M&A activity is kicking off around the prolific Telfer gold mine in Paterson Province, WA, as juniors and mining majors alike rush in to prove up or farm-in to the rejuvenating gold-copper mining district.

It’s been over three months since the world’s biggest goldie Newmont confirmed its stewardship exit from WA’s long-running 27Moz gold Telfer operation in WA’s Paterson, leaving a vacuum for M&A activity that’s been picking up traction.

Suitors came knocking almost instantly, with UK-based miner Greatland Gold - having already made head waves at the Havieron discovery (30:70 JV with Newmont) in the region - notably forking out $700 million to buy out Newmont’s share and its world-class Telfer mine.

Greatland’s self-confessed interest in consolidating Havieron was supported by Twiggy Forrest’s exploration arm Wyloo Metals, its second-largest shareholder with an 8.45% stake in the almost $1bn market-capped miner.

And it comes as no surprise the world’s biggest goldie Newmont has retained over 20% in Greatland to boot.

With a debt-for-ounces facility to the tune of a workable $100m, Telfer’s new owners' eyes may be wandering for deposits to harvest into its under-capacity mill.

Ructions in the Paterson

Newmont, for years, had been sitting on Telfer with a reluctance to invest in further developing the mine, instead looking towards its global ambitions.

The region became a little stagnant, yet that didn’t stop greenfield exploration by a number of companies in the meantime.

Over the last eight years roughly ~20 million ounces of gold and about 3.5Mt of copper has been discovered, adding weight to mineral-rich Paterson’s development potential.

That figure includes Rio Tinto’s Winu copper-gold project, which earlier this month saw a deal struck with Sumitomo to sell the $41 billion Japanese heavyweight 30% of the project for $399m.

Rio’s been sitting on Winu since it discovered the deposit in 2017 and the two new partners are now eyeing the potential of its huge 503Mt at 0.45% copper resource endowment.

Interestingly, a month prior, Rio bought out Sumitomo’s shares in an NZ aluminium smelter and its cut of Gladstone, QLD-based Boyne Smelters.

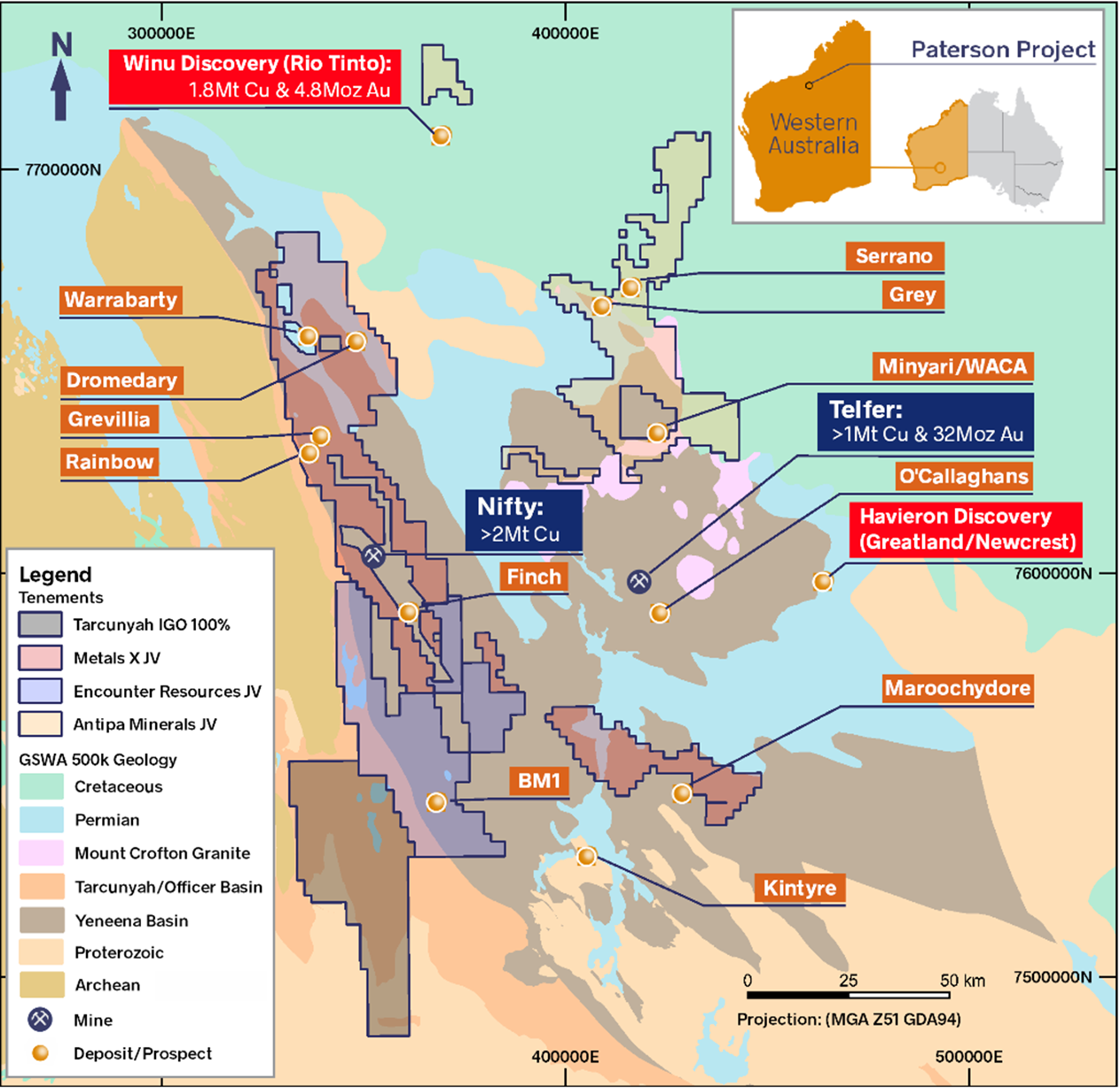

Further M&A movement was announced from the Paterson yesterday, with IGO (ASX: IGO) completing a $15 million spend on exploration to earn a 70% interest in Encounter Resources’ (ASX: ENR) Yeneena gold-copper project, ~60km south of both Telfer and Cyprium Mining’s (ASX: CYP) Nifty copper mine.

Missing out on Havieron - as it was rumoured to have thrown its hat into the ring to purchase the asset - it looks like IGO is adamant about keeping some fingers in the proverbial Paterson pie with its push into Encounters’ copper-gold prospectivity.

Findings from the recent exploration are due out early next year.

The promising explorer

With over 4000sqkm of tenure around Telfer and throughout Paterson, Antipa Minerals (ASX: AZY) is a junior with lots of prospective tenure taking advantage of the recent M&A activity.

It recently sold its minority stake in the Citadel JV with Rio Tinto (ASX: RIO) for $17m and is using the funds to prove up its 100%-owned Minyari Dome gold project.

Antipa showed the market yesterday that exploration drilling had exposed new zones of high-grade gold at its flagship landholding, cropping up hits of up to 6.8g/t and 17m wide as it unearths the growing endowment of the project’s GEO-1 prospect.

23 RC rigs drilled into three target areas and Antipa says gold and copper mineralisation has been found across multiple lodes.

“Our Phase 2 CY2024 program at Minyari Dome continues to deliver outstanding results, with this second batch of 23 holes confirming significant intersections across multiple target areas,” Antipa CEO Roger Mason told the market.

Speaking with Azzet, Euroz Hartley research analyst Michael Scantlebury says M&A in the region still has plenty of legs and Antipa is in pole position to keep benefitting from all the moves and shakes.

“Antipa would hope to position itself in the shop window, especially as Greatland is looking to gain further market exposure with its upcoming IPO to the ASX mid-next year,” Scantlebury says.

“The Paterson is getting another look over from the market and there was keen interest in Greatland Gold during its recent roadshow.

“The June quarter is likely going to be chock-full of activity.around Telfer.”

The +$130m market-capped Antipa has had a significant 45% rise in share price so far this year and up almost 200% over the past 12 months.