Having watched the share price fall by around 33% during the December quarter, shareholders in Liontown Resources (ASX: LTR) have reason to smile today with the price up around 7% ($0.675) after the lithium miner released a strong quarterly production report.

Due to the the ramp up at the Kathleen Valley Lithium Operation, Liontown delivered a 215% quarter-on-quarter increase in spodumene concentrate production to 88,683 dry metric tonnes (dmt) for the three months ending 31 December.

The lithium miner shipped 81,341 dmt of spodumene concentrate to customers during the quarter, up 651% on the first quarter.

Equally encouraging, the company managed to deliver its production with an all-in sustaining cost of US$763 per tonne. As a result, the operations remained profitable despite the weaker prices.

While cash and trade receivables as at 31 December 2024 were $205.0 million, the company has the capacity to generate $16.7 million net cash from operating activities in the initial phases of production ramp-up.

Overall, the company achieved net cash from operating activities of $16.7 million for the three months and ended the period with $192.9 million in cash.

Due to business optimisation work undertaken during the quarter, the company guided to an expected $775 – $855 per dmt SC6e sold for Unit Operating Costs (FOB) for the second half of FY25.

Fully operational

Liontown's managing director and CEO, Tony Ottaviano reminded investors that the company is now a fully operational producer (Kathleen Valley), having shipped over 100,000 wet metric tonnes of spodumene concentrate to customers since the commencement of production at the end of July 2024.

“…the Company generated positive net cash from operations in the first full quarter since we commenced production, in July 2024. Our performance this quarter reinforces that Liontown is firmly on track to achieve its ambition of becoming an established world-class producer in the lithium sector,” said Ottaviano.

“We remain focused on concluding our processing plant rampup, starting underground stoping production and lifting processing plant performance.”

Is the tide turning for lithium?

Liontown’s latest production update coincides with some encouraging signs that the lithium price is starting to stabilise. For example, since late September, spodumene prices have ranged between US$800/t and US$890/t, compared to lows of around US$730/t in August.

UBS suspects lithium price has likely bottomed and recently made minor upgrades to its 2025/26 spodumene pricing forecasts. In light of these upgrades the broker no longer feels that the equity valuations of Liontown and other miners in the sector look as stretched as they were.

Meanwhile, Canaccord Genuity expects pricing to gradually improve into 2026 but ahead of that improvement has lowered its near-term lithium price forecasts for spodumene and chemicals by -15% and -20% respectively.

This has led the broker to trim its 12-month price target for Liontown by 25% to $0.60.

Without a major and unexpected surge in demand, Goldman Sachs expects the lithium market to remain soft in 2025 which only encourages existing producers to focus on further cost/production optimisations.

With a market cap of $1.6 billion, Liontown sits well within the ASX300.

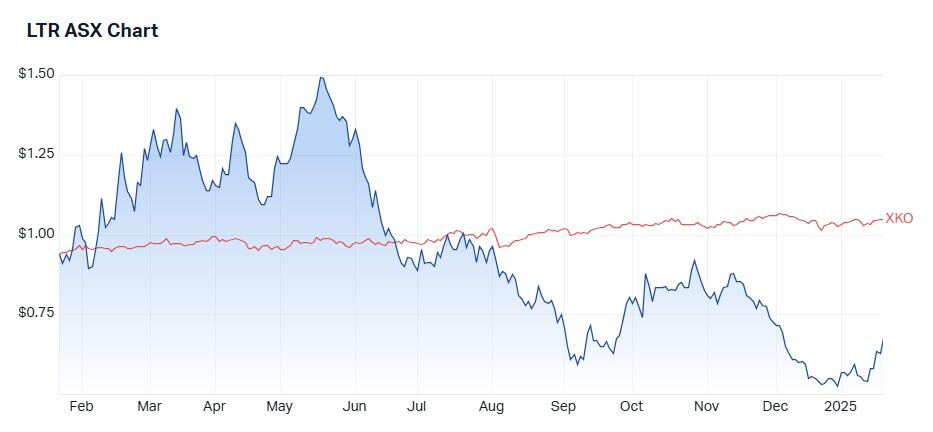

The broker consensus recommendation is Sell and in the last year the share price is down 28%.

Liontown shares appear to be in a long-term bearish trend with the 200-day moving average falling and this suggests that demand for this stock is low.