Welcome to Super Nation: Australia’s retirement savings industry in focus, a new fortnightly column about superannuation.

Every two weeks we will step away from the daily news cycle and examine, explain and analyse key issues in one of Australia's largest, fastest-growing and most important industries, one that helps determine the quality of life for millions of people when they retire.

An unnamed Australian superannuation fund trustee took more than 500 days to pay an A$100,000 (US$59,000) death benefit to a First Nations woman who was grieving the loss of her husband.

Australia’s largest super fund AustralianSuper allegedly spent between four months and four years assessing at least 6,897 death benefit claims between 1 July 2019 and 18 October 2024.

The Construction and Building Unions Superannuation Fund (Cbus) allegedly took more than 90 days to process death benefits and total and permanent disability (TPD) insurance claims, costing more than 10,000 members about $20 million in total.

Regulatory review

What has been taking place in superannuation, the A$4.1 trillion (US$2.6 trillion) industry to which 18 million Australians entrust their retirement savings?

So concerned was the Australian Securities and Investments Commission (ASIC) about how funds managed death benefit claims that it launched a review, culminating in the Taking ownership of death benefits: How trustees can deliver outcomes Australians deserve report released on 31 March.

Although it was probably an outlier, the investigation unearthed the egregious case of a First Nations woman who had to wait more than 16 months for a life insurance payout from one fund.

The offending institution was not named but we know ASIC’s review of claims in the two years ending 31 March 2024 covered the trustees for these funds (representing 38% of all member benefits):

Avanteos (Colonial First State)

Commonwealth Superannuation Corporation

NM Super (AMP)

Nulis (MLC)

Rest, and

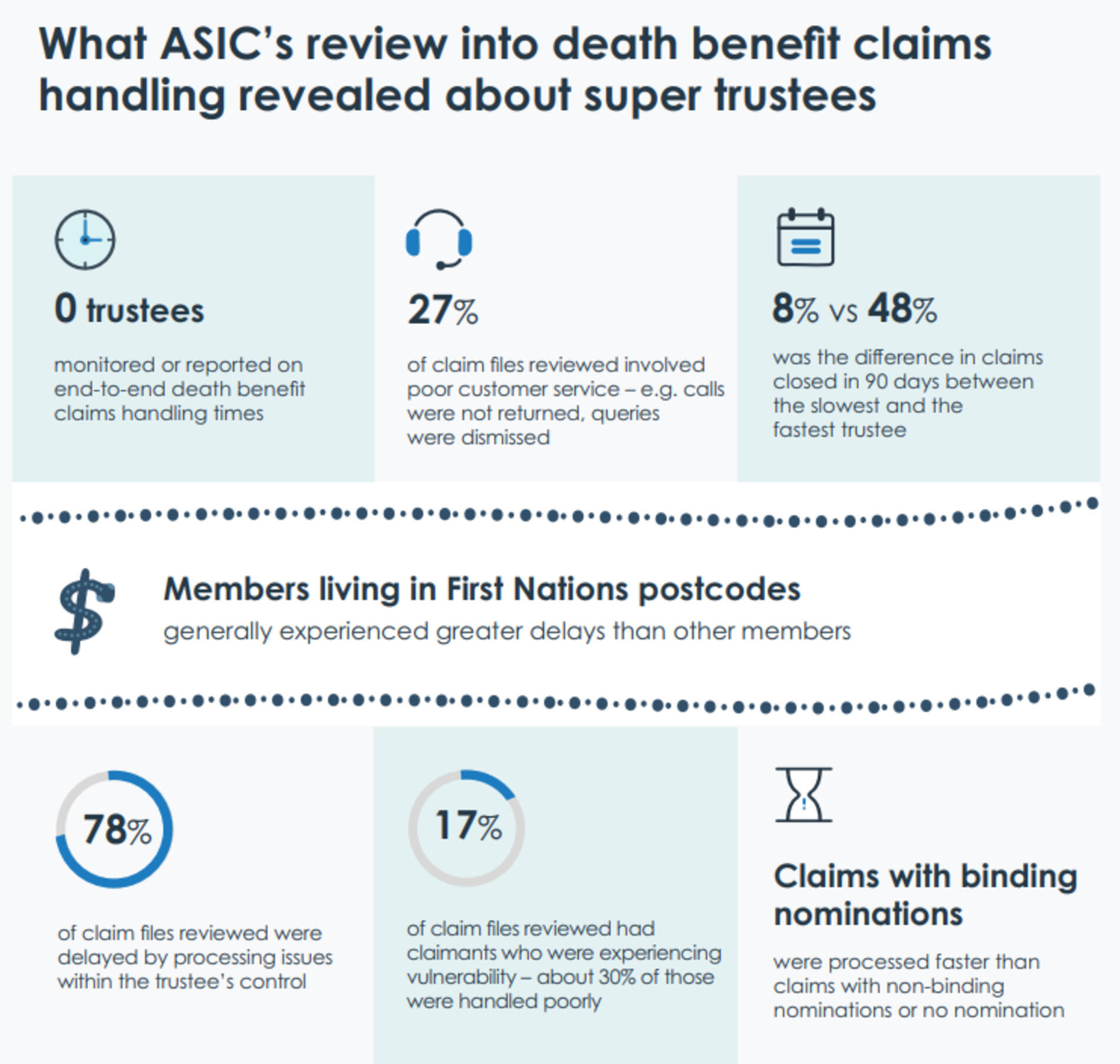

Almost as shocking was the finding that none of them monitored or reported on how long it took to handle claims from "end-to-end", in stark contrast to the claimants who certainly would have known exactly how long they had to wait.

ASIC also found:

four in five of the claims were delayed by processing issues within the fund’s control

larger balances were paid faster, raising serious equity concerns, and

some trustees ignored binding nominations and engaged in overcomplicated reviews, increasing waiting times and distress for grieving families.

The corporate regulator hit the nail on the head when it talked about the “devastating impacts that poor industry practices can have on grieving Australians” like the First Nations woman in the anonymised case study.

“Many of the complaints we read were distressing. We saw deep grief, vulnerability, frustration and genuine suffering,” ASIC Commissioner Simone Constant said in a media release.

How it unfolded

So how did it come to this?

Given super has been compulsory and universal for more than 30 years, it is surprising that delayed insurance payouts has proven to be one of the few negative issues that has cast a shadow over the industry, and then only in recent years.

It took a call to ABC Radio Melbourne in June 2023 for the public spotlight to be turned on this issue with Carolyn Hocking telling presenter Virginia Trioli she waited more than 15 months to receive her late husband's superannuation from Cbus.

"All these people are going through grief and trauma and stress and they're playing with people's lives," Hocking said at the time.

Super Consumers Australia (SCA) called the ASIC report “damning”, saying it revealed widespread failings by super funds in handling death benefit claims, including delays, unfair treatment, and a total lack of transparency, leaving grieving Australians without support at the most difficult moments in their lives.

SCA CEO Xavier O’Halloran said super funds were facing a moment of reckoning as they had not been held as accountable for their actions as banks because consumers did not interact with these funds as often.

“Super has been out of sight and out of mind for a lot of people and only at times when they come to claim on their money do they discover the customer service is lacking,” he told Azzet.

His organisation has called on the Government to urgently introduce mandatory service standards, including timeframes for processing death benefit claims, and to adopt ASIC’s plain language guidance into Treasury’s upcoming standards work.

“ASIC has laid out the steps. The Government must now turn this into enforceable obligations—so no family is left in the dark at the worst time in their lives,” O’Halloran said in a media release.

ASIC noted none of the industry codes, standards and guidance documents about claims handling and death benefit payments developed for super funds were binding on trustees.

Australia's corporate regulator broadened its wave of legal action in the super industry by prosecuting AustralianSuper in the Federal Court in March over the delayed processing of death benefit claims, alleging it failed to process them efficiently.

Peaks tread warily

While knowing they had to address the issue while it was current, the industry’s peak bodies stepped around it very carefully with their public statements.

Super Members Council, which represents profit-to-member industry, public sector and corporate funds, said in a media release that it acknowledged ASIC's report “with deep empathy”, a phrase which the Australian Financial Review newspaper called ‘psychobabble’.

The Association of Superannuation Funds of Australia (ASFA) apologised for the delay while emphasising they applied only to a minority of claims.

“The superannuation sector knows we have let down some of our members and their families at a time when they needed us, and we are sorry,” ASFA CEO Mary Delahunty said in a media release.

“While the majority of our members and their families have a seamless experience with death benefits claims, we know we need to do better to make sure this is the experience of as many people as possible.

ASFA said many of the 34 recommendations made by ASIC were underway, including helping members to make valid death benefit nominations, providing claimants with regular updates about the status of their claim, and ensuring communication was appropriately compassionate and thoughtful.