With all-time high gold prices and US$4.3 billion in proceeds from asset sales, gold major Newmont has posted quite the record quarter.

In its Q1 earnings report, the company revealed a record free cash flow of $1.2 billion on the back of delivering 1.5 million ounces (oz) of gold for $2.6 billion in EBITDA.

The average realised gold price was $US2,944/oz, an increase of $301 per ounce over the prior quarter.

It's expected that value to go up again for the foreseeable future, with gold currently sitting at US$3,343/oz at the time of writing.

Newmont CEO Tom Palmer said the company has now capped off its non-core asset sale, generating about $4.3 billion in total gross proceeds - including >$2.5 billion of after-tax cash for H1 FY25.

“With these significant achievements and a solid start to the year, we remain firmly on track to meet our 2025 guidance, continuing on our journey towards creating the world’s leading gold and copper portfolio,” Palmer said.

The sell-off over the last 12 months was aimed at sub-500,000ozpa gold assets and doesn’t consider them to be Tier 1 or “non-core”, so it can focus on building up its copper portfolio.

The list of breakaway operations divested in 2024 includes up to $475 million from the sale of the Telfer mine in WA and $527 million from the sale of the Lundin Gold stream credit facility and offtake agreement, as well as the monetisation of its Batu Hijau contingent payments.

This year:

- $850 million from Musselwhite (Canada)

- $784 million from Éléonore (Canada)

- $275 million from Cripple Creek & Victor (USA)

- $1 billion from Akyem (Ghana)

- $425 million from Porcupine (Canada)

(all figures in USD)

The goldie now has a strong $4.7 billion balance sheet for M&A and project development, and expansion across its operations.

That leaves still the world's biggest gold miner with 12 operations - Boddington, Tanami and Cadia in Australia, Lihir in Papua New Guinea, Brucejack and Red Chris in Canada, Ahafo in Ghana, Peñasquito in Mexico, Cerro Negro in Argentina, Yanacocha in Peru, and Merian in Suriname.

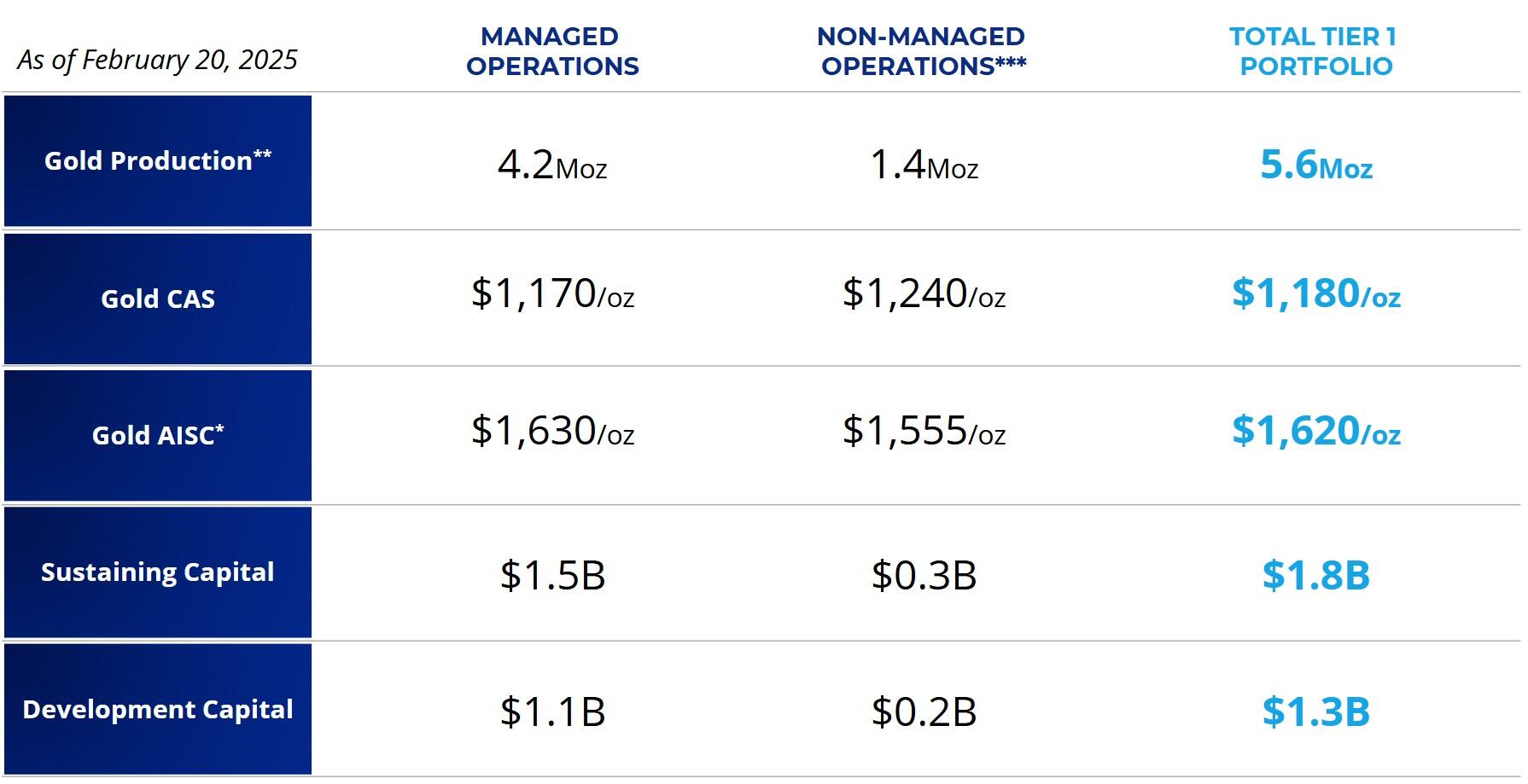

Guidance from those assets is pegged at 5.9Moz for this calendar year - 5.6Moz of that coming from its Tier 1 portfolio.