Due to underlying strength in its retail and wholesale broking business, shares in Bell Financial Group (ASX: BFG) were up around 2% heading into lunch (AEDT) following an expected 26% increase in full year profit to A$30.7 million, which the broker announced this morning.

Unaudited revenue for FY24 jumped 12% to $276 million.

Revenue in the Retail and Wholesale broking business was up 12% on FY 2023 to $177.8 million, with profit after tax up 115% to $9.2 million.

Revenues (normalised) in the Technology & Platforms and the Products & Services businesses were up 8% on FY 2023 to $85.8 million, with profit after tax up 16% to $21.5 million.

As a diversified financial services business, Bell operates a traditional stockbroking business (retail, institutional and corporate), and a range of financial product offerings including margin lending, portfolio administration, trade execution, clearing and settlement, and cash management.

Late last year, Bell announced interest in acquiring low-cost investing app SelfWealth (ASX:SWF) for around $58 million.

The company expects a 25 cents per share offer for SelfWealth to benefit shareholders through increased scale in the group’s online broking business, and revenue and cost synergies.

The offer represented a 108% premium to the last close share price of Selfwealth of 12 cents at 12 November last year.

The Selfwealth Board was quick to recommend the offer and shareholders are expected to vote on the deal before the end of March.

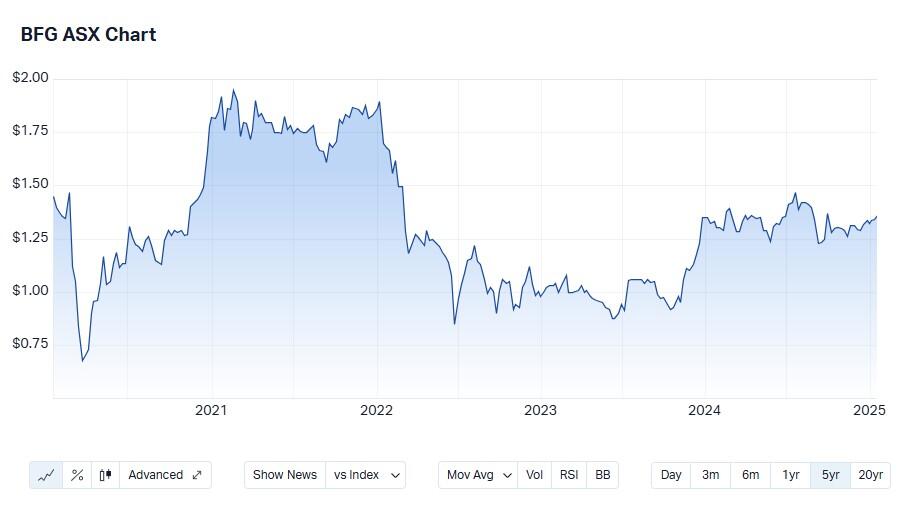

Meanwhile, Bell’s shares appear to be in a near-term uptrend confirmed by its 20-day moving average. Specifically, the 20-day moving average is rising and implies that investors see opportunity for profit.

Based on Morningstar’s numbers, Bell is trading close to fair value at $1.36, but there is no consensus recommendation on this smallcap stock (market cap $423 million).

At the half year, Bell announced a $16.6 million profit after tax, and 4 cents per share fully franked dividend.