Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from production and refinement, to manufacturing and consumer products.

Depending on where you source your info, 2025 is either promising or bleak for lithium this year. Some analysts project carbonate prices will remain depressed at around US$10,000/t after dropping over 24% last year. This is what Benchmark Intelligence (BMI) lays out its latest critical minerals outlook whitepaper.

There is a case for lower capital investment in upcoming developments sending lithium prices up. However, there’s also a case for more supply coming online through a plethora of near-term producers that will continue 2024’s supply glut of the battery metal.

Glut continues

BMI says that although overall lithium demand from EV and stationary storage end markets grew through 2024, the growth was insufficient to support lithium chemicals prices rising significantly.

For this year’s outlook, Goldman Sachs analysts are bearish and reckon that with a number of lithium projects ramping up through the year, and possible curtailment restarts, near-term price ceilings will prevail throughout the year.

“We expect lithium market softness to continue this year (in lieu of material demand upside), with existing producers likely to focus on further cost/production optimisations,” the analyst revealed in a note.

The investment bank also points to the potential for direct lithium extraction (DLE) tech to open up new sources of battery material, including developing U.S. domestic operations in the brine-rich Smackover Formation and at Lithium America’s gigantic Thacker Pass.

Added to the pile, Argentina and Zimbabwe are set to double lithium output this year. Rio Tinto (ASX : RIO) is making long-term bets with its multi-billion-dollar bet to acquire Arcadium (ASX : LTM).

Positive signs

CRU Group’s Thomas Matthews is more bullish on lithium, citing the supply glut is expected to shrink to about 80,0000t of lithium carbon equivalent (LCE) from nearly 150,000t LCE last year.

https://www.atk.com.cn/

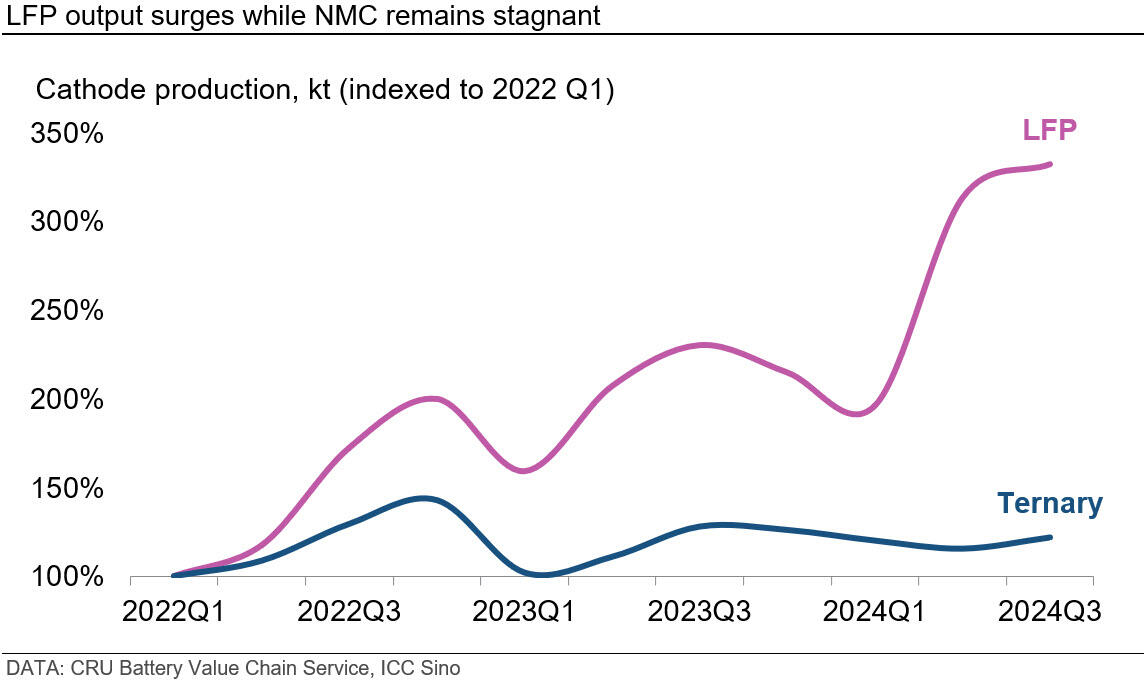

He notes that burgeoning lithium iron phosphate (LFP) cathode production growth for EVs will be a key driver of the battery metals’ price recovery this year.

“We expect that lithium prices will recover in 2025 amid strong demand and substantial curtailments to lithium supply,” Matthews says.

“Since the start of last year, CRU has downgraded its forecast by 14% for mined lithium supply in 2025, with CRU’s Lithium Asset Service indicating that even more operations are underwater at current prices.

“Of these curtailments, Australian operations have been hit particularly hard, with Mineral Resources’ (ASX : MIN) Bald Hill becoming the latest casualty of the weak price environment.”

EVs to maintain growth

EV sales are expected to continue to increase worldwide, with growth led by Chinese subsidies maintained throughout the year.

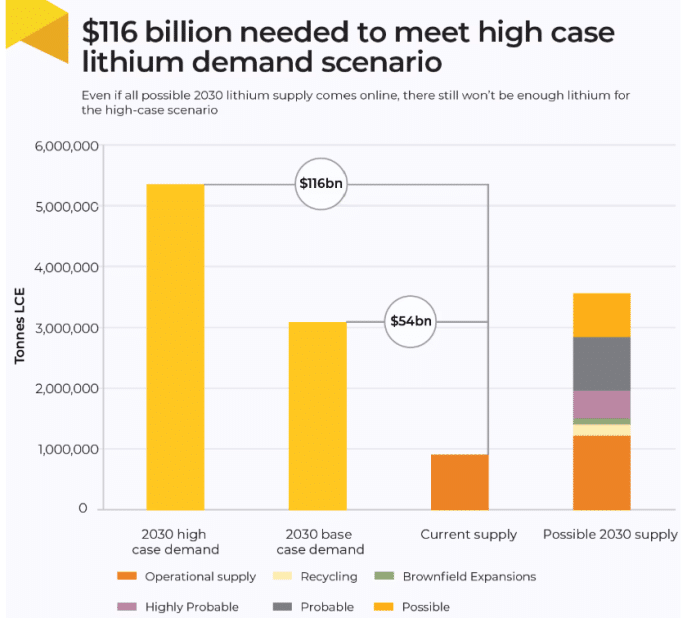

BMI says an eye-watering US$514bn of batteries investment will be required by 2030 - $220bn for upstream projects and $51bn for lithium production.

For the EV industry, $116bn will be required by then to meet targets as even if all possible 2030 lithium supply comes online by then, it will still fall short of projected demand.

And "from a policy perspective, potential tariffs imposed on Chinese imports to the USA could slow market activity in 2025," BMI notes.

Demand that stimulated the North American lithium scene through the U.S. Inflation Reduction Act could be weakened under the Trump administration, leading to slower EV adoption. The EU is considering following America in increasing tariffs on Chinese imports too.

Find out more: Economic emergency: Trump mulls way to impose tariffs