There’s mounting concern that the stellar performance of Australia’s big-four banks, which delivered an average total return of 33% in 2024, could unravel this year on the pretext that they’re looking significantly overpriced.

In light of the current valuation dilemma confronting the big four, brokers are unanimous in their call to sell these bank stocks.

UBS assesses fair value for Australian banks at around 10.2% below their current prices. Based on broker analysis reported by FN Arena, Australia & NZ Bank (ASX: ANZ), Westpac (ASX: WBC) and National Australia Bank (ASX: NAB) are currently trading with 3.9%, 11.5% and 13.1% downside to their consensus targets.

Beyond the big-four, Macquarie Group (ASX: MQG) and Judo Capital (ASX: JDO) still attract more Buy ratings than Sell ratings from brokers.

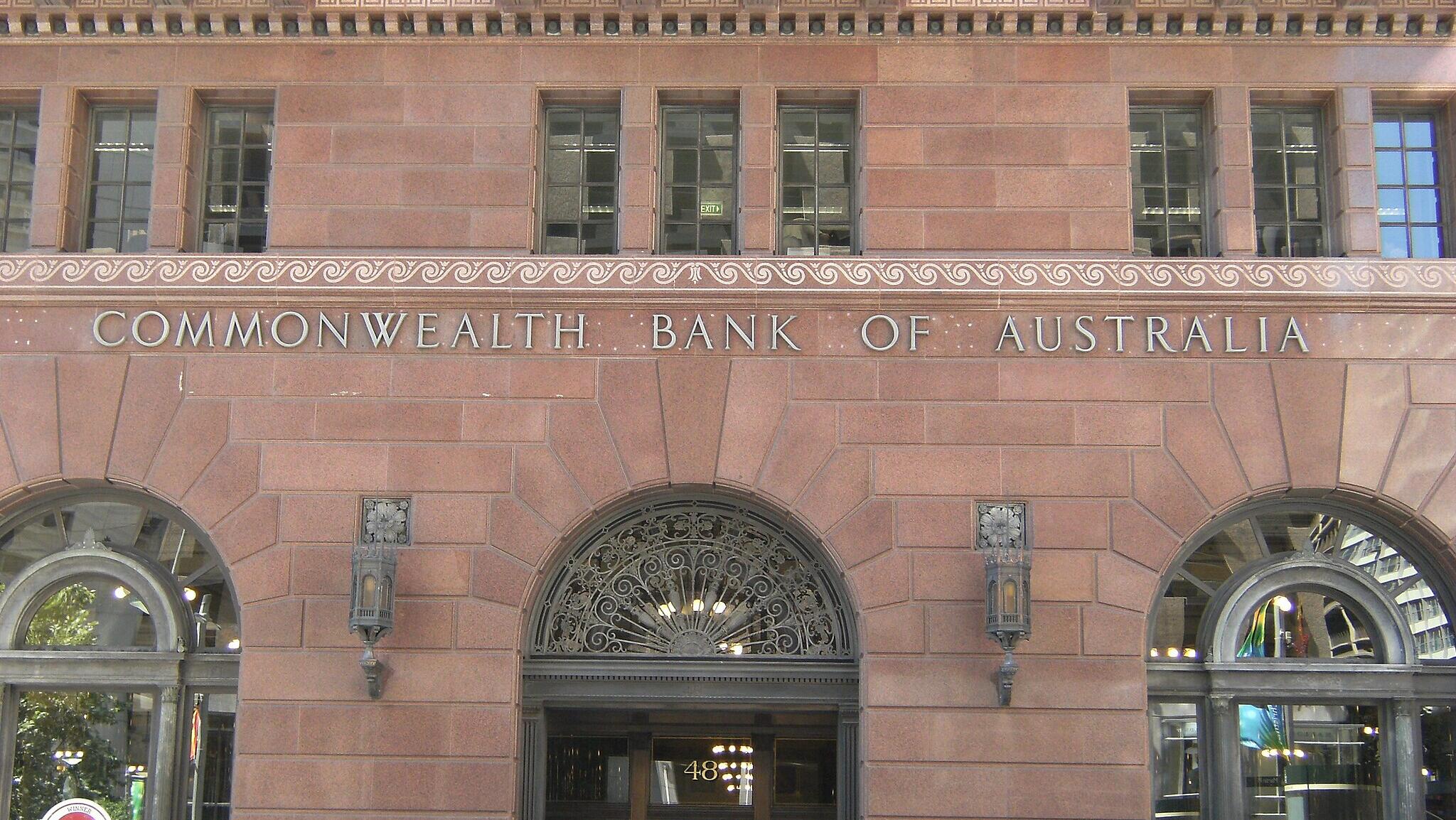

CBA appears most at risk

However, brokers have singled out Commonwealth Bank (ASX: CBA) for potentially the harshest treatment. Now considered the world’s most valuable bank, the index heavyweights' earnings are valued at 23 times — double the other big three Australian peers and twice the PE (price-to-earnings ratio) of JPMorgan Chase, the world’s largest bank.

With CBA looking progressively like a momentum trap – where gains simply don’t justify valuations - the broker consensus target ($102.88) on Australia’s largest bank is a whopping 34.5% downside to the current price ($159.75).

What exaggerates the tepid upside ascribed to CBA’s cash earnings over coming years is 26 times next year's PE the bank is currently trading at.

Passive fund inflow: Finger pointed at Super

Curiously, many of the valuation issues plagueing the [banking] sector can be laid at the feet of Super funds and inflows from passive Australian equity portfolios 10% weighted to CBA. While Australian equity managers have run for the exit on banks, big super fund money keeps pouring in and they remain overweight financials.

According to Macquarie data, in the twelve months to June super funds boosted their ownership of the [banking] sector by 1.6% over the period to 29%.

While this sounds counterintuitive in light of bank valuations, it’s worthwhile to note that most super funds are passive. This means they have little choice but to increase their bank holdings - as more funds flow in - whether they like it or not.

Based on research by JP Morgan strategists, Jason Steed and Dylan Adrian, super funds have increased bank positions net of external manager moves. The JP Morgan duo are miffed at the [bank] sectors' outperformance based on their flat earnings outlook.

In light of the stark dynamics currently playing out, these strategists believe banks are “materially overvalued” and risk average declines of around 20%.