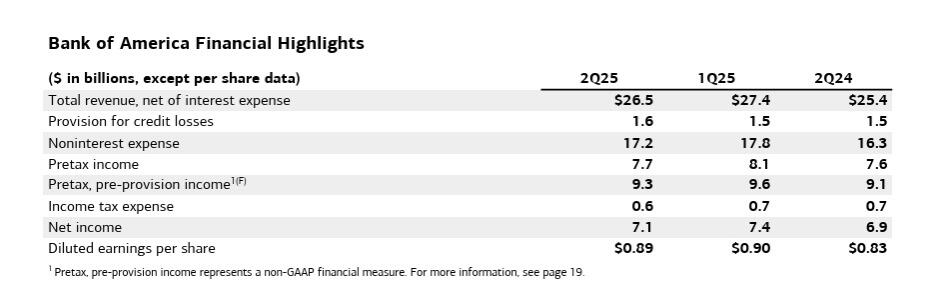

Bank of America reported $26.6 billion in revenue, up 4% year-over-year, and net income of $7.1 billion, with EPS of $0.89, topping analyst expectations by 3.5% (GAAP), but GAAP revenue missed forecasts.

Despite a sequential dip from Q1, the bank maintained strong fundamentals: $2 trillion in deposits, $3.44 trillion in total assets, and a CET1 ratio of 11.5%.

Chair and CEO Brian Moynihan said: "We delivered another solid quarter, with earnings per share up 7% from last year.

"Net interest income grew for the fourth straight quarter, reflecting eight consecutive quarters of deposit growth and 7% year-over-year loan growth.

"Consumers remained resilient, with healthy spending and asset quality, and commercial borrower utilisation rates rose.

“In addition, we saw good momentum in our markets businesses. So far this year, we have supplied more capital to our businesses and returned 40% more capital to shareholders in the first half of this year than last year.”

Consumer Banking and Wealth Management showed robust growth, while Global Markets delivered record sales and trading revenue.

Bank of America’s second-quarter results underscore its strength as a diversified financial platform with scale, liquidity, and digital momentum.

The bank added 175,000 net new checking accounts and grew consumer investment assets to $540 billion.

Wealth & Investment Management client balances reached $4.4 trillion, up 10% year-over-year.

A dividend hike (+8%) and $5.3 billion in share repurchases signal confidence in long-term capital deployment.

AI-driven tools like Erica (3B+ interactions) and 79% digital engagement across households reinforce operational efficiency and client retention.

At the time of writing, the Bank of America Corp (NYSE: BAC) share price was US$46.03, down 12 cents (0.26%). In after-hours trading, it was $46.08. BoA's market cap is around $346.32 billion.