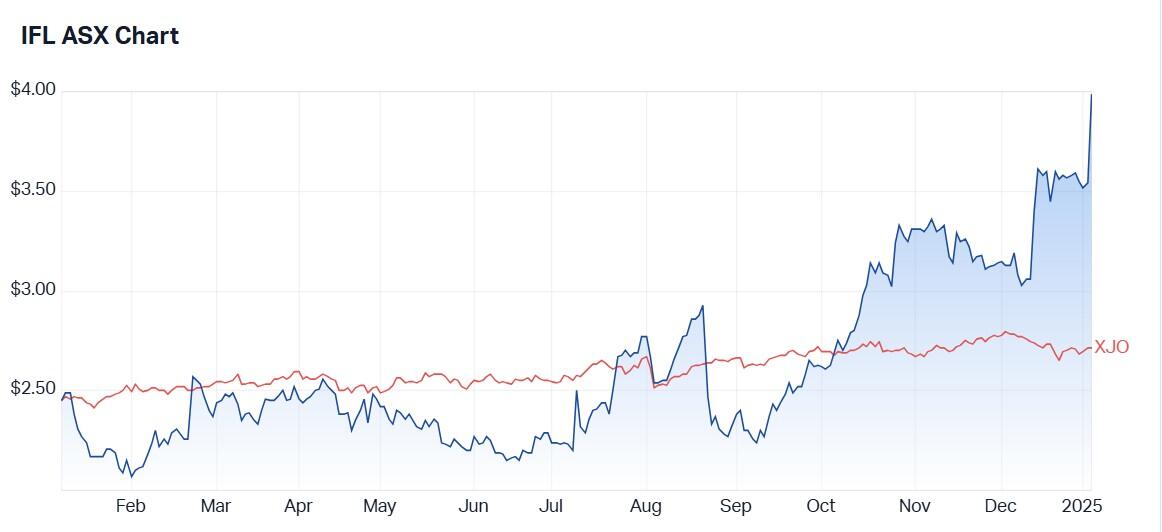

Shares in MLC-owner Insignia Financial (ASX: IFL) were up around 13% at the open to $3.99 on revelations that the Australian wealth manager had received a more favourable takeover offer than the one it rejected last month.

Today’s fresh non-binding offer by New York-based private equity player, CC Capital, for $4.30 a share is 7.5% up on the $4 a share mid-December bid by global private equity giant Bain Capital (formerly IOOF), which Insignia’s board took no time to reject as opportunistic and undervalued.

The CC Capital bid also represents a 21.5% premium to Insignia's last closing price of sector $3.54 on Friday.

In additional to being subject to numerous conditions - including satisfactory completion of due diligence and unanimous recommendation from Insignia’s board - the deal would also require approval of the Foreign Investment Review Board (FIRB) and the Australian Prudential Regulation Authority (APRA).

Given that the latest bid represents a 40% premium to where Insignia shares were trading 9 December, Insignia is said it be taking the CC Capital proposal seriously. While the board is not obliged to respond to potential acquirer's bid within any stipulated time frame a response is expected later this week.

However, give that it hasn't jumped at the latest offer, the board may conclude that fair value, plus a reasonable premium is worth more than what's currently on the table.

MLC is the jewel

Interestingly, Insignia and CC Capital are no strangers to each other, with the former beating the private equity newcomer in a bid for National Australia Bank’s (NAB) former superannuation arm MLC Wealth four years ago.

While Insignia’s assets include a suite of financial services businesses, most of the company’s energies have been focused linking its four master trusts together.

By creating an umbrella MLC fund, CC Capital would deliver on its long-term aspirations of becoming a major player within Australia’s lucrative superannuation sector.

Also appealing to CC Capital, MLC is regarded as the second-most-recognised brand in Australia’s superannuation sector behind AustralianSuper.

A relative dark horse on Australia’s deal making scene, much of CC Capital’s playbook is centred around investment with a longer-term trajectory than PE investors would typically be comfortable with.

More bids?

While CC Capital may consider its current bid for Insignia an “unfinished busines”s, the wealth manager’s bankers at Citi and Gresham will clearly review this offer in light of any possible counter offer from Bain Capital.

"Insignia's board may demand a higher premium given the company's significant role in Australia's superannuation industry, but whomever the buyer is will not only need to please the board and shareholders, but also regulators to get a deal over the line," notes Stella Ong, market analyst at share trading platform Superhero.

"With Insignia's forward P/E still trailing behind that of AMP though, this may not be the last bid we see.”

What CC Capital will see, assuming it gets to look at Insignia’s financials is a mixed set of books. The firm's book value yield of 85.5% sits in the top 40% globally. But Morningstar believes the, the firm's lack of profitability is potentially concerning.

While Insignia’s underlying full-year profit increased 13.6% to $216.6 million, investors reacted badly to news that it was halting its dividend on the back of a reported annual loss of $185.3 million.

Insignia has hired King & Wood Mallesons as its legal adviser.

A successful takeover offer for Insignia would remove yet another large cap from the ASX 200. The stock’s share price is up over 60% over one year.