Australia’s property market made a confident comeback in FY25, PEXA reports, with settlement volumes climbing 3.2% to nearly 722,000 deals.

Queensland led in total activity, while Victoria took top spot for residential settlements in the June quarter. Despite the upswing, quarterly figures slipped slightly — down 1.6% year-on-year — thanks to weather disruptions and the May election.

Total property value soared to $726.6 billion, up 9.4%, with Queensland and Western Australia driving growth.

Falling interest rates and steady job gains helped cushion consumers from cost-of-living pressures, keeping mortgage defaults low and demand strong. The RBA’s double rate cuts in February and May lifted sentiment, while wages finally outpaced inflation.

Still, home-building lagged behind demand. Australia faces a projected shortfall of 79,000 homes by 2029, with approvals rebounding in May but still below cycle peaks.

Regional hubs and growth corridors are absorbing the demand, especially in states like Victoria and Queensland, where suburbs like Mickleham, Wollert, and Yarrabilba have seen a wave of new land sales.

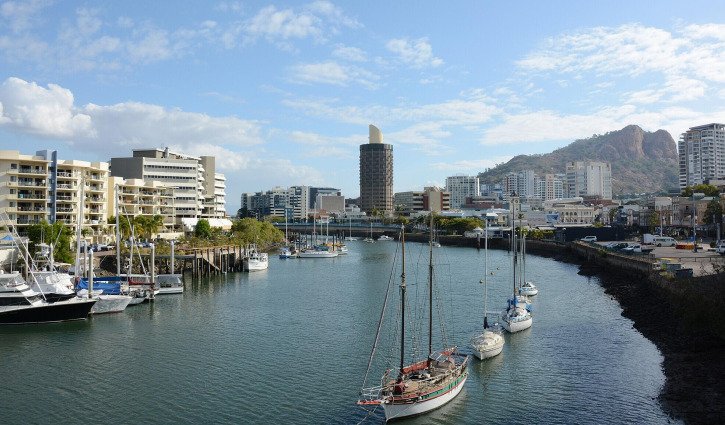

Queensland’s residential property topped $643 billion in value, outpacing Victoria, with a 19.8% annual jump. Western Australia wasn’t far behind at 19.1%. Meanwhile, commercial deals held up well, totalling more than 31,000 nationwide, with regional NSW, Victoria, and Brisbane leading the charge.

Buyers are increasingly looking beyond the major cities. Regional settlements were up across the board, and price growth in Greater Brisbane and regional Queensland hit 12.5% and 13.8%, respectively. With affordability tightening in metro areas, regional migration is back in focus.

The market’s momentum is undeniable — but so are the supply constraints.

As housing targets grow tougher to meet, competition is heating up.

Investors watching the medium-term landscape may find their best returns in well-positioned regional centres and growth suburbs where demand is already surging.