Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- JB Hi Fi, Ansell and Car Group all report a rise in net profit

- McDonald's reports worse-than-expected quarterly revenue

- United States stocks climb on Wall Street

- monday.com surpasses fourth-quarter estimates

- DBS posts record performance, with net profit rising 11%

-----------------------------------------------------------------------------------------------------------------------------------------------------

8:40 am (AEDT):

Good morning, it’s Chloe Jaenicke here to get us started with today’s Azzet live earnings blog.

Yesterday, JB Hi Fi (ASX: JBH) lifted net profit 8% to $285.4 million in the six months ended 31 December 2024, with Australian sales rising due to continued demand for technology and consumer electronics products, as reported by Azzet senior writer Garry West.

Global protective products manufacturer, Ansell (ASX: ANN) also announced earnings yesterday, reporting an 184% increase in half-year net profit.

Last but not least for yesterday’s earnings, Car Group (ASX: CAR) reported that their net profit grew 5.5% to $123.4 million.

8:45 am (AEDT):

Overnight, McDonald’s (NYSE: MCD) reported weaker-than-expected quarterly revenue of US$6.39 billion, falling short of the expected $6.45 billion, according to our own Oli Gray.

This was because U.S. same-store sales saw the steepest drop since the pandemic, weighed down by reduced customer spending and the impact of an E.coli outbreak.

To regain momentum in the U.S., the fast food giant plans to introduce new deals and menu additions.

“We’re playing to win, focusing on our customers with outstanding value, exciting menu innovation and culturally relevant marketing,” Chairman and CEO Chris Kempczinski said.

9:06 am (AEDT):

U.S. stocks climbed this morning, led by major tech names, as investors shrugged off fresh tariff concerns.

The Dow Jones Industrial Average rose 167 points or 0.4% to close at 44,470.4 due to a 4.5% surge in McDonald’s shares.

Tech giants Microsoft, Amazon and Meta Platforms all gained by 0.6%, 1.7% and 0.4% respectively with NVIDIA (2.9%), Broadcom (4.5%) and Micron (3.9%) all rising well.

This comes as Trump stated on Sunday he plans to impose a 25% tariff on steel and aluminium imports, along with retaliatory duties on countries taxing U.S. goods.

On the bond markets, 10-year and 2-year yields were 4.497% and 4.279%, respectively.

9:19 am (AEDT):

Diversified investment company SGH's (ASX: SGH) net profit lifted by 16.7% to A$505.4 million in the six months to 31 December 2024 as it completed the $4.4 billion acquisition of building materials company Boral.

According to managing director and chief executive officer, Ryan Stokes, the result was driven by a disciplined focus on customer service, execution and operating leverage to deliver revenue, margin and earnings growth.

Stokes said he was also pleased with Boral’s continued progress toward mid-teen EBIT margins.

“We remain excited about the opportunities we have long identified for further improvement at Boral,” Stokes said in an ASX announcement.

According to our own Garry West, revenue was driven by strong capital sales and service activity at mining and construction supplier WesTrac, partially offset by marginally lower revenue at Boral and equipment hire company Coates.

9:32 am (AEDT):

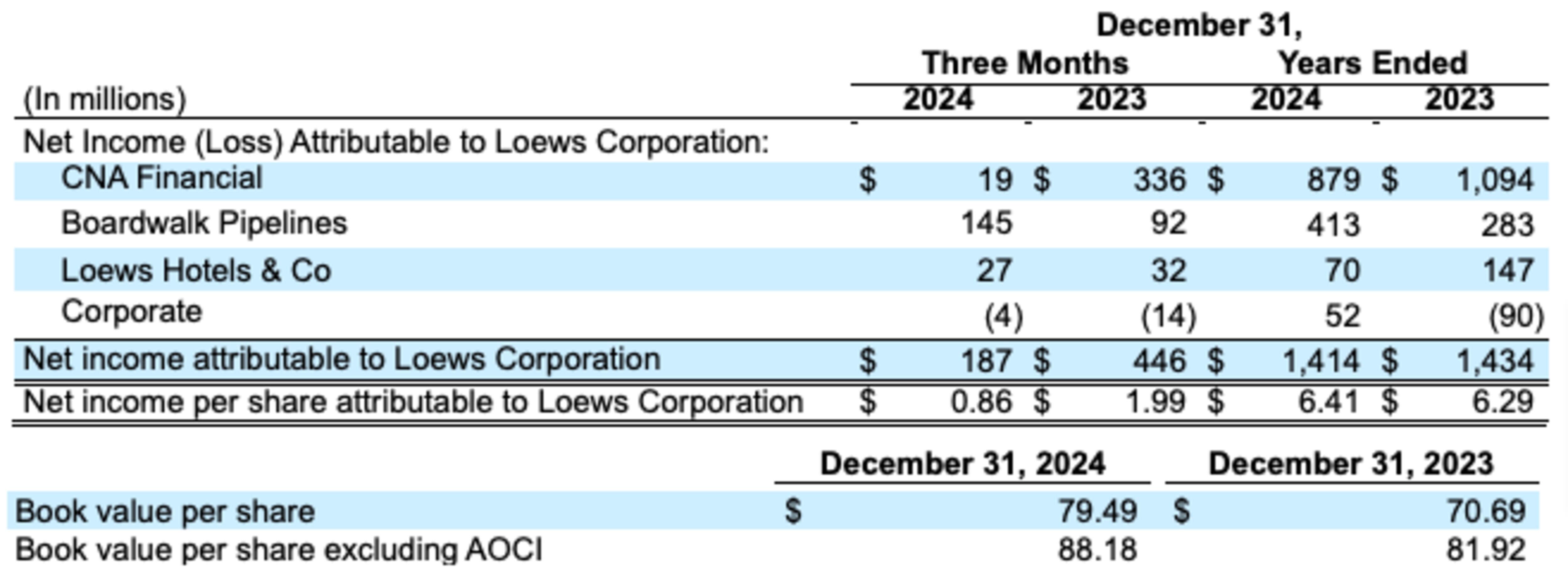

Loews Corporation's (NYSE: L) earnings took a hit due to a US$265 million pension settlement for CNA Financial Corporation’s (NYSE: CNA).

For the fourth quarter of 2024, Loews reported net income of $187 million, or $0.86 per share in comparison to $446 million or $1.99 per share in the fourth quarter of 2023.

CNA Financial’s revenue increased to $3.69 billion from $3.51 billion a year ago, however net income fell to $19 million from $336 million a year ago.

As of 31 December 2024, the parent company had $3.3 billion in cash and investments and $1.8 billion in debt.

9:45 am (AEDT):

Cloud-based platform, monday.com (NASDAQ: MNDY) surpassed fourth quarter estimates with revenue of US$268.0 million, which is a 32% year-on-year increase.

monday.com co-founders and co-CEOs Roy Mann and Eran Zinamn said 2024 was a remarkable year for the company.

“We are proud to have further expanded our product suite with monday service, which is already seeing rapid adoption from both existing and new customers,” they said.

“As we look to 2025, we are excited to double-down on our AI efforts, with a focus on AI Blocks, Product Power-ups, and our new Digital Workforce of AI Agents.

“We believe AI can be a game-changer for our customers, giving them the ability to transform their workflows and scale faster than ever before.”

The company also surpassed $1 billion in annual recurring revenue.

9:53 am (AEDT):

Owner of Australia’s Seven television network, Seven West Media (ASX: SWM), reported a plunge of 67% in net profit to $18 million in the first half of the 2025 financial year.

Managing director and chief executive officer, Jeff Howard, attributes the plunge to the ongoing soft TV advertising market and the major one-off sporting events, including the FIFA Women’s World Cup on Seven and the Olympic Games on Nine.

“Mitigating the full impact of these headwinds was an increase in total TV revenue share to 41.5% (up 0.5 points) and the benefits of year-on-year operating cost savings initiatives,” Howard said in an ASX announcement.

Howard says TV audiences were up 1.5%, excluding one-off sporting events. Seven West Media is expected to see modest growth in second-half-year earnings based on current expectations and market conditions.

10:06 am (AEDT)

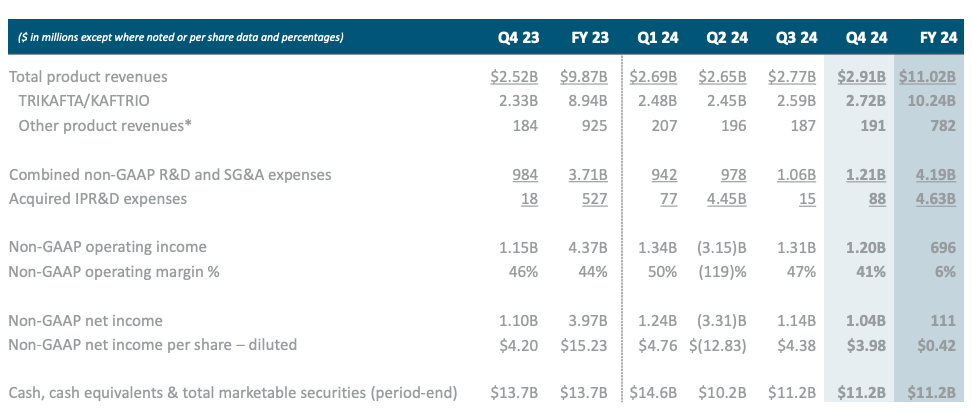

Full-year product revenue for Vertex Pharmaceuticals Inc. (NASDAQ: VRTX) increased by 12% from 2023 to US$11.02 billion.

Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex said 2024 marked a year of “tremendous growth” for the company.

“We anticipate 2025 will be another important year with the landmark JOURNAVX approval and launch for moderate-to-severe acute pain; the launch of our fifth CF medicine, ALYFTREK; the continuing global launch of CASGEVY; and multiple ongoing pivotal trials,” Kewalramani said.

“We are excited to drive diversification of the revenue base, disease areas of focus, R&D pipeline, and geographies to continue to deliver long-term value to both patients and shareholders.”

10:18 am (AEDT):

DBS Group Holdings Ltd. (SGX: D05) posted a record performance in 2024, with net profit rising 11% to SGD$11.4 billion.

Total income grew 10% to $22.3 billion as the commercial book's net interest margin expanded. Fee income crossed SGD 4 billion for the first time.

As for the fourth quarter, net profit grew 10% from a year ago to $2.62 billion and total income rose 10% to $5.51 billion.

“We achieved a record financial performance in 2024 with return on equity of 18.0%, one of the highest among developed market banks," DBS CEO Piyush Gupta said.

“Balance sheet management supported net interest income growth while improving investor sentiment drove wealth management fees and Treasury customer sales to new highs.”

10:28 am (AEDT):

CSL Ltd (ASX: CSL) reported net profit of US2.01 billion for the 6 months ended 31 December, up 7% on a constant currency basis.

Dr. Paul McKenzie, CSL’s Chief Executive Officer and Managing Director said CSL delivered solid results for the first half of the 2025 financial year led by CSL Behring, which had total revenue of $5.7 million, up 10% from the last comparable period.

“Strong demand for many of our market leading therapies has translated into sales growth, particularly in our core Ig franchise,” McKenzie said.

“We continue to advance key initiatives to improve gross margin, which is tracking according to our plans.

“CSL Seqirus was negatively impacted by significantly low influenza immunisation rates, particularly in the United States.

“CSL Vifor grew sales, underpinned by robust iron volumes in Europe and the expansion of our nephrology products.”

11:15 am (AEDT):

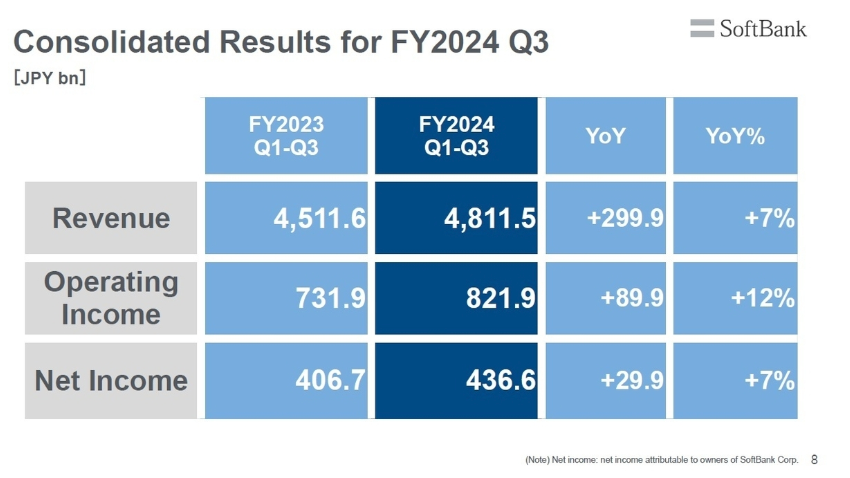

SoftBank Corp. (TOKYO: 9434) reported revenue of 4,811.5 billion yen, a 7% year-on-year increase.

There was also an increase in operating income of 12% to 821.9 billion yen.

In the earnings conference call, SoftBank president and CEO Junichi Miyakawa said he believes they've been able to transform their corporate structure to be stronger than before.

“As shown in the overall results, we have entered a period of harvesting areas other than telecommunications, and diversification of our revenue sources is beginning to produce results,” Miyakawa said.

11:42 am (AEDT):

Breville Group Ltd (ASX: BRG) reported solid half-year results with a 10.1% increase to A$997.5 million driven by strong consumer demand and significant growth in the coffee segment.

12:27 am (AEDT):

Other U.S. companies also released their results after hours.

SelectQuote (NYSE: SLQT) surged 35.8% after the company announced strong earnings results and guidance, along with a $350 million investment from Bain Capital, Morgan Stanley Private Credit, and Newlight Partners.

For the second quarter of the 2025 fiscal year, they reported a revenue of US$481.1 million and Net income of $53.2 million.

Coty Inc. (NYSE: COTY) reported a net revenue loss of 1% year-over-year and its net revenue declined 3% on a reported basis.

For the fourth quarter of 2024, Lattice Semiconductor Corporation (NASDAQ: LSCC) reported revenue of US$117.4 million for the fourth quarter and $509.4 million for the full year of 2024.

"We achieved record design wins, significantly reduced operating expenses, and delivered a strong 31.8% adjusted EBITDA margin in 2024,” Lattice Semicondcutor Corporation CEO, Ford Tamer said.

Fluence Energy Inc. (NASDAQ: FLNC) reported a decrease of about 49% from last year to US$186.8 million.

"We have experienced customer-driven delays in signing certain contracts that, coupled with competitive pressures, result in the need to lower our fiscal year 2025 outlook,” Julian Nebreda, Fluence's CEO said.

12:50 pm (AEDT):

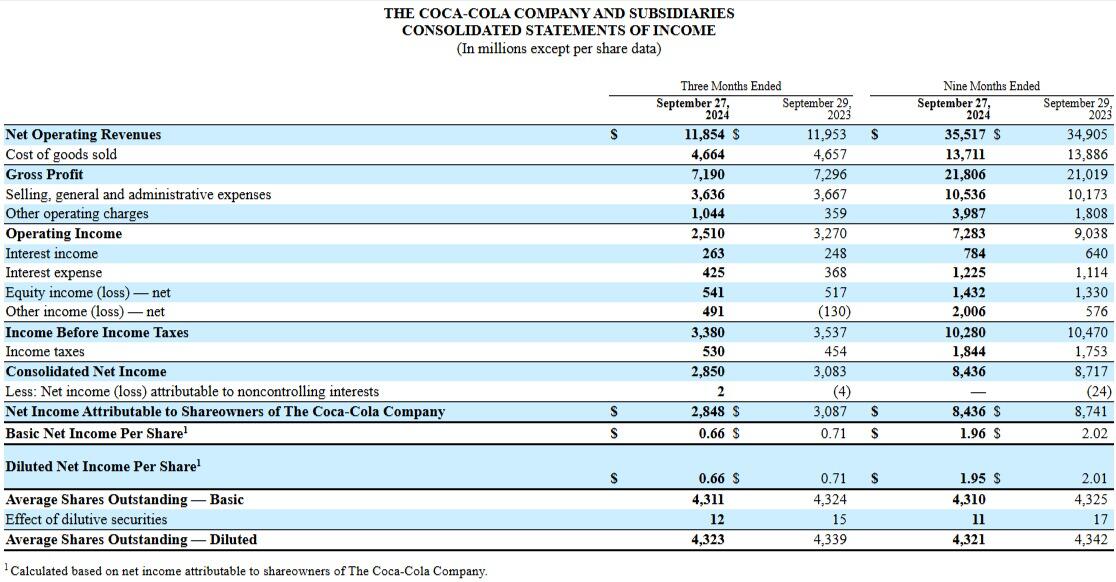

Coca-Cola (NYSE: KO) is set to announce earnings results on 11 February at 8:30 am ET (12 February, 12:30 am AEDT) and analysts are expecting their revenue to decline 2.2% year-on-year to US$10.71 billion.

This would be a reversal from the 7.4% increase recorded in the same quarter last year. Adjusted earnings are expected to be $0.52 per share.

At the time of writing, Coca-Cola (NYSE: KO) stocks were trading at $64.55. Up 1.11% from the previous close of $63.84. It reached a day high of $64.65 and low of $63.66. The market cap is $278.07 billion.

1:15 pm (AEDT):

Analysts expect Shopify's (NYSE: SHOP) revenue to rise 27.4% year on year to $2.73 billion, improving upon the 23.6% increase it recorded in the same quarter last year.

Adjusted earnings are expected to be $0.43 per share.

2:05 pm (AEDT):

Good afternoon everyone, it's Frankie Reid taking over from Chloe to carry us through the rest of the day!

Heading over to NASDAQ, DoorDash (DASH) is set to announce their earnings tomorrow after market hours local time, and early in the morning around 4 am for us in Australia.

Last quarter the food delivery service reported a strong quarter and beat analysts expectations by 1.7% and reporting revenues of $2.71 billion, up 25% year on year.

For Q4, the Zacks Consensus Estimate for revenue is predicted to come in at $2.83 billion, which would mark a 22.97% increase year over year.

2:30 pm (AEDT):

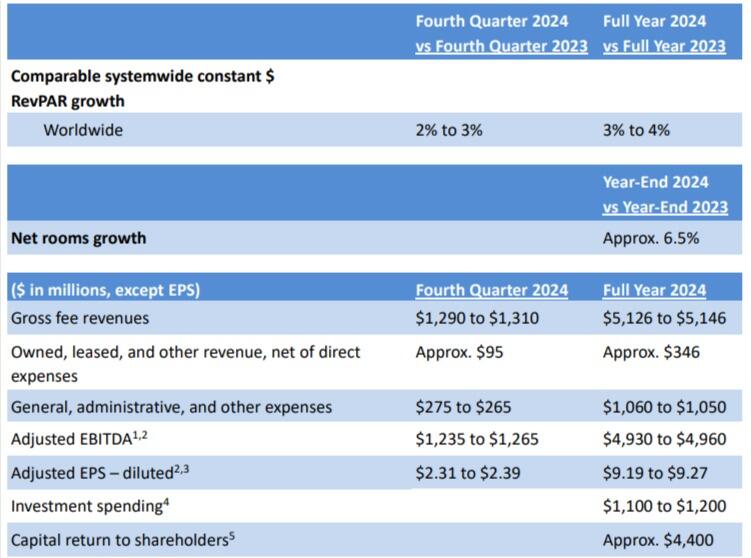

Another of the many set to release overnight is Marriott Inc. (NASDAQ: MAR).

The Zacks Consensus Estimate for Q4 was a 5% growth for revenues from the same time last year, at $6.40 billion.

The analysis also noted that the prediction of a strong quarter for Marriot is due to steady performance in the United States and Canada, thanks to a large demand for global travel.

Unit expansion and its launch of MGM Collection with Marriott Bonvoy are also key factors for this performance.

2:55 pm (AEDT):

Coming back to home territory, Breville Group (ASX: BRG) reported its 1H result today with fairly strong numbers across the board but the market was unimpressed, with shares down around 3% at the open.

The kitchen appliance company saw an earnings growth of 10.5%, revenue growth of 10.1% and a net debt of just $55.1 million compared with $97.5 million last year.

Despite this, it seems the market may have still taken issue with a fall in the Global Product gross margin to 37.4% from 38.1% in the previous period.

This decline was due to elevated shipping costs in Europe, the Middle East and Africa, as well as a strong U.S. dollar.

3:35 pm (AEDT):

S&P Global Inc. (NYSE: SPGI) is scheduled to release its Q4 results overnight, before markets open local time.

The financial information provider has previously exceeded the Zacks Consensus Estimate in three of the previous four quarters, with the average surprise being 6.3%.

The estimate this time is set at revenue for $3.5 billion, which would mark a 10.3% growth from the same quarter a year ago.

3:55 pm (AEDT):

British Petroleum (NYSE: BP) is set to report at 7 am GMT, after a difficult third quarter where shares fell to the lowest point since 2022.

This was the result of the market observing the oil giant's weakest quarterly earnings in nearly four years.

Analysts say this is likely to be another challenging quarter for BP, with possible pressure from activists.

Activist hedge fund Elliott Management recently took a significant stake in BP, potentially signalling a push for changes such as restructuring with a focus on renewable energy assets away from the traditional oil and gas business.

4:25 pm (AEDT):

Back to local ground again, two major Aussie financial institutions are set to release on 12 February.

Suncorp Group Limited (ASX: SUN) released their full years earnings in August of last year, reporting strong results after the sale of its banking division to ANZ, contributing $379 million to the annual profit.

The Commonwealth Bank of Australia (ASX: CBA) will join Suncorp in reporting its earnings tomorrow, the only major bank to do so, with shares having risen hugely over the last year.

Analyst Morgan Stanley reports expecting that the bank will have results line with expectations, with strong revenue growth pushing earnings expectations slightly higher.

At the time of reporting Commonwealth's stock was trading at $162.16, displaying a 39.5% one-year increase.