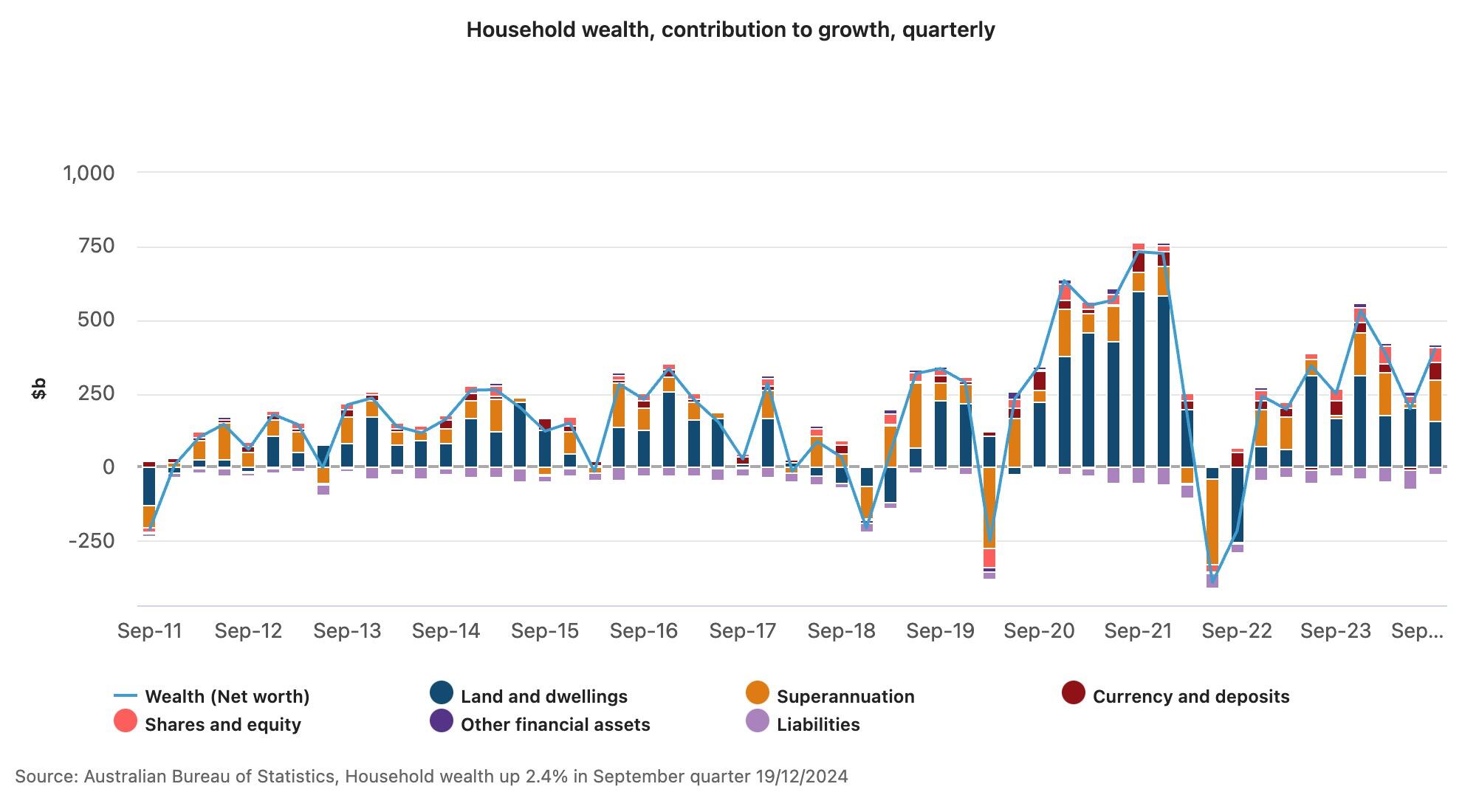

Household wealth in Australia rose by 2.4%, or A$401 billion, for the eighth quarter in a row in the September quarter of 2024, according to figures released by the Australian Bureau of Statistics (ABS).

At the end of the September quarter total household wealth was $16.9 trillion, 9.9% ($1.5 trillion) higher than a year ago. The highest contributor was residential land and dwellings, providing 0.9% percentage points to the rise in household wealth.

“Household wealth continues to be supported by rising house prices despite a recent moderation in growth,” ABS head of finance statistics Dr Mish Tan said.

“Strong performances in domestic and overseas share markets contributed to the growth in household superannuation balances this quarter.”

Share market growth over September drove superannuation assets up 3.5% ($137.4 billion) which contributed 0.8% to the quarterly growth in household wealth. The superannuation guarantee added to retirement savings balances through increased employer contributions, rising from 11% to 11.5%.

The rise in household deposits (3.7% or $61.5 billion) reflected a higher household saving ratio and there was also growth in disposable income driven by an increase in income received by households and the introduction of stage 3 tax cuts.

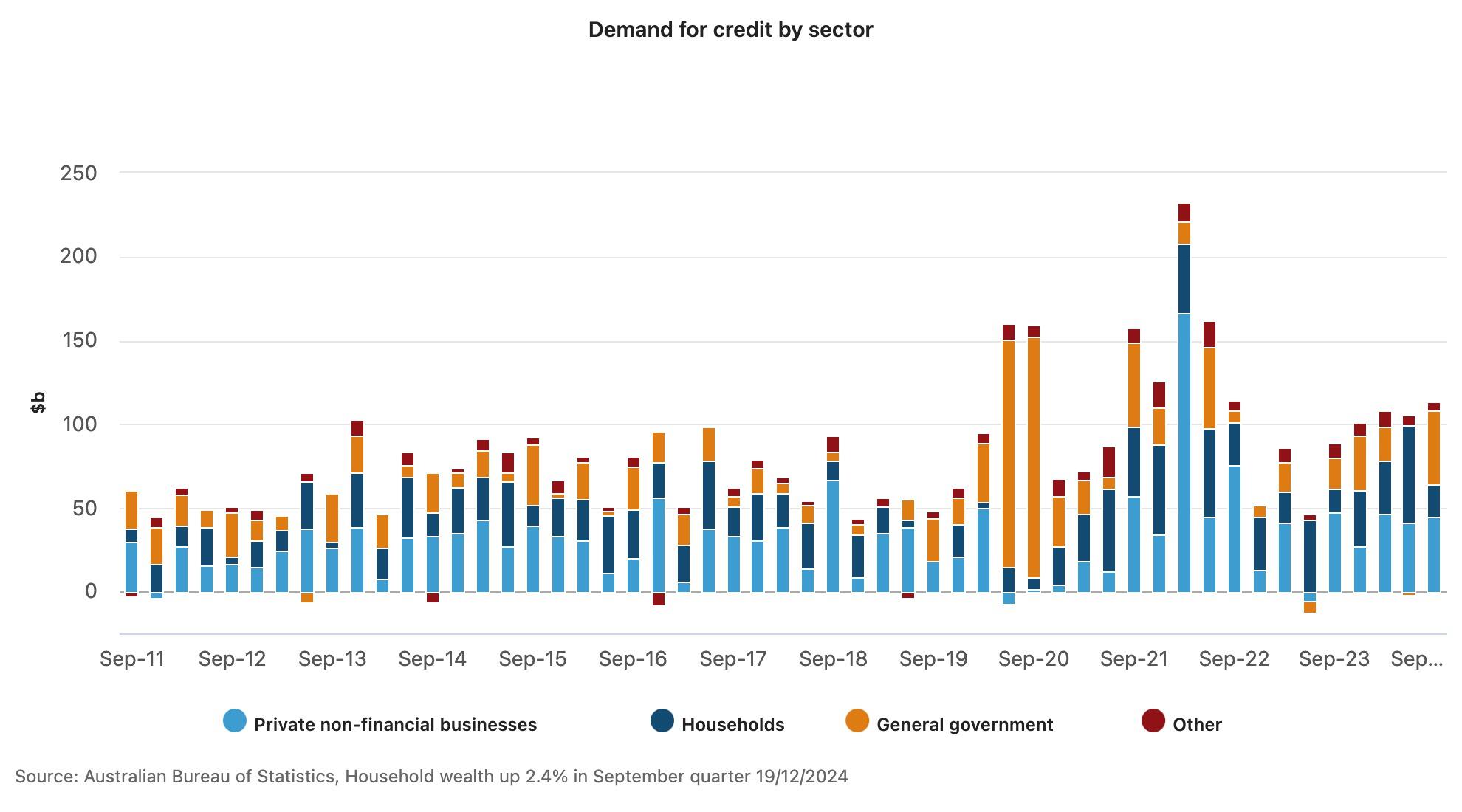

Total demand for credit was was $113.3 billion, driven by private non-financial businesses ($44.7 billion), general government ($44.6 billion) and households ($19.2 billion).

“Commonwealth government issuance of Treasury bonds was the highest since September quarter 2020, driven largely by increased funding requirements,” Tan said.

Overall, Australia remains wealthy with insights published by Morningstar in September showing it is ranked second in the world for median wealth per adult and fifth for average wealth per adult.

According to the Morningstar report, average household wealth in Australia is $810,000.