Azzet reports on three ASX stocks with notable trading updates today

Mayne Pharma soars on earnings lift

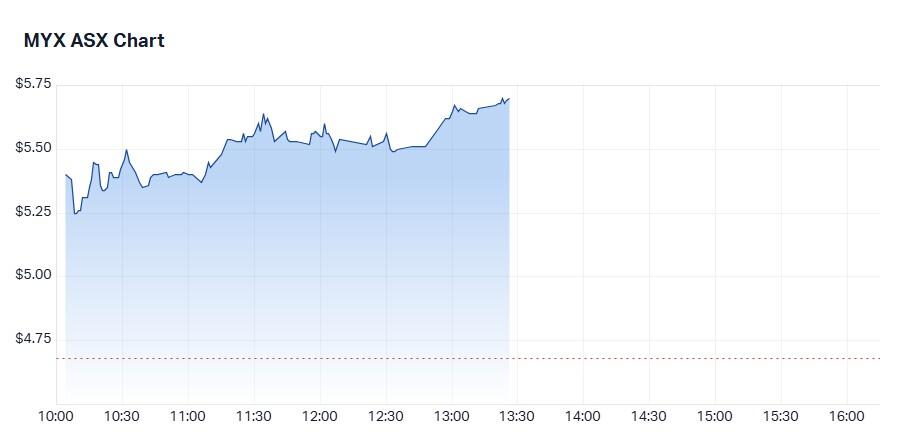

Mayne Pharma’s (ASX: MYX) shares were trading 21% higher in early trading today after the drugmaker guided to a major earnings lift.

Due to growth across the women’s portfolio and margin improvement, the ASX midcap now expects underlying earnings for 1H FY25 of $30 million - $32 million to be up between 275% - 300% on the previous period last year.

Other notable updates today include:

Revenues to be $210 – $215 million , up 12% – 14% on 1H FY24.

Cash and marketable securities at 31 December 2024, down $4.6 million to $124.9 million.

CEO Shawn Patrick O’Brien told the market today that market conditions have continued to favour the company since the AGM updated last November.

“We have experienced solid trading conditions in the first half as we execute against our corporate strategies, with robust revenue growth recorded particularly within our Women’s Health segment,” O’Brien said.

Today’s share price kicker is a welcomed relief for longsuffering shareholders who have witnessed the stock’s share price bounce from a high of $40.60 in July to 2016. to around $5.37 today.

Analysts see Mayne Pharma’s recent attendance at six global healthcare conferences in New York and London as a clear signal the company is looking for takeover suitor.

Assuming that is the case, all eyes will be on this year’s 1H FY25 result and how the company is successfully turning around its topline result.

Potential suitors can take some comfort in the company’s significant debt reduction over the past five years, with the company now maintaining more cash than total debt. However, any acquirer will want to see signs of improved free cash flow which has been decline at historical rates.

The company grew its revenue by 112% in FY24 to $388.4 million and gross profit by 162% to $218.8 million, while its net losses narrowed to $168.8 million for FY24, down from a $317.4 million net loss.

Full details of the 1H FY25 results, together with a review of the company’s performance in 1H FY25 will be released on Wednesday, 26 February 2025.

Mayne Pharma has a market cap of $459 million, the share price is up around 4% over 1 year and up around 14% year to date.

The stock’s shares appear to be weak with the 200-day moving average downward sloping.

Consensus is Strong Buy.

Car Sales dives on earnings miss: Broker downgrade

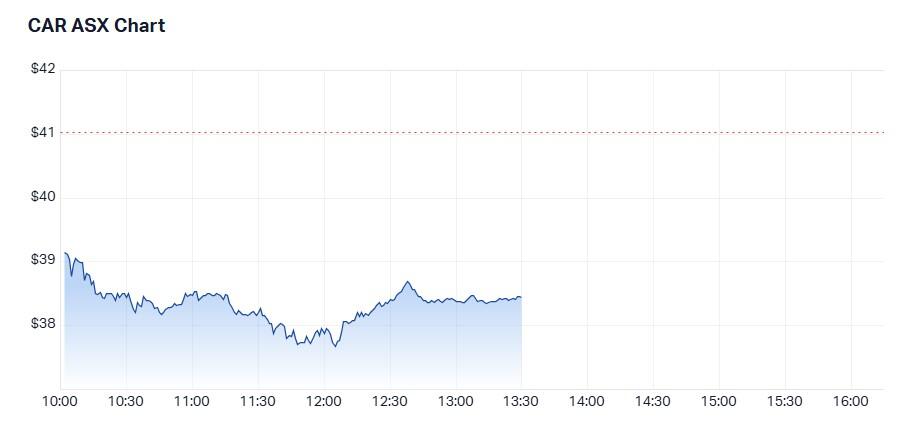

Shares in Car Group (ASX: CAR) were trading around 7% lower this morning after the auto listings company announced 1H FY25 earnings and adjusted profit of $302 million and $177 million - down 2-3% on market expectations – and higher than expected capex.

Having run an initial eye over the result, Citi concluded that the result was reasonably resilient, especially given tough industry conditions in the U.S. and private in Australia normalising.

Operational highlights within the 1H FY25 result included strong growth at its webmotors unit in Brazil - where the group significantly extending its audience leadership – plus increasing product penetration of its flagship premium products in the U.S. and Korea.

Closet to home, the group’s customer to customer (C2C) payments initiative has processed close to $30 million worth of transactions to date and management has flagged huge potential within this slice of the business.

Despite ongoing cost of living and interest rate pressures on consumers, CEO of CAR Group, Cameron McIntyre told investors that the Australian automotive market has continued to be resilient over the over the past six months.

However, he notes consumer purchasing intent favours used over new car purchases and vehicle prices have edged lower from post pandemic highs.

While the carsales.com.au owner described North America, Trader Interactive's performance as "resilient" and well-positioned for further growth, price increases in this market are expected.

Highlights within today’s update (inclusive of recently exited Australian Tyres business) were:

- Revenue of $579 million, up 9% year on year

- EBITDA of $292 million, 9% from the pcp

- Net profit after tax of $123 million up 5%

- Earnings to operating cash flow conversion of 95%

- 50% franked interim dividend of 38.5 cents per share, up 12%.

“The opportunity ahead of us is significant. We operate in diverse geographies with large, under penetrated addressable markets,” said McIntyre.

“With a robust balance sheet and prudent leverage, we are strategically positioned to invest in further innovation and continue to deliver excellent results for our customers.”

Despite a fairly reasonable result by Car Group, the share price appears to have been dragged down by falls across the broader market today, plus a downgrade by Ord Minnett to Hold from Accumulate. While the broker retains the target price at $39, it’s concerned the stock moving closer to fair value at current levels.

Car Group has a market cap of $14.3 billion making it an ASX50 stock, the share price is up around 15% over 1 year and up around 6% year to date.

The stock’s 200-day moving average is trending upwards and highlights long-term investor interest in the stock.

Consensus is Moderate Buy.

Pilbara Minerals trades higher after flagging interim loss

While Pilbara Minerals (ASX: PLS) shareholders were quick to run for the exits after the lithium miner warned of a net loss of $67 million-$71 million for 1H FY25 this morning, the stock’s share price was trading around 1% higher this afternoon.

The initial run for the exits is understandable given that this result will be compared with the company’s $220 million profit in the previous period.

The company earnings are expected to range between $45 million-$49 million, compared with its previous result of $415 million.

The overall result also includes a non-cash reduction to the carrying value of its call option to increase it stake in the POSCO Pilbara Lithium Solution joint venture from 18% to 30% of $16 million.

However, as the morning progressed today, the market appears to have looked beyond some disappointing numbers posted today and refocused on operating outcomes for the first half, including a new record for total production and sales from the Pilgangoora Operation along with delivering the P680 project on time and on-budget.

For the Pilgangoora Operation, the company flagged underlying earnings of $71 million-$75 million and a net loss of $5 million-$7 million.

What may have also excited the market today is talk between the company and Australian technology company, Calix, of resuming construction of the demonstration project which was paused last October due to the lithium outlook.

Beyond the core business, the company also advanced its chemicals strategy to increase exposure to value added battery chemicals while further diversifying our supply chain.

During the period, the PPLS JV and Midstream Demonstration Plant project progressed through their ramp-up and development phases respectively. These projects continue to reflect the effects of current lower market pricing, development costs or ramp up costs as shown in the expected results.

Managing director and CEO, Dale Henderson also reminded the market that in addition to having a positive long-term outlook for the lithium market, the company has a solid balance sheet with $1.2 billion of cash (as at December 2024) to help grow the business in step with market dynamics.

Pilbara Minerals has a market cap of $7.1 billion, making it an ASX100 stock, the share price is down around 40% over one year and up around 2% year to date.

The company’s sentiment among investors may be improving. The demand/supply equation has come into balance but the stock has shown little in the way of a confirmed trend.

Consensus is Moderate Buy.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.