Azzet reports on two Listed Investment Companies (LICs) with noteworthy ASX updates today

Despite global uncertainty Argo Investments remains poised to seize short-term upside

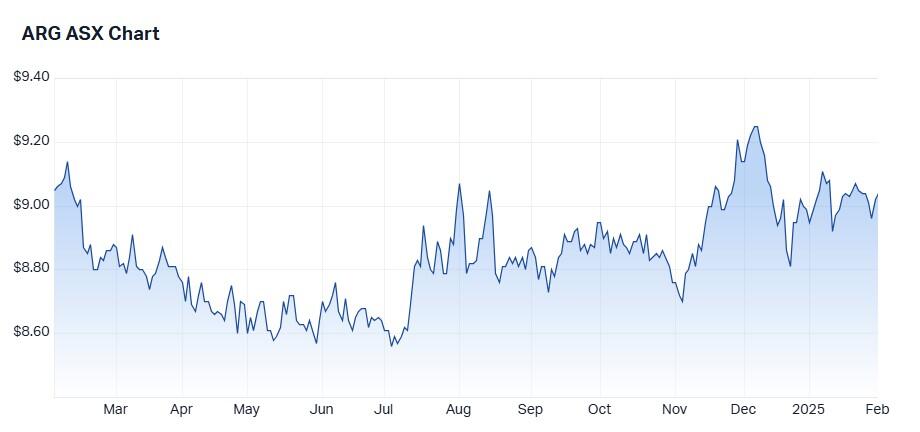

With market momentum clearly against it this morning – ASX200 down over 2% - Argo Investments (ASX: ARG) reasonably healthy half year result failed to capture the market’s imagination with the share price trading only marginally higher at $9.03 heading into lunch.

While net profit fell 3.7% to $121.2 million in the six months to December, the listed investment company (LIC) posted an investment return of 11.7% in 2024, due in part to the kicker provided by technology bellwether Technology One (ASX: TNE).

Dividend income rose to $137.5 million and this resulted in management boosting the ASX200 stock’s interim dividend to a record 17c (up from 16.5%) for the half year.

Due to the current share price discount to its net tangible assets position (NTA), the LIC plans to “neutralise” its dividend reinvestment plan and dividend substitution share plan for the interim dividend by buying the shares required for shareholders.

The full-year return – which came in ahead of the S&P/ASX 200 Accumulation Index’s 11.4% – obscured the company’s marginal underperformance in the half-year when the return of 6.3% fell short of the benchmark.

Noteworthy movements within Argo’s portfolio during the period include the purchases of Worley (ASX: WOR), Steadfast Group (ASX: SDF), National Australia Bank (ASX: NAB) and BHP (ASX: BHP), and the sale of Commonwealth Bank (ASX: CBA), Arcadium Lithium (ASX: LTM) and Aristocrat Leisure (ASX: ALL).

Looking ahead, the company expects the new U.S. administration’s policies and pronouncements to continue to play a pivotal role in reshaping the global economic landscape, including trade conditions and supply chains.

“Despite recent market fluctuations, we remain generally optimistic about the outlook for the domestic economy. The jobs market remains strong, corporate balance sheets are robust, and expenditure has remained resilient,” management said.

“As the February corporate results reporting season gets underway, we will be particularly focused on the outlook for companies’ earnings, which have been relatively subdued in more recent times.”

While management did not update guidance, it reminded investors that cash available will help capitalise on short-term opportunities and a diversified portfolio, which includes stocks that benefit from the strong US$.

Argo Investments’ market cap is $6.8 billion putting it well inside the ASX100. The share price is down around 1% over 12 months.

The 20-day moving average is falling as upward momentum wanes.

Hearts and Minds Investments defies the sinking market

Amid the sea of red ink on the main board today, courtesy of U.S president Trump's trade war fears, Hearts and Minds Investment (ASX: HM1) was up around 1% in afternoon trading following an encouraging half year up to date, which saw its post-tax NTA move from $3.53 to $3.60.

Based on a 23.6% increase in its investment portfolio to 31 December 2024, the LIC’s board chose to make an early announcement of an increased fully franked half yearly dividend of 8.0 cents per share. This equates to an annualised fully franked dividend yield of 5.2%, and a grossed up yield of 7.4% on the LIC's share price at 31 December 2024.

Buoyed by a fall in the A$, the LIC reported a pre-tax investment return, less expenses, of 23.6% for the six months to 31 December 2024.

While the LIC experienced good gains across most holdings, stand out performers over the half year were Zillow up 60%, Guzman y Gomez (ASX: GYG) up 48%, Brookfield Corp up 45%, Rokt up 40% and Block (ASX: XYZ) up 32%.

Management noted that the strong performance of the investment portfolio over the last eighteen months has boosted investment returns since inception in November 2018 to 12.3% per annum.

“The Board of Directors are confident that HM1’s continued strong investment performance and increased fully franked half-yearly dividend will continue to narrow the share price discount to HM1’s pre-tax net tangible assets (NTA) per share,” the LIC said.

The LIC, which draws high-conviction investment ideas from a group of core and conference managers, has a board lineup including identities from Australia’s financial services community: These include Barrenjoey’s Guy Fowler and Matthew Grounds, funds management stalwart Chris Cuffe, Wilson Asset Management founder and sole owner Geoff Wilson and famed corporate raider Gary Weiss.

While the LIC takes long-only positions in 25-35 global securities, it surprised the market last year by abandoning its listed equities-only position and investing in two private companies, Rokt and Guzman y Gomez.

Former abrdn Australia managing director Brett Jollie is expected to replace Paul Rayson as CEO over the next few months.

The LIC has a market cap of $744 million, making it the ASX’s 400th largest stock.

The stock’s share price is up 22% over one year.

Consensus does not cover this stock.

The LIC appears to be in a long-term uptrend confirmed by multiple indicators.

It will release its full half-yearly results on February 20, 2025.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.