Azzet reports on three ASX stocks with notable trading updates today

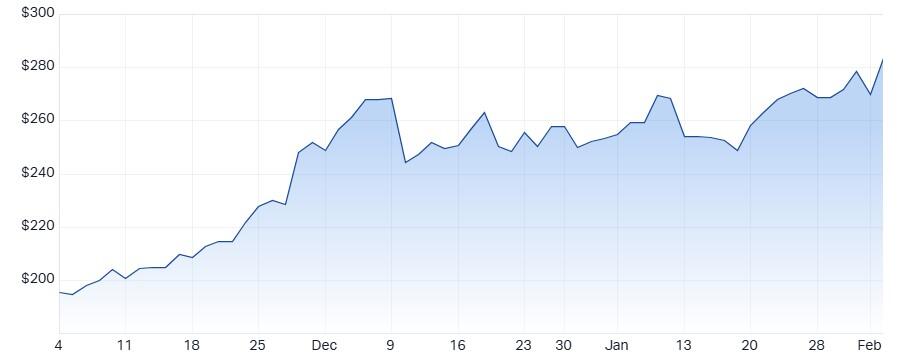

Pro Medicus soars on news of another major US contract

Shareholders in Pro Medicus (ASX: PME) had lots to cheer about today with the share price up around 8% to a record high of $283.12 on revelations that the health imaging technology company had signed a major deal with a leading health care system in the United States.

What got the market excited today was the news that the company’s subsidiary, Visage Imaging, Inc., has signed a $53M, 7-year contract with BayCare, a health care system in the Tampa Bay and central Florida regions of the U.S.

Based on a transactional licensing model, the contract will see the ASX50 company’s cloud-based Visage 7 Enterprise Imaging Platform, including Visage 7 Viewer and Visage 7 Workflow modules, implemented throughout BayCare.

Planning for the rollout will begin immediately and is set for the late third quarter/fourth quarter of this calendar year.

Dr Sam Hupert, Pro Medicus CEO notes BayCare joins 70% of all Visage 7 North American clients opting for a cloud-based solution, “which, as a result of our CloudPACS strategy, is becoming the standard in the North American healthcare IT market," Hupert said.

“Our pipeline remains strong and spans all market segments.”

With the company’s share price up over 160% in the last 12 months, Pro Medicus was one of the best performers on the ASX 200 index last year.

What's driving the stock’s growth is a string of major contract wins announced during the past 12 months. These include a whopping 10-year deal signed with Trinity Health valued at $330 million.

Driven by increased revenue from North America (up 34.4%), the company reported a 29.3% lift in revenue to $161.5 million for FY 2024.

Underlying earnings margin expanded to 69.5% (from 67.2%), while net profit grew 36.5% to $82.8 million in FY 2024.

While the company trades on 114x FY26 earnings, Goldman Sachs maintains a buy on Pro Medicus shares and is encouraged by the company’s revenue/margin outlook, unique cloud offering, and significant long-term opportunity. Despite uncertainty in the U.S. the broker believes the MedTech sector is increasingly seen as a safe haven within healthcare that’s somewhat incubated by policy volatility.

Pro Medicus’ market cap is $29.5 billion which makes it the ASX’s 20 largest stock; the stock is up 13% year to date.

Consensus is Hold.

The stock appears to be in a long-term uptrend confirmed by multiple indicators.

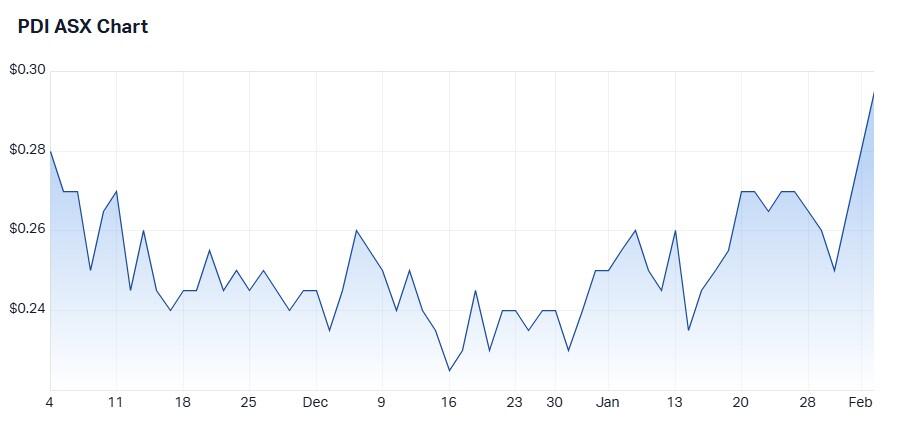

Predictive Discovery jumps on divestment news

Shares in Predictive Discovery (ASX: PDI) were up around 12% after lunch on news that the midcap Australian gold explorer would offload a 10% stake to two mining investors to raise $69.2 million.

The Lundin Family will invest approximately $45.1 million to acquire a 6.5% stake in the miner, while Zijin Mining Group will invest $24.1 million to acquire a 3.5% stake.

Funds are being raised at 26.5 cents per new share, which is in line with its last close price and will be used to advance the Bankan Gold Project's Definitive Feasibility Study, continue regional exploration programs, and conduct selected early development activities.

Predictive Discovery has a market cap of $700 million, making it the ASX’s 411th largest stock.

The stock’s share price is up around 50% in the last 12 months and the year to date is up around 30%.

The company appears to be in a long-term uptrend confirmed by multiple indicators.

Consensus is a Strong Buy.

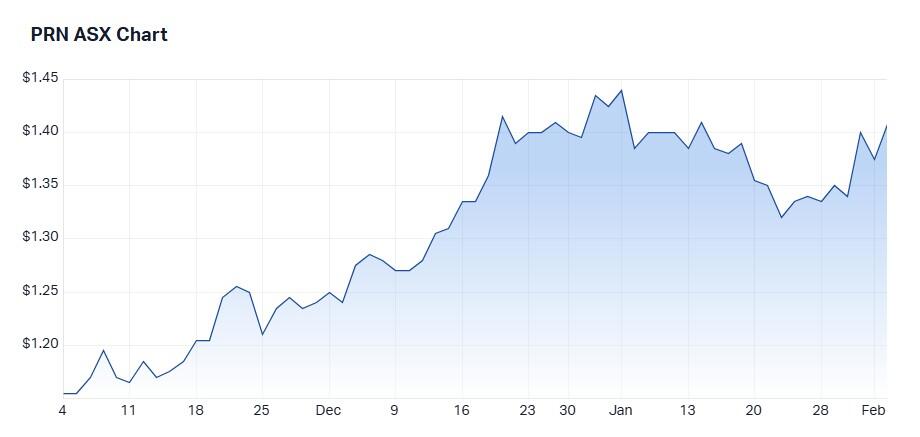

Perenti moves up following a major contract win in US

Shares in Perenti (ASX: PRN) were up around 2.5% today on news that the mining services group’s underground mining business had won its first US mining contract.

Barminco, Perenti’s underground mining subsidiary, will provide underground development and ground support for Nevada Gold Mines at the Goldrush mining project in Nevada.

Nevada Gold Mines is a joint venture between Newmont and US mining giant Barrick Gold.

The 36-month, $120 million contract is set to commence in February.

“This win represents a milestone achievement for Barminco and our Contract Mining team as we execute our growth strategy,” said Gabrielle Iwanow, president of Contract Mining at Perenti.

“With an expanded operational footprint in North America, Barminco looks forward to continuing safe and productive operations for our clients in both the USA and Canada.”

Today’s announcement follows $180 million in new contracts and extensions to existing agreements that Perenti has already commenced in 2025.

Bell Potter has initiated coverage on Perenti with a Buy rating and a $1.47 target price. The analyst believes the stock offers value at under 6x FY25 price-to-earnings.

Numerous indicators confirm that Perenti is in a strong bullish trend.

The company has a market cap of $1.3 billion making it an ASX300 stock; the share price is up around 80% over 12 months.

Consensus is a Strong Buy.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.