Investors are flocking to the safe haven of gold as tariffs, the latest iteration of a United States-China trade war, send market analysts and investors flapping up and down like headless chickens in a china shop.

This is evident in the current price volatility in equities and investment firms such as Goldman Sachs give bullion a long-term positive outlook.

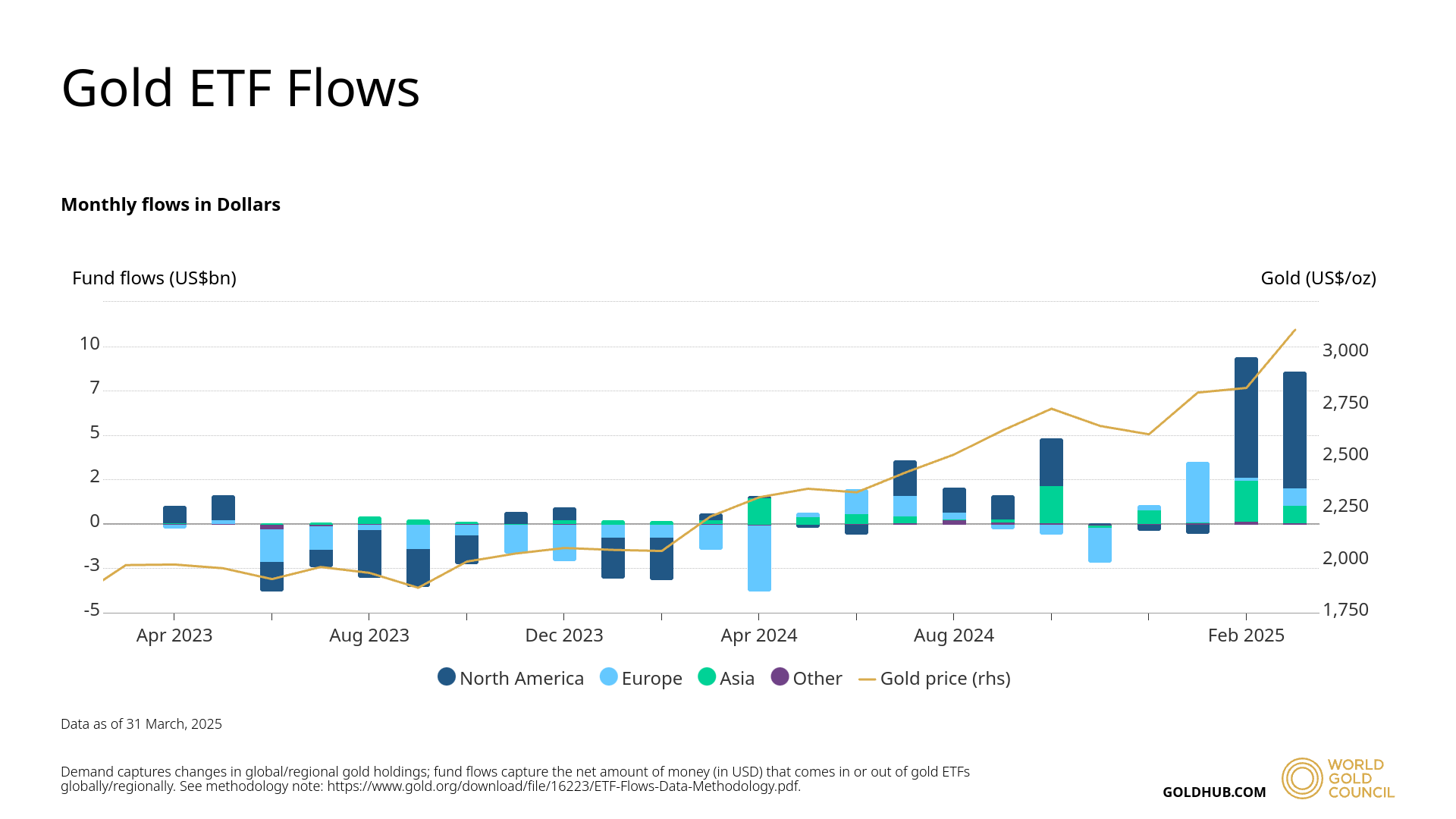

Global gold ETF inflows continued through March, with positive demand across all regions. After four consecutive monthly inflows, global gold ETFs reached another month-end peak of US$345 billion and holdings rose 3% to 3,445 tonnes.

Figures showed an eye-popping 28% increase during Q1.

Price outlook

As always in times of crisis, bullion has been climbing - recording its most impressive ever year-to-date price rise no less, ending last week up another 6.6% to US$3,237/oz.

Having received basically a cease or desist order from bonds, market pressures have forced U.S. President Donald Trump to pivot into his tariff strategy, causing even more confusion for investors.

That, in turn, has led Goldman Sachs to reinforce a positive long-term outlook for gold, and is even considering bullish (if we enter one) recession targets of US$4,250/oz.

"The long-term outlook for gold remains structurally bullish, despite the recent volatility," Goldman Sachs head of global commodities research Daan Struyven says.

“I think this is a very attractive point to enter long gold positions, especially as a hedge both against the general risk of a recession in the U.S. or globally, but also given the particularly important role that gold could play to mitigate against the likely drivers of a potential recession,” says Struyven, who forecasts that gold prices could rise to US$4,250/oz in a recession.

Gold can help mitigate some of those recession drivers, he notes, which includes policy risk from the U.S., “whether it's on the trade policy side, pressure from the Fed, or other changes in U.S. institutions and governance that may erode global investors' trust in U.S. assets".

Which ASX goldies are wheeling and dealing?

Ramelius Resources (ASX : RMS) X Spartan Resources (ASX : SPR) - $2.4 billion

One of the first big mergers in the Australian gold scene for 2025, Ramelius was long-touted to take over its neighbour Spartan in the WA Gascoyne region which found high-grade gold at depth at two major deposits - Never Never and Pepper.

A deal was finally inked last month, with Ramelius actioning a friendly takeover of Spartan, a 27.5% premium to the latter's 30-Day VWAP share price.

Northern Star Resources (ASX : NST) X De Grey Mining (ASX : DEG) - $5 billion

Ever-growing Northern Star is back on the M&A trail and has just received the OK from fellow gold miner and 27% shareholder Gold Road Resources (ASX : GOR) to purchase De Grey's world-class 11Moz+ Hemi gold project with a $5 billion bid at a 44% premium.

Greatland Gold X Telfer (Newmont) - $26 billion

With its Havieron deposit right next door, Canadian goldie Greatland snapped up the Newmont-owned and prolific Telfer gold mine for a relative song - as Newmont had deemed the mine a non-core asset after its multi-billion takeover of Newcrest Mining last year.

The miner plans to list on the ASX sometime this year, and may be on the prowl to consolidate and expand in the region and is rumoured to have eyes on Antipa Minerals' (ASX:AZY) tenements nearby.