Earnings for BlackRock, Inc (NASDAQ: BLK) rose 23% from last year to US$11.93, beating estimates of $11.26 per share. The company's revenue rose 23% to US$5.68 billion (A$9.12 billion).

As adjusted, the American multinational investment company reported diluted EPS of $42.01 for the full year 2024, or $43.61 as reported. According to adjusted earnings, it earned $10.63 per share in the fourth quarter, or $11.93 per share overall.

BlackRock's assets under management (AUM) reached $11.6 trillion, driven by record net inflows of $641 billion for the full year, including $281 billion in the fourth quarter.

The company's revenue for the full year increased by 14%, primarily due to markets' positive impact on average AUM. This was due to organic base fee growth and higher performance fees.

Operating income also saw a 21% increase for the full year, reflecting strong performance across the board. BlackRock returned $4.7 billion to shareholders in 2024, including $1.6 billion through share repurchases.

BlackRock's strategic acquisitions, including the recently closed GIP Transaction and the planned acquisitions of HPS Investment Partners and Preqin, are expected to significantly enhance its private markets investment and data capabilities. These acquisitions are part of BlackRock's broader strategy to scale and improve client service, technology, and scale.

Laurence D. Fink, Chairman and CEO, highlighted that clients entrusted BlackRock with record net inflows, demonstrating strong client engagement and support for the company's strategy. The company's operating model delivered exceptional performance, crossing $20 billion in annual revenue and achieving an industry-leading 44.5% margin.

"2024 was also a milestone year for strategic acquisitions grounded in client service, technology and scale. Our closing of GIP and planned acquisitions of HPS and Preqin are expected to significantly scale and enhance our private markets investment and data capabilities," Fink said.

“For many companies, periods of M&A contribute to a pause in client engagement. At BlackRock, clients are instead embracing and rewarding our strategy. Client activity accelerated into the fourth quarter, resulting in 7% organic base fee growth and 12% technology services ACV growth.

“In the 25 years since our IPO, BlackRock has delivered a 21% compounded annual total return for our shareholders, compared to 8% in the S&P 500. BlackRock enters 2025 with more growth and upside potential than ever. This is just the beginning.”

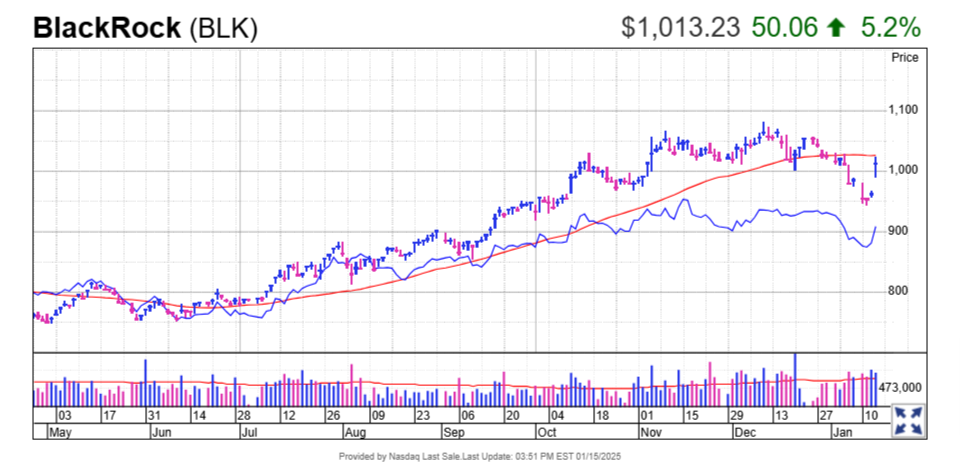

At the time of writing, BlackRock, Inc's share price was US$1,013.04. Its market cap was approximately $148 billion.

Related content