to trigger a new gold rush and with it a new wave of dealmaking and exploration. This will require fresh fundraising rounds.

Fundraising finds its way to the minnows

Overall, December was a strong quarter for fundraising activities with explorers securing $2.88 billion in funding, a 48% increase from the previous quarter.

While this represents a strong capital raising period, BDO notes equity market interest was confined to a single commodity − gold.

57 companies raised funds of $10 million or more (aka Fund Finders) and made up 75% of the total funds raised during the quarter.

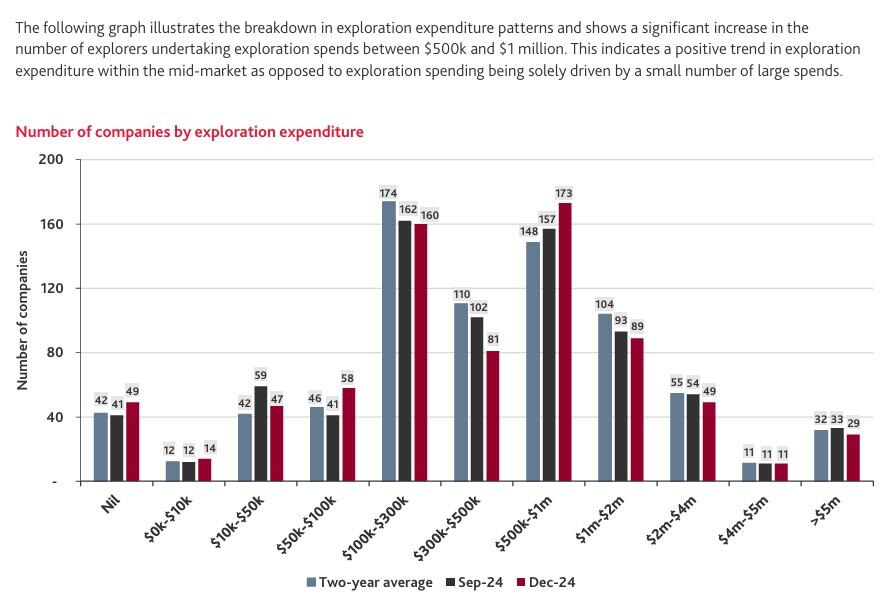

Interestingly, the proportion of companies reporting a financing inflow increased from 45% in the September 2024 quarter to 52% in the December 2024 quarter − the highest level since December 2022.

"This trend suggests that funding is becoming increasingly accessible not only to larger explorers and developers, but also those at the smaller end of the market,” the BDO report noted.

“This is reflected in the increasing number of exploration companies spending between $50k and $100k, indicating that smaller explorers are prepared to undertake modest exploration programs with confidence in their ability to secure future capital."

Based on BDO’s December 2024 quarter Fund Finders report, the top ten exploration companies who raised funds of $10 million or more were:

Gold fever

Shades of gold fever have already started to reignite mining activity in the tiny WA town of Coolgardie, 554 kilometres north-east of Perth, where gold nuggets were first discovered in 1892.

North of the town, Horizon Minerals (ASX: HRN) is just one of many nearby mothballed gold mines that have been recommissioned, and is again pouring gold after a 12-year hiatus when the gold price was US$1,600 an ounce.

It’s understood high profile investor, Tim Goyder could also be instrumental in opening a new mining hub in nearby Bullabulling, after acquiring ASX-listed Minerals 260 (ASX: MI6 suspended) from a Zijin Mining subsidiary for $156.5 million and $10 million in shares.

New era, new ballgame

Goyder reminds the market that when Bullabulling was last in commission in 1998, the gold price average US$294 an ounce.

Based on some estimates, Bullabulling could have gold resources of around 2.3 million ounces, which is comparable with the Dalgaranga deposit, a core Spartan asset that Ramelius recently acquired for $2.4 billion.

Assuming Goyder can raise his targeted $220 million during his current roadshow, he will have raised more than the second-placed commodity in the fundraising stakes [in the December quarter], copper-gold $211 million, while in third place, lithium only managed to raise $198 million.

However, it’s not just Coolgardie that’s experiencing a revival in production and exploration, with pits all over the country resuming production for the first time in decades.

M&A galore

Fundraising aside, the lofty gold piece has also triggered a renewed wave of M&A activity.

Northern Star Resources’ (ASX: NST) kicked off the current round of M&A activity after its $5 billion scrip acquisition of Pilbara developer De Grey Mining (ASX: DEG) in December.

At the Resources Rising Stars Summer Series in Brisbane early February, Lion Selection Group (ASX: LSX) CEO and managing director Hedley Widdup flagged M&A activity as the big theme for 2025.

At the junior end of town, Astral Resources (ASX: AAR), which owns the 1.27Moz Mandilla project outside Kalgoorlie, launched a takeover offer for smaller neighbour Maximus Resources (ASX: MXR) in late December.

Then there was Alto Metals, which was recently acquired by another nubile goldminer, Brightstar Resources (ASX: BTR), which bought unlisted Linden Alliance last year and merged with Kingwest Resources in 2023.

At the RIU Explorers Conference, Brightstar's managing director Alex Rovira told delegates that the average enterprise value per ounce of gold recently acquired in WA had been around $100/oz.

The race between juniors for infrastructure to capitalise on the long-term future of their gold operations is also evident within the recent decision by Black Cat Syndicate (ASX: BC8) to pay around $85 million to buy Westgold’s non-core Lakewood Mill south of the Super Pit.

Meanwhile, Alkane Resources (ASX: ALK) -backed Medallion Metals (ASX: MM8) is understood to be kicking the tyres on a plan to turn IGO’s disused Cosmic Boy nickel plant to process gold from its Ravensthorpe project in the southern WA Goldfields.