Woolworths' (ASX: WOW) corporate “spin-off” of booze retailer and pub owner/gambling company Endeavour Group (ASX: EDV) was supposed to create untold opportunities, but all the demerger appears to have done is destroy wealth for shareholders.

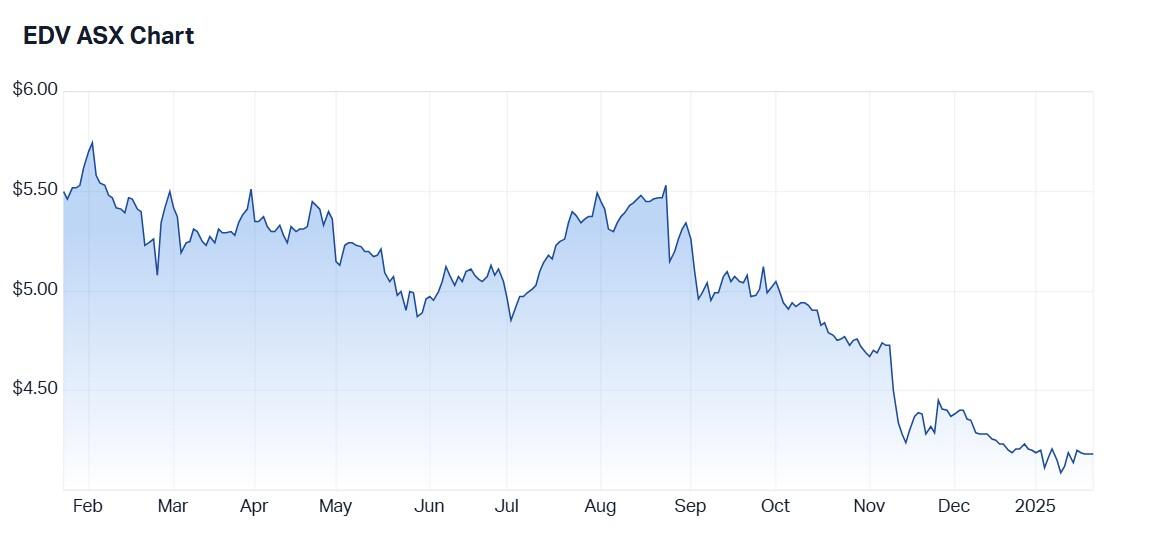

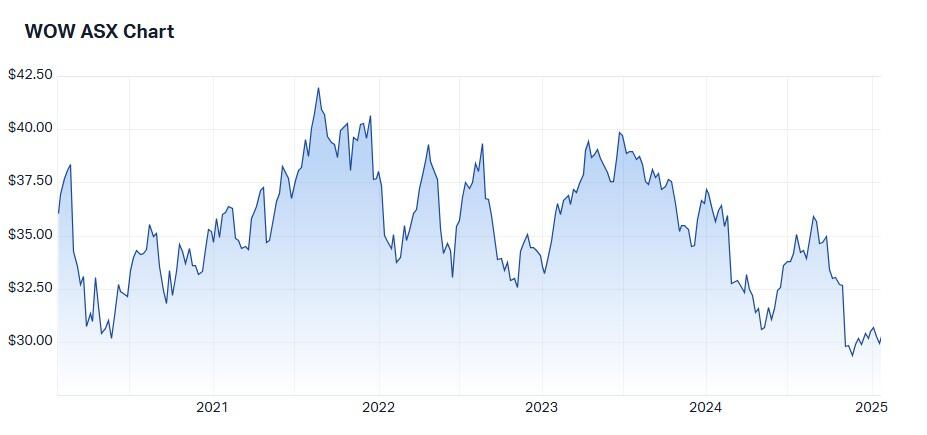

The share price in both ASX200 stocks – which have a combined market cap of over $43 billion - is down around 23% and 17% respectively over 12 months.

Both stocks should be well past the indigestion period that typically follows a demerger. For example, based on quantitative analysis at Macquarie Bank demerged businesses usually underperform in the first six months and in last five years or so the underperformance has lasted 12 months.

However, when it comes to the parent company, investors have to wait even longer for outperformance to commence, with 18 months passing after the demerger before outperformance is registered.

Still under water

While some research suggests demerged companies eventually outperform, neither stock appears to have benefitted from the removal of cost sharing and corporate overhead allocations.

Four years on, Endeavour - which operates the Dan Murphy’s and BWS bottle shop chains, along with six wineries and more than 350 pubs is still trading at a 10% discount to its listed price of $6.50 and Woolworths is trading at a 22% discount to its $39.10 five-year high back in August 2021.

It’s not uncommon for investors to buy the parent company ahead of a demerger to capture the value created by the demerger that’s “hidden” from analysts in the parent and hence not properly valued by the market.

However, recently revealed data appears to suggest that it wasn’t gems hidden from shareholders but lingering costs.

Hidden costs

It's understood that Endeavour never disclosed the cost of its One Endeavour program, which in addition to the development of specialised software included separating the processes previously provided by Woolworths, from which it demerged in 2021.

Last August, Endeavour management hinted that it would have spent around $440 million on the separation plan by the middle of 2026, but recently acquired documents suggest the figure could be as high as $570 million, including $60 million of advisory and assurance work.

It’s clearly taking a lot longer than normal for Endeavour to overhaul its business management systems and fully decouple itself from Woolworths. Endeavour management doesn’t expect the booze retail chain to be an entirely stand-alone company for yet another four years.

To hasten the separation process, Endeavour has brought in consultants from PwC, Kearney and KPMG, plus Bob McKinnon, a former senior technology executive at Commonwealth Bank and Westpac.

IT systems

If internal documents obtained by the Financial Review are any proxy, the single largest transitioning cost is the development of a software platform for the core financial, retail and hotel businesses.

While that specific project will cost an estimated $190 million, the second-highest expense, an end-to-end software system for stores due for completion in 2027, could be around $155 million.

Collectively, work across five key platforms – supply chain and stores, loyalty and fintech, digital and media, business support and its international arm - is according to demerger documents, expected to cost around $564 million annually.

In addition to paying Woolworths around $94 million annually for business support in areas such as IT, people, finance and procurement, Endeavour also has sublease arrangements where some of its stores are inside a Woolworths supermarket.

Talking anonymously, some Endeavour employees have also noted that lack of expertise and executive turmoil had made the Endeavour-Woolworths separation more difficult. With all this playing out, Endeavour's chief executive Steve Donohue stepped down in September last year. A replacement has yet to be found and Donohue has no end date for his departure.

Shareholder dissention

Meanwhile, Endeavour’s recent antics have not gone unnoticed.

The retail chain’s largest shareholder, billionaire publican Bruce Mathieson, attempted to get rid of the company’s chairman and chief executive in 2023 citing poor retail strategy and as the driver of long-term underperformance.

While Endeavour managed to post a resilient FY24 result, lingering technology cost are expected to make FY25 another challenging year.

Endeavour managed minor growth in earnings in FY24, in line with broker forecasts, and also managed to declare a fully-franked dividend slightly ahead of forecasts.

Within its 1Q FY25 outlook, Endeavour guided to capital expenditure within the range of $450 million to $500 million, including the One Endeavour program capital.

One Endeavour program capital expenditure and operating costs in FY25 are each expected to be within the company’s guidance range of $60 million to $80 million, while finance costs in FY25 are expected to be within the guidance range of $310 million to $325 million.

Changing consumer behaviour

While Macquarie has long maintained that consumer staple retailers are resilient to economic cycles, both Endeavour and Woolworths are clearly having to navigate changing market behaviour.

While Woolworths has been in the spotlight for making too much profit, Endeavour is having to face negative consumer and investor towards alcohol and gambling.

Consensus on Woolworths is Hold and the target price of $32.69 suggests an 8.3% upside to the current price.

Consensus on Endeavour is Moderate Buy and the target price of $4.88 suggests a 16.9% upside to the current price.

At the time of writing, the Woolworths Group Ltd (ASX: WOW) share price was $30.27, with a market cap of around $36.98 billion. Endeavour Group Ltd's (ASX: EDV) share price was $4.18, with a market cap of approximately $7.49 billion.