While conventional share market wisdom suggests buying on the dips, some brokers are telling their clients that today’s rally – with the ASX up 6% at the open - is an opportunity to run for the exit. Lower commodity prices following last week’s tariff-induced market meltdown would also typically signal positive buying opportunities.

Downward pressure on oil and base metals

However, Citi strategists expect the increasing likelihood of a recession in the United States and a broader global slowdown to bruise the long-term outlook for oil and base metals, aluminium, nickel and copper – often viewed as a barometer of the global economy.

It’s this fear of recession that’s unravelling recent gains for copper, following attempts by traders to ship copper to the U.S. in the lead up to the imposition of tariffs.

The broker forecasts Brent crude to shed another 8% to US$60 following its recent 14% drop to around US$65 a barrel.

Meanwhile, Citi expects tariffs to ultimately stifle raw materials demand and ignite further selling across commodity markets.

“We would push back on the notion that the commodity markets are pricing the full impact of these developments,” Citi global head of commodities research Max Layton wrote in a note to clients.

“The physical impact of the tariffs imposed should be doubly bearish as the pre-buying and stockpiling of goods and commodities would fully reverse after tightening commodity markets for the past few months.”

Copper to continue falling

Despite the recent flurry of buying by Chinese traders, which pushed copper prices almost US$1000 higher in just two hours, Citi still expects copper to drop to between US$7500 and US$8000 a tonne over the short term.

Then there’s Bank of America which believes copper could fall as low as US$5700 from current levels.

Gold to kick higher

Like Citi, Goldman Sachs expects gold to continue offering solid returns, despite some recent profit taking, in which the precious metal endured its worst three-day sell-off in over four years.

Given that gold remains Goldman’s highest-conviction view of commodity markets, the broker sees recent falls as presenting attractive buying opportunities.

The broker expects gold prices to hit $US3300 an ounce by the end of this year.

“Not only do we see structural support to prices from EM central bank buying continuing, but we also see further support from higher ETF demand on Fed cuts and recession fears,” said Goldman analyst Samantha Dart.

Reduced metal consumption

While the impact of tariffs on commodity demand is uncertain, Goldman also expects reduced metal consumption over the next six months to negatively impact commodity prices.

“Chinese steel mills and manufacturing companies we met with on our recent China M&M trip expressed concern to us about the impact to demand and exports from US tariffs,” Goldman said.

Having looked at prior commodity down cycles, the broker reminds investors that metals with tighter fundamentals and companies with free cash flow (FCF) and strong balance sheets outperform during a downturn.

“Overall, with US “Reciprocal” Tariffs and concern over the global macro heading into 2Q, we prefer precious and base metals over steel and the bulks (iron ore and coal),” the broker noted.

Following its China M&M trip, the broker has downgraded its coal (met and thermal) and alumina price forecasts and has also downgraded zinc and lead prices.

Recommendations

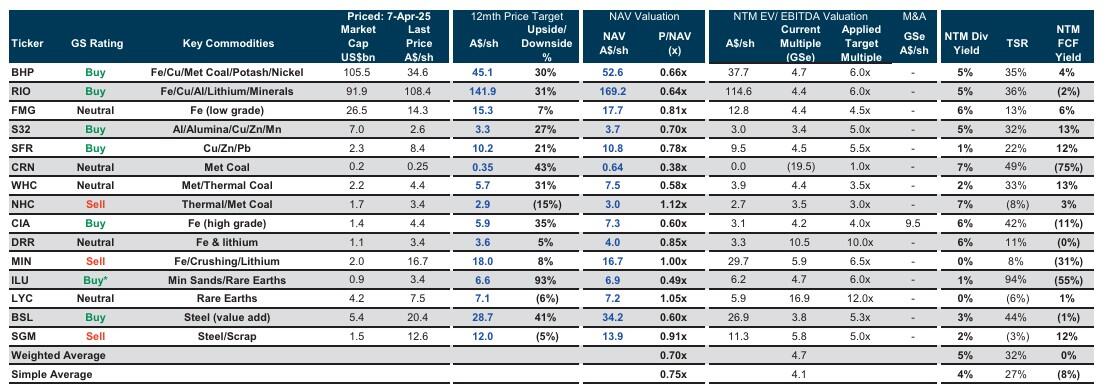

The broker remains Buy rated on the majors, Rio Tinto (AS:RIO), BHP (ASX: BHP), and (ASX: S32) and the steel company Bluescope Steel (ASX: BSL) due to resilient FCF and strong balance sheets.

Golman is also Buy rated on pure plays Champion Iron (ASX: CIA) and Iluka (ASX: ILU) built on attractive valuations.

The broker has also upgraded Sandfire Resources (ASX: SFR) to Buy from Neutral (price target $10.20) - based on valuation and a positive long-run view of copper, despite expected near-term volatility.

Meantime, the broker has downgraded Mineral Resources (ASX: MIN) to Sell from Neutral based on valuation, high net debt and low FCF, and after downgrading earnings estimates.