With the Chinese economy feeling the brunt of the Trump administration's tariffs as part of the United States-China trade war, Xi Xinping is expected to volley another stimulus package. If directed towards housing, that could be a boon for Australia's iron ore export volumes.

China has long been Australia’s top goods export destination, accounting for 6.6% of GDP last year - and over the past decade, iron ore has made up 56.6% of that (~3.4% of total GDP).

Yet the slowdown in China’s economic growth could reduce demand for Australian exports - particularly commodities.

There may be a workaround. Historically, Australian raw materials were processed into inputs in China for manufacturing goods and sold elsewhere; however nowadays, Australian exports such as iron ore are consumed more in China.

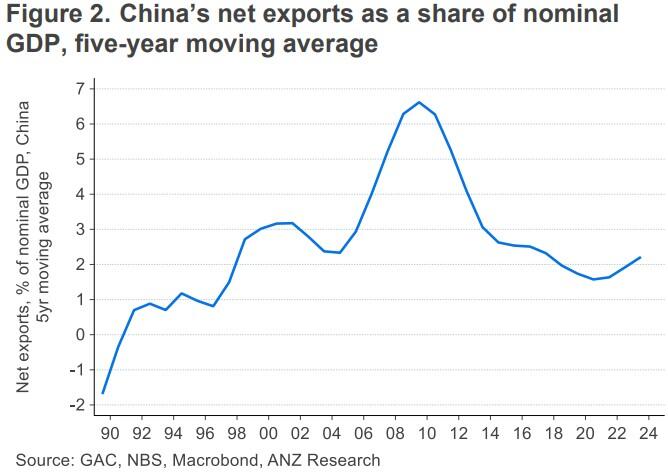

Net exports in China peaked at 8.5% of nominal GDP in 2007 but have since declined to 2.1% as of 2023 data - opting to consume domestically rather than move to processed materials.

This suggests, says Angala, that in the near term demand within China is likely to have a far greater impact on Australia’s exports than will the flow-on effect of US tariffs on the latter’s imports of Chinese goods.

“Any benefits that Australian exports may feel from China’s anticipated policy stimulus will depend on which sectors the policies target.”

Housing boost?

If Xi Xinping's expected government stimulus is directed at resource-intensive industries, such as infrastructure or the property market, it will reduce the negative impacts on Australia’s commodity exports of any slowdown effects, “whereas [a] stimulus focused on boosting China’s household consumption will be less beneficial”, Angala says.

China's housing market has been on a downturn since 2021, and any stimulus designed to reignite it would bode well for Australian iron ore, exported to be turned into steel.

“In terms of composition, this would echo China’s response to the 2008 global financial crisis, when authorities introduced stimulus focused on infrastructure,” Angala says.

“The rise in Chinese steel production led to increased demand for Australian resource exports such as iron ore, and this was a key contributor to Australia’s mining boom.”

In the case of a bottoming out of iron ore exports to the Middle Kingdom, Angala suggests Australia’s resources exports are also pretty significant in China’s pivot to decarbonisation and digitisation.

“Those policy goals will structurally shift trade flows away from iron ore and support demand for the metals used in clean energy technology, like copper or lithium.”