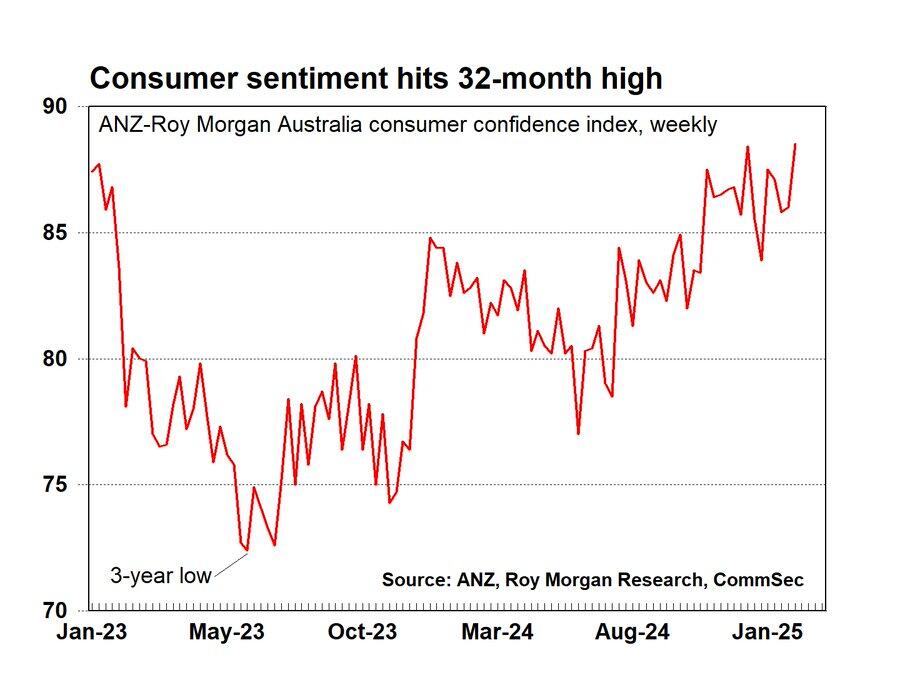

ANZ-Roy Morgan Consumer Confidence climbed 2.5 points to 88.5 following the Australia Day long weekend, rebounding after three consecutive weeks of declines to touch its highest level since May 2022.

The uptick was primarily driven by stronger buying intentions and a more optimistic economic outlook.

Consumer Confidence now stands 4.7 points higher than the same period last year at 83.8 and 1.5 points above the 2025 weekly average of 87.0.

Confidence improved in Victoria, Queensland, Western Australia, and South Australia, while it remained largely unchanged in New South Wales.

In terms of financial conditions, 20% of Australians believe their families are financially "better off" than a year ago, while 46% say they are "worse off".

Looking ahead, 33% expect their financial situation to improve in the next year, while 28% anticipate a decline.

Optimism about the economy increased, with 11% expecting "good times" over the next year - the highest level since July 2024.

Meanwhile, 27% foresee "bad times", leading to the best net result of negative 16 for this indicator since April 2022.

Long-term sentiment also improved, with 13% expecting economic growth over the next five years, while 17% predict a downturn.

Consumer sentiment regarding major purchases improved, with 27% considering now a good time to buy major household items, compared to 44% who view it as a bad time.

ANZ Economist, Sophia Angala, commented: "Households are feeling more confident about the economic outlook, with short-term economic confidence rising to its highest level since April 2022 (before the first rate hike in May 2022), while economic confidence over the next five years reached a 12-month high.

“The decline in weekly inflation expectations and the broad-based lift across the subindices may have been influenced by discussion that the RBA could cut rates at its February meeting. This comes after the quarterly CPI indicator showed that the RBA’s preferred measure of inflation, the trimmed mean, printed below RBA forecasts in Q4.”