Rather than choke on their drinks and snacks, investors in PepsiCo toasted a 59% dive in net income for the second quarter (Q2) of the 2025 financial year (FY25) as the outcome was expected to be worse.

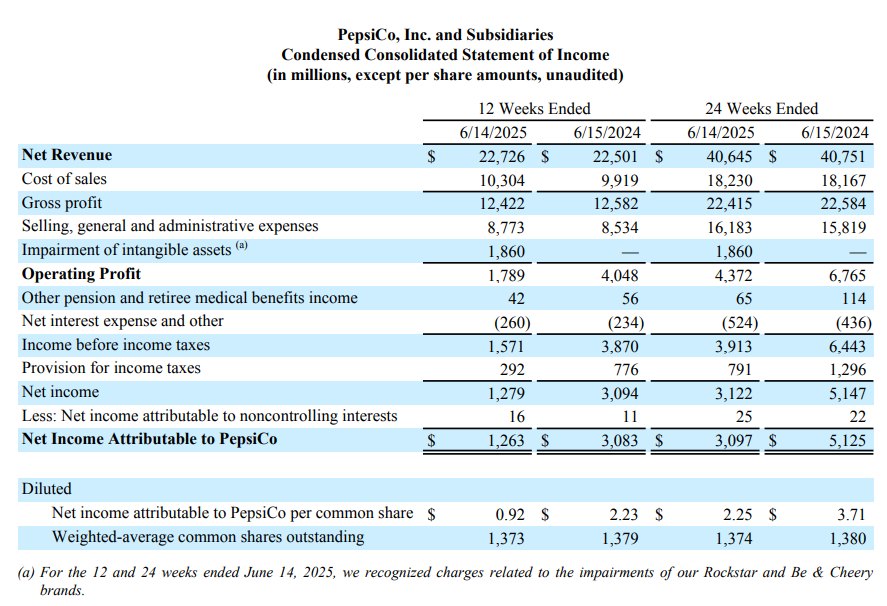

Shares in the global food and beverage company jumped more than 8% after learning that net income was US$1.263 billion (A$1.946 billion) in the 12 weeks ended 14 June 2025, compared with $3.083 billion in the previous corresponding period (pcp).

The United States-based company, whose brands include Pepsi, Gatorade and 7UP drinks and Lay’s, Doritos and Quaker Oats snacks and foods, said core earnings per share (EPS) fell 5% to $2.12 on net revenue which grew just 1% to $22.726 billion in Q2.

PepsiCo also presented half year results showing a 40% fall in net income to $3.097 billion and a 4.5% drop in core EPS to $3.59 on a 0.3% reduction in net revenue to $40.645 billion in the 24 weeks ended 14 June.

Chairman and CEO Ramon Laguarta said the company was encouraged by the acceleration in net revenue growth in Q2, as its businesses effectively navigated a challenging environment.

He said in a press release that its international business momentum continued while North American businesses improved their execution and competitiveness.

PepsiCo will continue to expand its international business and accelerate initiatives to improve its North America performance.

He said the company remained confident it could deliver low-single-digit organic revenue growth in FY25 with core constant currency EPS to be flat.

“We're very pleased with our performance in Q2. Also, we have the right tools, and we're taking the right steps to deliver year on year and create a stronger PepsiCo in the long-term,” Laguarta told analysts on a conference call.

PepsiCo and rival Coca-Cola (NYSE: KO) have been offering healthier drinks and food, including offering products with no artificial colours or flavours.

The result was higher than expectations of revenue of $22.28 billion and core EPS of $2.03 per share.

Pepsico (NASDAQ: PEP) shares closed $10.09 (7.45%) higher at $145.44, capitalising the company at $199.41 billion.