Renewed interest in Woodside Energy (ASX: WDS) - which is evident in its 11% share price rise in the last month - comes as long-awaited relief for long-suffering shareholders who witnessed the share price fall 42% from over $38 per share in 2023.

Despite merging with BHP’s oil and gas portfolio in June 2022 – creating a global top 10 independent energy company by production – the discount in the group’s share price relative to its global peers remains.

While there are many factors driving the Woodside share price, one of the lingering concerns is due to the unwillingness of the federal government to finally give the green light to its $30 billion North West Shelf (NWS) gas project.

The former Labor government had been sitting on its hands for years citing environmental concerns.

Conservationists dig in

There was some hope that new environment minister Murray Watt – one of the few winners in Prime Minister Anthony Albanese’s cabinet reshuffle – would succumb to calls by WA's Roger Cook-led government and finally give the thumbs up for Woodside's gas plans in northwestern WA.

However, despite Woodside’s recently amended plans to overlap with shallow water around Scott Reef and avoid green turtle habitats, the Australian Conservation Foundation (ACF) remains unrelenting its opposition to the development.

To further complicate matters, the ACF has reopened public consultation on the proposed Browse development. In addition, Woodside has plans to pipe gas 1000 kilometres to its NWS plant until 2070.

Meantime, in light of growing frustration with Australia’s painfully slow regulatory environment, Woodside CEO Meg O’Neill has hedged the company’s on-shore exposure by advancing discussions with additional potential partners offshore.

This involves a targeted equity sell-down of around 50% of the integrated projects.

Future-proofing its portfolio

While Woodside has been consciously investing in new energy initiatives – with oil, gas, and new energy pillars - to future-proof its portfolio, investors shouldn’t forget that after merging with BHP Petroleum, Woodside remains primarily a petroleum company.

That said, much of the recent share price falls can be attributed to the decline in oil prices from US$124/barrel in 2022 to US$61/barrel.

But while the price continues to determine Woodside's share price fortunes on any single day, efforts to diminish its reliance on oil appear underappreciated.

Louisiana LNG project

One of the integrated projects that’s helping to drive its transformation is the US$17.5 billion Louisiana LNG project, located in the Gulf of “Mexico” – (yes Mexico).

Approved in April 2025, this three-train facility will ultimately produce 16.5 million tonnes per annum (Mtpa) of LNG.

By the 2030s this project is expected to significantly boost Woodside’s global LNG supply capacity to approximately 24 Mtpa – which will represent a whopping 5% of the global LNG market.

According to Roger Montgomery of the Montgomery [Private] Fund – which is 2.3% exposed to Woodside – the project plan [at Louisiana LNG] to deliver first gas in 2029 is a bold step toward establishing Woodside as a global LNG leader.

“ It capitalises on growing demand in Europe and Asia, underpinned by a projected 13 per cent internal rate of return and a seven-year payback period,” Montgomery notes.

“By leveraging a supportive U.S. administration and strategic partnerships, Woodside is positioning the Louisiana LNG project as a cornerstone of its global expansion.”

Project de-risking

Another key element of Woodside’s transition into an infrastructure-focused company is its partnership with U.S.-based private equity (PE) firm Stonepeak.

Last month Woodside offloaded a 40% stake in Louisiana LNG Infrastructure LLC (InfraCo) to Stonepeak for US$5.7 billion.

With Stonepeak covering 75% of capital expenditures in 2025 and 2026, Woodside has been able to de-risk the project, optimise capital allocation, and focus on operations while retaining the lion’s share of the operations.

Included within further sell-downs are plans to divest an additional 20–30% stake in the project with potential partner, Kuwait Foreign Petroleum Exploration (KUFPEC) being quick to flag confidence in the project’s long-term value.

According to Montgomery, the strategy of partnering with infrastructure investors underscores Woodside’s shift toward a capital-efficient model that prioritises scaleability and financial flexibility.

New energy

Beyond LNG, Woodside is advancing hydrogen production through projects like H2Perth, H2TAS, and H2OK.

By supplying clean hydrogen for heavy transport, industrial applications, and energy storage, also plans to position Woodside as a player in the emerging hydrogen economy.

For example, H2Perth is designed to produce hydrogen for domestic and export markets, while H2TAS in Tasmania focuses on regional hydrogen supply chains.

Strategic partnerships

In addition to major project derisking, Woodside is also hitching its transformation to the development of strategic partnerships that enhance its operational and market capabilities.

One example is an agreement with BP (LON: BP), signed in April 2025, which secures the supply of up to 640 billion cubic feet (Bcf) of natural gas for the Louisiana LNG project, starting in 2029.

Buying opportunity?

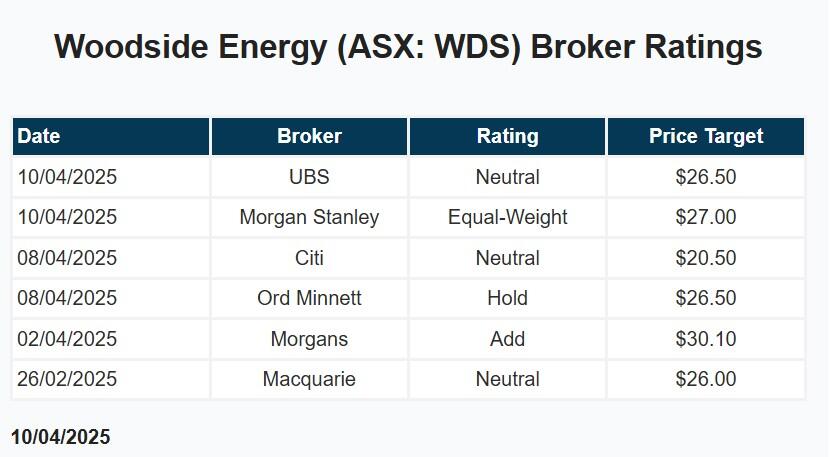

While some brokers expect Woodside to lower its dividend payout, the Louisiana LNG project is broadly seen as a key near-term catalyst.

Based on broker ratings, the stock is trading at around a 20% discount to the average price target.

Woodside has a market cap of $41.6 billion making it the ASX’s 14th largest stock; the share price is down 21% over one year and down 10% year to date.

The stock’s shares appear to be in a strong near-term rally within a longer-term bearish trend.

Consensus is Moderate Buy.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.