JB HI FI has announced a change in Group Chief Executive Officer (CEO) after unveiling an increase in net profit after tax (NPAT) and dividends for the 2025 financial year.

The electronics and home appliance retailer said Group CEO Terry Smart would be succeeded by Group Chief Operating Officer Nick Wells on 3 October.

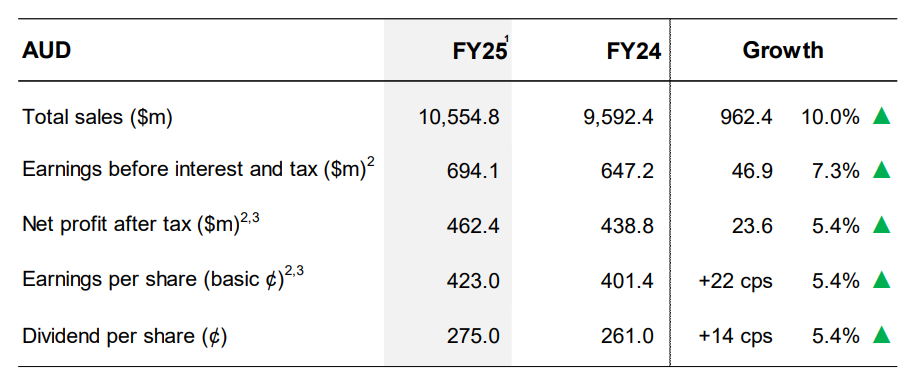

The company earlier announced a 5.4% lift in NPAT to $462.4 million for the 12 months ending 30 June 2025 (FY25).

Earnings before interest and tax (EBIT) grew 7.3% to $691.4 million and earnings per share (EPS) rose by 5.3% to $4.23 on sales which increased 10% to $10.554 billion.

Excluding the $13.7 million cost of resolving Australian Competition and Consumer Commission (ACCC) proceedings against The Good Guys subsidiary, EBIT rose 9.4% to $707.8 million, NPAT was up 8.5% to $476.1 million and EPS grew 8.5% to $4.355.

Directors declared a fully franked final dividend of $1.05 cents per share, compared with $1.03 a year earlier, bringing FY25 ordinary dividends to $2.75 (versus $2.61), and a special dividend of $1.00 per share with both to be paid on 5 September 2025 to shareholders registered on 22 August 2025.

This was driven by an elevated net cash position and a significant franking credit balance as a result of its continued strong financial performance and cashflow generation.

The Board also announce that from the current financial year it would lift the dividend payout ratio from 65% to 70-80% of NPAT.

“It has been another strong year of sales and earnings, as we built on the momentum of the previous year,” Smart said in an ASX announcement.

He said the company remained focused on its core proposition of driving great value and delivering consistently high levels of customer service which continued to resonate with our customers.

The company also provided a sales update for July 2025 with growth of 6.1% for JB HI-FI Australia, 38.1% for JB HI-FI New Zealand, 4.2% for The Good Guys and 1.0% for e&s, the 75%-owned home appliance and bathroom retailer purchased in September.

At the time of writing JB Hi Fi (ASX: JBH) shares were trading $8.54, or 7.26%, lower at $109.16 on Monday, capitalising the company at $11.93 billion, after trading between $109.12 and $120.86.