When asked about the secret to the New Zealand Dairy Board’s past successes, a former global marketing director used to smile and say… it’s all down “two million ladies out standing in their field”.

Fast-forward several decades, and the one-time cow-focused dairy board has morphed into one of the most dynamic dairy groups globally - operating as a publicly-listed Kiwi cooperative (market cap NZ$7.8 billion), Fonterra Co-operative Group (NZX: FCG).

In an attempt to better unlock both value and growth potential, Fonterra's management have set the wheels in motion for the potential ASX spinoff of its multibillion-dollar consumer operation which would be known as Mainland Group.

One of Australia’s big three dairy processors, Mainland boasts iconic household brands like Western Star butter and Mainland cheese.

While this is music to the ears of the ASX, which has suffered from a recent dearth of IPOs, in terms of volume and scale, this isn't the first time Fonterra has talked about an IPO.

Back in 2021 the Kiwi milk giant flagged an IPO of a similar magnitude to the IPO plans part two.

As well as testing the merits and value of an IPO, Fonterra CEO Miles Hurrell noted that the co-op is also exploring this divestment option alongside a trade sale.

“We are pleased to be making progress in both the potential trade sale and IPO processes and will continue to keep our farmer shareholders, employees and the market updated on milestones,” said Hurrell.

Big stocks that previously used a two-track process between the IPO and the auction include PEXA (ASX: PXA), StatePlus and Alinta Energy and more recently SG Lottery.

Regardless of whether the final deal is a trade sale or an IPO or both, it will require the approval from Fonterra’s farmer shareholders.

Roadshow

It’s understood Mainland Group's leadership team, including NZ-based CEO-elect René Dedoncker and CFO-elect Paul Victor recently did the rounds with investor groups, like Jarden, JPMorgan and Craigs Investment Partners in Sydney earlier this week.

Sydney marked the first leg of the Kiwi company’s spruiking roadshow, with Dedoncker and Co destined to repeat this week’s performance in Asia on 24 March.

In typical Kiwi fashion, the roadshow appears to have been an understate affair.

However, initial talk suggests an ASX float of Mainland Group could potentially value the consumer business northward of $4 billion, which would catapult the stock into the ASX100 with a bullet.

Early indications also suggest Mainland Group’s ASX float could be accompanied by an IPO which stands to raise between $1.5-$2 billion.

However, the actual bookbuild will be determined by Fonterra’s expected growth trajectory for Mainland, listed comparables valuations and the overall health of the IPO market, which right now looks shaky.

The numbers

Included with the slide decks being presented by Dedoncker and Co at their travelling roadshow are revelations that Mainland Group has:

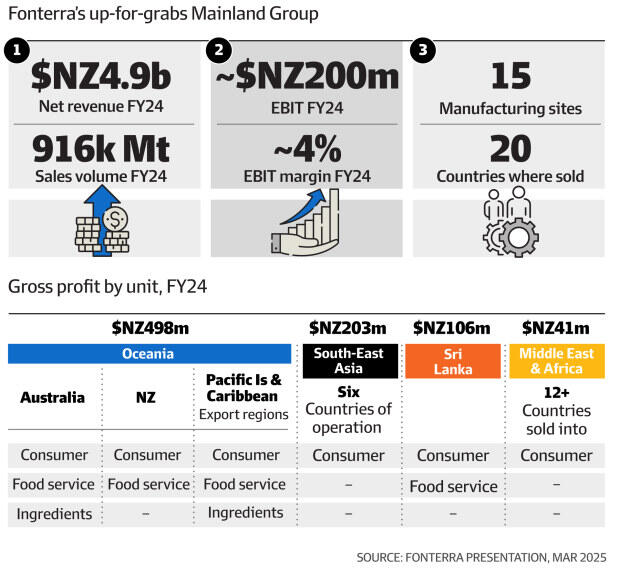

- $NZ4.9 billion ($4.4 billion) in revenue.

- $NZ200 million earnings – double the suggested amount initially flagged four years ago.

- 41% of the gross profit comes from South-East Asia, Sri Lanka and the Middle East, and the bulk from Oceania.

Mainland’s operation

As the roadshow began, Fonterra increased its FY25 earnings guidance from 40 to 60 cents per share (cps) to 55 to 75 cps due to strong dairy prices.

Mainland Group, the largest consumer dairy business in Australia and NZ, also has operations in South East Asia, Sri Lanka, while also selling dairy products into the Middle East and Africa.

As well as cheese, butter, milk, yoghurt and ice cream, Mainland produces infant formula and “healthy ageing” dairy products.

The operation has 15 factories in NZ, Australia, Sri Lanka, Malaysia and Indonesia.

In an attempt to optimise costs, the company has flagged plans to consolidate of its manufacturing facilities by potentially using third-part manufacturers.