Philip Morris International (PMI), based in Stamford, Connecticut, reports strong second-quarter results for 2025, driven by growth in its smoke-free portfolio.

The company, which controls global brands like Marlboro, IQOS, ZYN, and VEEV, posted net revenues of $10.14 billion, up 7.1% year-over-year, but falling short of analysts’ forecasts of $10.31 billion to $10.33 billion.

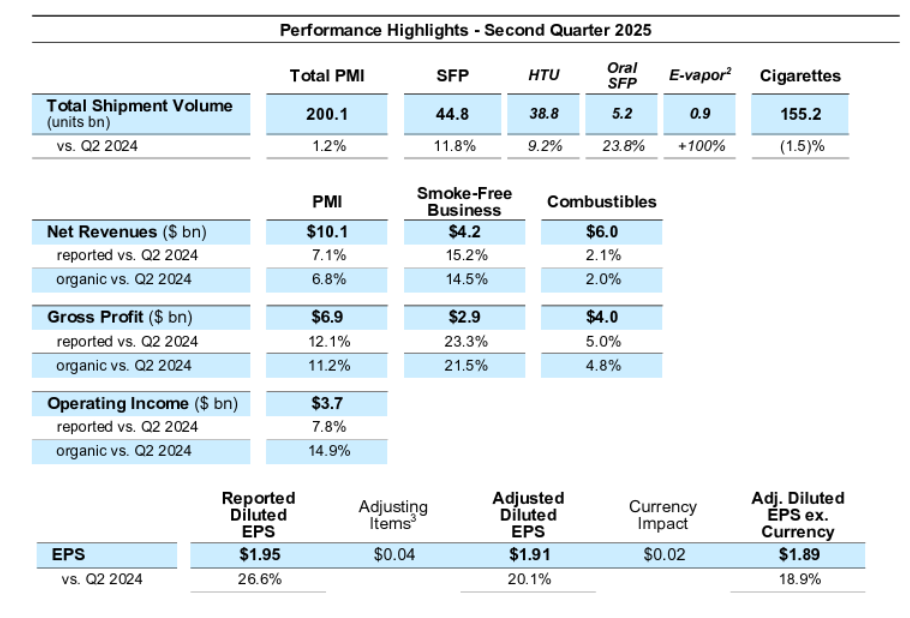

Adjusted diluted earnings per share rose 20.1% to $1.91, above Wall Street’s consensus of $1.86, according to FactSet. Gross profit climbed 12.1% to $6.9 billion. Smoke-free products now account for 41% of total revenue, reflecting PMI’s accelerated shift away from traditional tobacco. Tuesday afternoon (Wednesday AEST), shares fell over 7%.

IQOS, PMI’s flagship heat-not-burn device, generated over $3 billion in quarterly net revenue and gained 9.2% market share in its category.

In Japan, IQOS reached more than 10 million legal-age users, with market share rising to 31.7%. E-vapor brand VEEV more than doubled its shipments in Europe, while ZYN nicotine pouches saw 36% growth in U.S. offtake in June.

Oral product shipments rose by 23.8%, with nicotine pouches up over 40%. Despite a 1.5% decline in cigarette volumes, combustibles revenue grew 2.1%, supported by pricing strength and Marlboro’s highest market share since 2008.

PMI raised its full-year guidance, forecasting adjusted EPS between $7.43 and $7.56, up 13% to 15% from 2024. Smoke-free product volumes are expected to grow 12% to 14%, offsetting a projected 2% decline in cigarette volumes.

The company’s smoke-free offerings are now sold in 97 markets and used by over 41 million consumers. Since 2008, PMI has invested more than $14 billion in developing reduced-risk products, supported by regulatory approvals from the U.S. FDA for IQOS, and General snus.

While PMI continues to expand its smoke-free footprint, it acknowledges risks including regulatory changes, litigation, and geopolitical instability.

The company uses non-GAAP metrics to provide clear insights into performance, excluding currency impacts and one-off items.

"Our business delivered very strong results in the second quarter, with record net revenues and exceptional growth in operating income and adjusted diluted EPS," said Jacek Olczak, Chief Executive Officer. "These results reflect excellent momentum in our multi-category smoke-free business, with a reacceleration [in] IQOS adjusted in-market sales growth and ZYN U.S. offtake growth, coupled with combustibles resilience. Given our strong year-to-date performance, we are raising our full-year guidance."

At the time of writing, Philip Morris International Inc. (NYSE: PM) was trading at $164.67 at the close, down 60 cents (0.36%) today. Philip Morris has a market cap of around $256.31 billion.

All financials in U.S. dollars.