Aussie icon stocks like Qantas, Telstra, Ramsay Healthcare, and those with household-recognised brands like Wesfarmers and Endeavour Group are among a growing list of ASX-listed large caps that may no longer deserve the moniker ‘bluechip’ due to the worrisome levels of debt they carry.

Azzet looked under the financial bonnet of the share markets' largest stocks for those displaying varying degrees of financial distress. Investors may wish to steer clear of these stocks in the challenging trading environment ahead.

First, housekeeping: When we searched for stocks carrying a larger than normal amount of debt, we started by applying key filters.

Given that highly leveraged stocks in the banking, financial and infrastructure/utility sectors typically have enough cash flow to justify an investment-grade rating, we removed these stocks from our selection process - and Telstra (ASX: TLS) which has a net-debt to equity of more than 100%, is a classic example.

The filters

For starters, we limited our universe to ASX300 stocks, and focused exclusively on companies with market caps of around $1 billion or more.

While investment-grade stocks like to keep their net debt-to-equity - a measure of a company’s financial leverage - well under 70%, we created some slack and filtered for more highly leveraged stocks with net-debt to equity in excess of 100%.

We then filter for long-term debt-to-equity ratios. This represents debt that is not due for repayment within 12 months, and as such isn’t included in the current liabilities figure on the balance sheet.

Another filter we added was free cash flow to long-term debt. This ratio gauges how easy it is for a company to service its long-term debt obligations from its current cash flow, plus what’s needed to support operations and maintain its capital assets.

Given that it relies on cash flow, this ratio can experience higher volatility than others.

Finally, we rated these stocks using the Altman Z score to identify how closely a company resembles other companies that have filed for bankruptcy. This complex calculation provides some clues as to how close a company - everything else being equal - might be to failure.

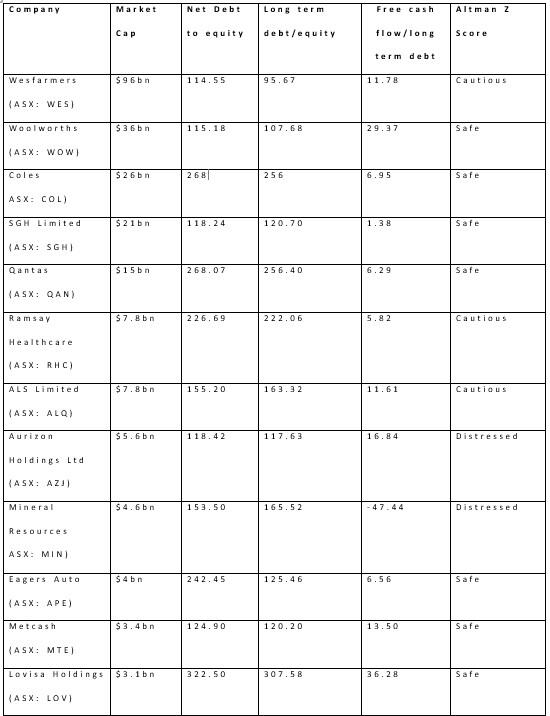

This table shows a list of the top dozen stocks by market cap, which, when based on the numbers, appear most susceptible to future pain if they don't reduce debt balances.

Beyond these 12, other larger cap stocks trading with disproportionate levels of debt include: Domino's Pizza Enterprises (ASX: DMP), Regis Healthcare (ASX: REG), , Healius (ASX: HLS), Ooh!Media (ASX: OML), Myer Holdings (ASX: MYR), Australian Clinical Labs (ASX: ACL), Ingham (ASX: ING), Vulcan Steel (ASX: VSL) and Collins Foods (ASX: CKF). With the exception of the three latter stocks, the remainder of this group of stocks appear to be distressed based on the Altman Z score.

But as we discussed last week, it's imperative to note that no one financial ratio can be viewed in isolation. Likewise, just because a stock carries no debt on balance doesn't necessarily shield it from financial risk.

So while it may be helpful to look for stocks with low debt, there are many other factors to consider.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.