The value of the Australian superannuation industry has passed through the A$4 trillion mark, according to the Australian Prudential Regulation Authority (APRA).

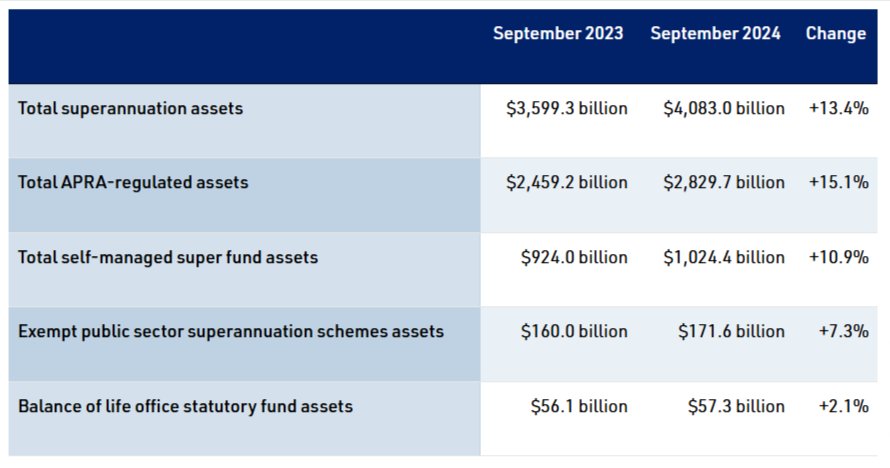

Publishing its Quarterly Superannuation Performance publication and the Quarterly MySuper Statistics report for the September 2024 quarter, APRA said superannuation assets increased 3.7% to $4.1 trillion at September 2024.

Of these retirement savings, $2.8 trillion are in APRA-regulated funds, where assets grew 15.1% over the year.

The next highest category is self-managed super funds where assets increased 10% to $1.024 billion while exempt public sector super scheme assets rose 7.3% to $171.6 billion and the balance of life office statutory fund assets gained 2.1% to $57.3 billion.

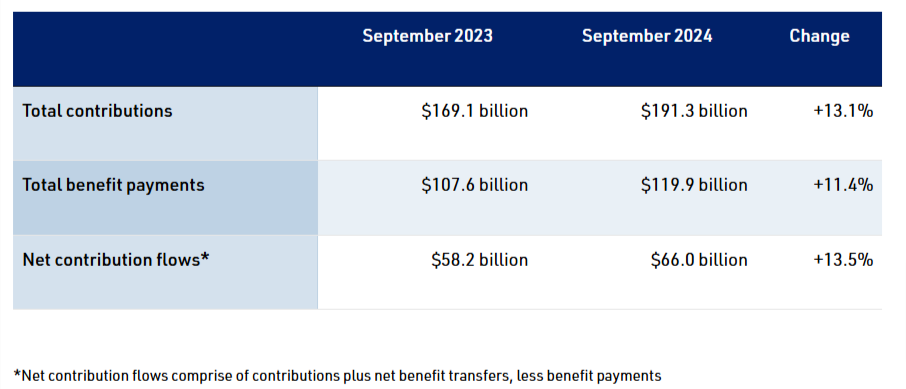

Contributions increased 13.1% to $191.3 billion in the year ending September 2024, with employer contributions rising 11.4% to $140.8 billion and member contributions jumping 18.1% to $50.5 billion.

Benefit payments increased by 11.4% to $119.9 billion as lump sum payments edged 4.9% up to $65.1 billion and pension payments surged 20.3% to $54.8 billion.

Australia has the world’s fourth-largest pension pool because employers have been required since 1992 to put aside a percentage (3% then, 11.5% now) of an employee’s salary to be invested for their retirement.