Earnings Season: Azzet updates on three resources stocks that reported Q4 results today.

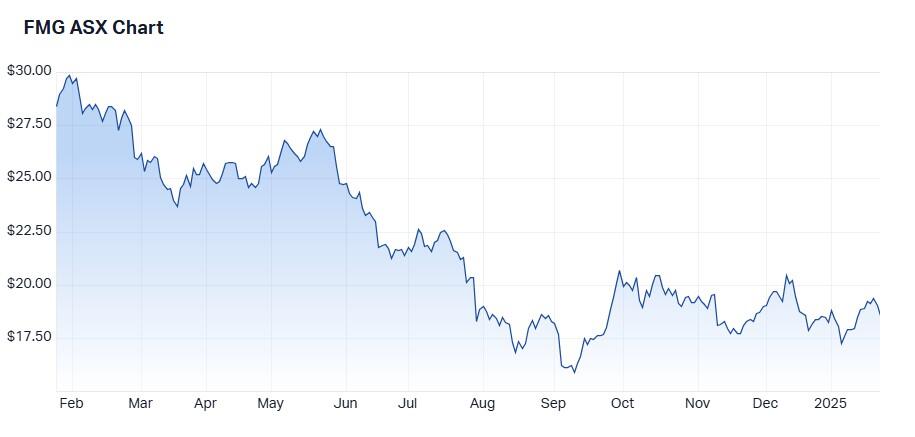

Fortescue down despite record 2H result

Despite a record-breaking second quarter and first-half result amid some challenging conditions, the Fortescue Metals Group (ASX: FMG) share price was trading around 2% lower heading into lunch today.

At face value, market sentiment towards Fortescue is inconsistent with what was a good result. The miner delivered on the market's shipments estimate and outperformed on costs.

Underscoring the quarterly result, the miner shipped 49.4 million tonnes (Mt) of iron ore.

Total shipments for the first half of the financial year were up 4% to 97.1Mt, which despite wet weather in the Pilbara region, was the highest half-year shipments in the company's history.

While the majority of this came from its Hermatite Operations, Fortescue's trouble-plagued Iron Bridge magnetite operations – supposed to be producing 22mt of high grade concentrate annually by mid-2023 - shipped 1.5mt in the second quarter, contributing a total of 3.2mt for the first half of FY 2025.

Overall, total ore mined in second quarter of FY 2025 increased by 12% year-on-year to 61.9mt, while total ore processed rose by 5% to 51.0mt.

The big miner reassured investors that it was on track to stay within capital expenditure guidance of between US$3.2 billion and US$3.8 billion and maintain full year iron ore production and guidance.

Due to higher mining volumes, a lower strip ratio aligned with the mine plan, and favourable currency exchange rates, the Hematite C1 costs dropping 10% quarter-on-quarter to US$18.24 per wet metric tonne (wmt).

Fortescue's FY 2025 Hematite C1 cost guidance remains unchanged at US$18.50–US$19.75 per wmt.

On the Fortescue energy front, the miner is continuing to assess the feasibility of the Holmaneset Project in Norway and the Pecém Project in Brazil.

Consensus on Fortescue is Hold.

The stock has a market cap of $57.24 billion and based on today’s share price has a 5.94% fully franked dividend yield.

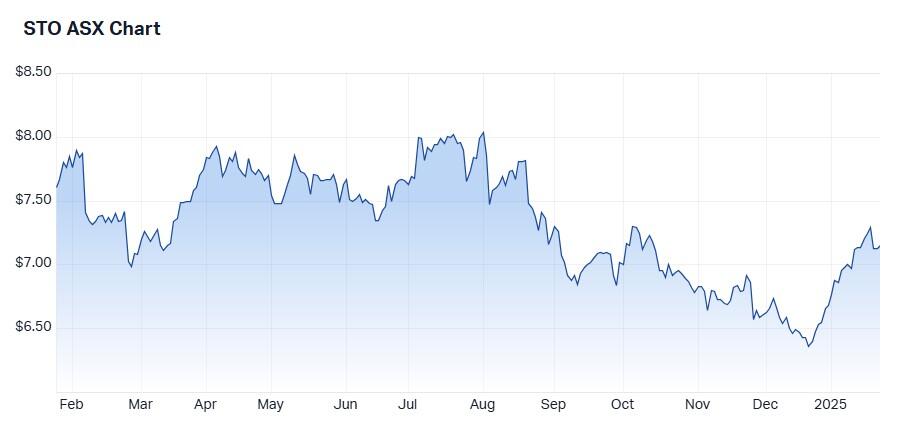

Santos up despite falling revenue

Shares in energy giant Santos (ASX: STO) were up by as much as 1.5% in early trading this morning following its Q4 and full-year update.

The market appears to have looked beyond a 9% fall in annual revenue as production slipped. Instead, it revealed that it was on track to deliver two major growth projects.

The company’s CEO Kevin Gallagher reminded the market that it is operationally focused on delivering its Barossa and Pikka projects within cost and schedule guidance in 2025.

“… we are making excellent progress towards first gas at Barossa in the third quarter of this year and first oil at Pikka in Alaska in 2026. The Barossa Gas Project is almost 90% complete and advancing to its final stages," he said.

“The Pikka project is almost 75% complete, with the second winter season pipelay activities underway and strong progress achieved to date. For both projects, well results are in line with pre-drill expectations.”

Meanwhile, despite lower LNG prices taking their toll on total revenue during 2024 of US$5.4 billion, the company expects to produce 90-97 million barrels of oil equivalent (MMBoe) during 2025, up from the 84-90MMBoe it expects to report in its annual report in February.

Santos reported strong fourth quarter free cash flow from operations of around US$430 million. This took its free cash flow from operations to US$1.9 billion for the full year.

Looking forward, Santos also guided FY25:

• Sales volumes of 92-99 MMBOE

• Unit production costs of US$7.00 to US$7.50 per barrel

Consensus on Santos is a Moderate Buy.

The stock has a market cap of $23.3 billion and for the past 12 months has an unfranked trailing yield of 6.6%.

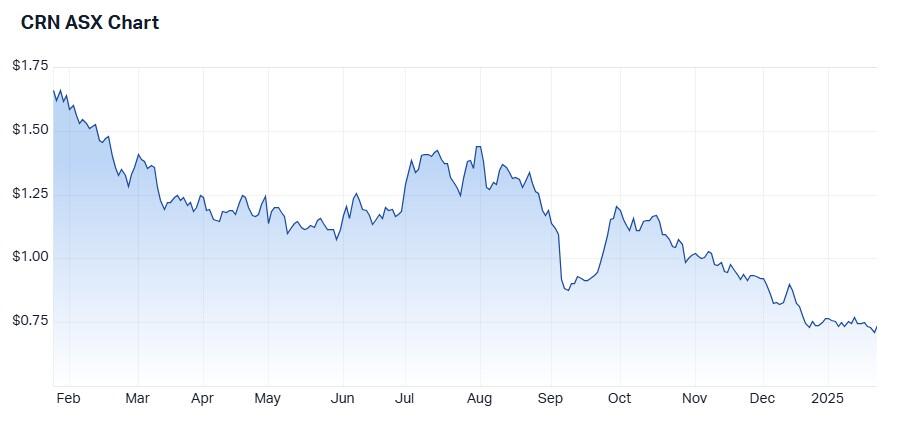

Coronado bounces on strong 4Q result

Shares in Coronado Global Resources (ASX: CRN) were up by 7% at noon following the coal miner’s revelations that its recently opened Mammoth Underground Mine - delivered on time and within budget – will ramp up production throughout 2025.

Investors also focused today on an update on Coronado’s Curragh mine complex near Blackwater. This complex lifted production to 3.4Mt run of mine (ROM) coal last quarter, marking an increase of 29.1% over the September quarter.

The fourth quarter result also delivered positive operational results with increased production and sales volumes, supported by improved Australian operations performance.

For example, Q4 Group run of mine (ROM) production of 6.9 Mt was up 8.8%; saleable production of 4.0 Mt was up 4.1%; and sales volumes at 4.1 Mt were up 4.7%, against Q3.

Coronado’s CEO Douglas Thompson noted that while the company ended the year with 0.6 Mt of ROM inventory - which would have resulted in saleable production of around 15.8 Mt for the year if processed - the benefit will be realised in January 2025.

“We believe we are well positioned for the near term met coal market challenges with the successful implementation of derisking activities, the delivery of the growth portfolio, enhanced liquidity and a strong balance sheet,” said Thompson.

“The focus for 2025 remains on driving operational improvements and further reducing costs… particularly the Mammoth Underground Mine and Buchanan Expansion projects, both of which are expected to have extremely positive prospects and continue to be developed from available cash.”

On a YTD basis, in December 2024 Coronado achieved ROM production of 26.6 Mt, up 4.5% compared to 2023 and up 4.9% compared to 2022. This reflects improved planning and efficiencies across all operations.

December quarter group revenue was $558 million, 8.3% lower than September quarter group revenue of $608 million.

FY2024 group revenue was $2,508 million, down 13.2% compared to FY2023 revenue of $2,891 million.

Consensus on Coronado is a Moderate Buy.

Coronado has a market cap of $1.2 billion putting it just inside the ASX300.

The stock’s share price has been down around 55% over 12 months. It pays an annual dividend of $0.016 per share, with a yield of 2.19%.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.