Azzet reports on three ASX stocks with noteworthy trading updates today.

Fortescue Ltd lifts, Red Hawk Mining soars on takeover plans

During a morning of abnormally higher trading volume, Fortescue Ltd (ASX: FMG) outperformed its peers on the ASX, up over 1%, after the iron ore giant announced plans to acquire fellow ASX mining stock Red Hawk Mining (ASX: HK).

It’s understood that Fortescue was one of over a dozen parties interested in acquiring Red Hawke’s Blacksmith Iron Ore Project, located 30 kilometres west of Fortescue's Solomon operations in the Western Hub.

The total Blacksmith Mineral Resource estimate is 243 million tonnes at 59.3% Fe grade.

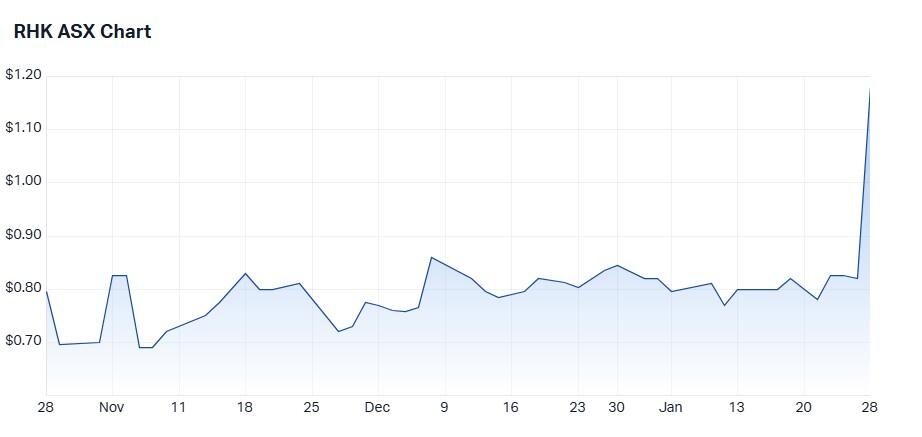

Management at Red Hawk took no time to accept Fortescue’s offer to acquire all the company’s shares for a cash consideration of $1.05 per share - a 28% premium to where its shares last traded.

The offer will increase to $1.20 per share if Fortescue acquires a relevant interest in 75% or more in Red Hawk shares within seven days, by way of an off-market takeover bid.

Assuming it does, this will represent a 46.3% premium to its last close price and values Red Hawk at $254 million.

The Red Hawk share price was up around 44% after the announced takeover today.

Based on independent expert's report from BDO Corporate Finance, which concludes that the offer is fair and reasonable, the Red Hawk board unanimously recommends that shareholders accept the offer at both the offer price and the increased offer price.

Red Hawk's Chair, Cheryl Edwardes explained to shareholders why the company didn’t wish to embark on the development Blacksmith Project on its own.

“While the Blacksmith Project has the potential to be a major iron ore project, there is significant cost, time and risk associated with developing a project of this scale, particularly in the context of an uncertain broader global economic outlook,” Edwardes said.

"As such, the Board believes that the offer provides shareholders with a compelling opportunity to de-risk their investment and realise certain value at an attractive premium to historical trading levels leading into the announcement of the Offer."

Fortescue’s market cap is $58.6 billion and the stock’s share price is down 35% on one year.

Consensus is Hold.

Consensus doesn’t cover Red Hawk, the share price is up 94% in one year, following today’s announcement.

De Grey Mining falls on new drilling results

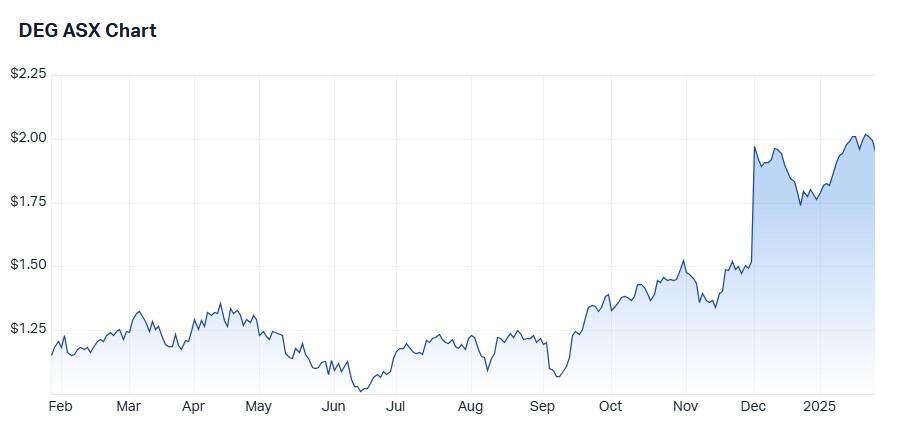

Investors took little comfort in De Grey Mining’s (ASX: DEG) new results from infill and extension drilling at the Eagle deposit at the Hemi Gold Project with the share price down around 2% today.

Given that De Grey had previously recorded strong diamond drilling results in the same area, today’s update may have been overlooked or simply failed to impress.

A program of infill drilling conducted in November to boost the MRE for the same Eagle pit identified six metres of gold grading 12.7g/t. Overall, Eagle’s mineralisation has been extended by at least 100 metres down plunge, with this remaining open down plunge and along strike.

General manager of exploration Phil Tornatora said stronger definition work on Eagle was proving promising and praised the “outstanding intersections, including the 78.1m at 7.9g/t Au from HEDD347.

“Mineralisation has now been defined for over 1km down plunge at Eagle, and it is exciting to see that it is still open. Potential for new lodes developing in the hanging wall of Eagle is also demonstrated,” he said.

Late last year Northern Star Resources (ASX: NST) announced plans acquire De Grey Mining.

Under the proposed arrangement, De Grey shareholders would get 0.119 new shares in Northern Star for each of their own, with this pricing De Grey shares at $2.08. This marks a 37.1% premium to the company’s last closing price (of $1.52 on 29 November), plus a 43.9% premium to De Grey’s 30-day volume-weighted average price of $1.45.

Northern Star managing director and CEO Stuart Tonkin believes the acquisition of De Grey would be a boon to shareholders and play a key role in enshrining the company’s place as a top 10 global gold major.

De Grey’s market cap is $4.6 billion and the share price is up 69% in one year.

Consensus on the stock is Moderate Buy.

Brainchip tumbles after dismal trading updates

Shares in Brainchip (ASX: BRN) were trading 16% lower in early afternoon trading following a dismal quarterly update for the three months ended 31 December.

The semiconductor company announced cash receipts of just US$50,000 despite spending over US$4 million on operating activities during the period.

However, some of the today’s fall could be attributed to the tough love being dished out to US tech stocks following revelations that China's new low-cost DeepSeek AI could derail Nvidia Corporation (e) dominance in the industry.

In light of this news Nasdaq Composite Index (NASDAQ: .IXIC) plunged 3.1% overnight.

While Brainchip’s share price has been on a wild ride over the past 12 months, the stock is still up 111% in one year, despite today’s fall.

Brainchip's market cap is $645 million and consensus does not cover this stock.

Morningstar believes the stock is overvalued at $0.33.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.